Tata Elxsi is a leading technology and design company in India. Tata Elxsi Share Price on NSE as of 24 January 2025 is 5,917.80 INR. On this page, you will find Tata Elxsi Share Price Target 2025, 2026, 2027 to 2030 as well as Tata Elxsi bonus share, Tata Elxsi share price target screener, Tata elxsi share price target tomorrow, and more Information.

Tata Elxsi India Ltd

Tata Elxsi is a leading technology and design company in India, specializing in providing cutting-edge solutions in engineering, technology, and product design. It is a part of the Tata Group and operates globally, serving industries like automotive, media, healthcare, and telecommunications. The company focuses on innovation in areas like artificial intelligence, Internet of Things (IoT), 5G, and cloud technologies, helping businesses improve their products and services.

Tata Elxsi Share Price Chart

Current Market Overview Of Tata Elxsi Share Price

- Open: 6,353.95

- High: 6,392.95

- Low: 6,290.00

- Mkt cap: 39.71KCr

- P/E ratio: 49.04

- Div yield: 1.10%

- 52-wk high: 9,080.00

- 52-wk low: 5,920.00

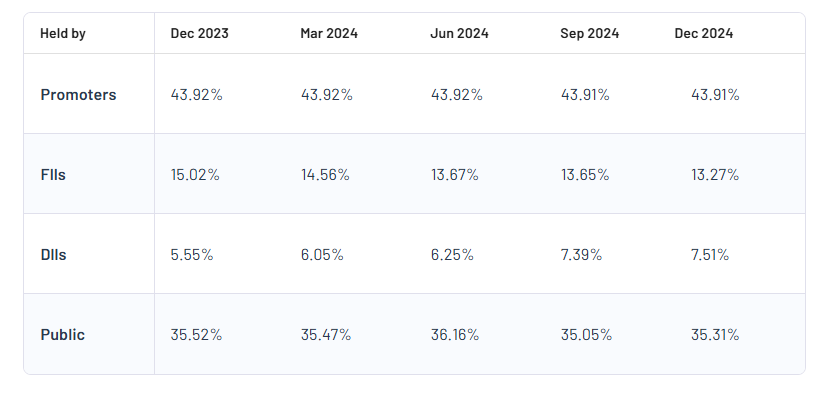

Tata Elxsi Shareholding Pattern

- Promoters: 43.91%

- FII: 13.27%

- DII: 7.51%

- Public: 35.31%

Tata Elxsi Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Tata Elxsi Share Price Target Years | Share Price Target (₹) |

| Tata Elxsi Share Price Target 2025 | ₹9,200 |

| Tata Elxsi Share Price Target 2026 | ₹11,125 |

| Tata Elxsi Share Price Target 2027 | ₹12,457 |

| Tata Elxsi Share Price Target 2028 | ₹13,640 |

| Tata Elxsi Share Price Target 2029 | ₹14,555 |

| Tata Elxsi Share Price Target 2030 | ₹15,733 |

Tata Elxsi Share Price Target 2025

Tata Elxsi share price target 2025 Expected target could be between ₹9000 to ₹9,200. Here are 3 Key Factors Affecting Growth for Tata Elxsi Share Price Target 2025:

-

Increased Demand for Digital Solutions

Tata Elxsi specializes in cutting-edge technologies like artificial intelligence, IoT, and design engineering. As industries like automotive, healthcare, and entertainment continue adopting digital solutions, the company is well-positioned to benefit from growing demand, contributing to its share price growth by 2025. - Expansion in Automotive and EV Segments

With a strong focus on advanced automotive technologies such as autonomous driving systems and electric vehicles (EV), Tata Elxsi’s partnerships with global automobile manufacturers are expected to drive revenue growth. The rising global emphasis on sustainable transportation is a key factor that may positively influence the company’s share price. -

Focus on Innovation and R&D

Tata Elxsi’s investments in research and development help it stay ahead in providing innovative solutions across industries. Its expertise in design-led innovation attracts major clients, ensuring consistent business growth. This focus on innovation is a significant factor that could enhance its market position and share price in the coming years.

Tata Elxsi Share Price Target 2030

Tata Elxsi share price target 2030 Expected target could be between ₹15,600 to ₹15,733. Here are 3 Key Factors Affecting Growth for Tata Elxsi Share Price Target 2030:

-

Global Adoption of AI and Emerging Technologies

By 2030, the global demand for artificial intelligence, virtual reality, and robotics is expected to skyrocket. Tata Elxsi’s expertise in these technologies positions it as a key player in providing advanced digital engineering services, enabling strong revenue growth and enhancing its share price over the long term. - Expansion in Healthcare and MedTech Solutions

The healthcare and medical technology sectors are projected to experience significant growth by 2030. Tata Elxsi’s focus on developing cutting-edge MedTech solutions and collaborations with global healthcare companies could open new revenue streams, boosting the company’s financial performance and share value. -

Strengthening Global Client Base

Tata Elxsi’s ability to expand its client base across industries such as automotive, media, and telecommunications globally will play a vital role in its long-term growth. Sustained partnerships with top-tier companies and its strong delivery capabilities could contribute to consistent earnings and a positive outlook for its share price by 2030.

Risks and Challenges for Tata Elxsi Share Price

Here are 5 Risks and Challenges for Tata Elxsi Share Price:

- Intense Industry Competition

Tata Elxsi operates in a highly competitive market with several global and domestic players offering similar digital engineering and technology services. The constant race to innovate and maintain a competitive edge can pressure profit margins and limit the company’s market share growth. - Dependence on Global Markets

A significant portion of Tata Elxsi’s revenue comes from international markets. Fluctuations in global economic conditions, foreign exchange rates, or changes in regulations in key regions like the US and Europe can negatively impact the company’s financial performance and share price. - Technology Evolution and Adaptability

Rapid advancements in technology mean the company must continuously innovate to remain relevant. If Tata Elxsi fails to adopt or invest in emerging technologies like artificial intelligence or 5G at the right time, it risks losing business to competitors, potentially affecting its share value. - Client Concentration Risk

A large portion of Tata Elxsi’s revenue comes from a few key clients in industries like automotive and telecommunications. Any loss or reduction in business from these major clients could significantly impact the company’s financial health and lead to a decline in its share price. -

Economic Slowdowns and Industry-Specific Risks

Slowdowns in key industries, such as the automotive sector or media and entertainment, can directly affect Tata Elxsi’s business as clients may reduce their budgets for technology services. Additionally, global economic uncertainties and geopolitical risks can contribute to reduced demand, impacting the company’s growth prospects.

Read Also:- Polycab Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Update