PC Jeweller Ltd is a prominent jewelry retailer in India, known for its exquisite gold, diamond, and silver jewelry collections. PC Jewellers Share Price on NSE as of 20 January 2025 is 14.92 INR. On this page, you will find PC Jewellers Share Price Target 2025, 2026, 2027 to 2030 as well as PC Jeweller News today Live, PC Jeweller share price target for long term, Pc jewellers share price target tomorrow, and more Information.

PC Jewellers Ltd

PC Jeweller Ltd is a prominent jewelry retailer in India, known for its exquisite gold, diamond, and silver jewelry collections. Established in 2005, the company has built a strong reputation for offering high-quality craftsmanship and innovative designs that cater to traditional and contemporary tastes. With a growing network of showrooms across the country, PC Jeweller has positioned itself as a trusted brand for wedding jewelry and special occasions.

PC Jewellers Share Price Chart

Current Market Overview Of PC Jewellers Share Price

- Open: ₹14.64

- High: ₹15.20

- Low: ₹14.64

- Mkt cap: ₹8.77KCr

- P/E ratio: 456.41

- Div yield: N/A

- 52-wk high: ₹19.30

- 52-wk low: ₹4.40

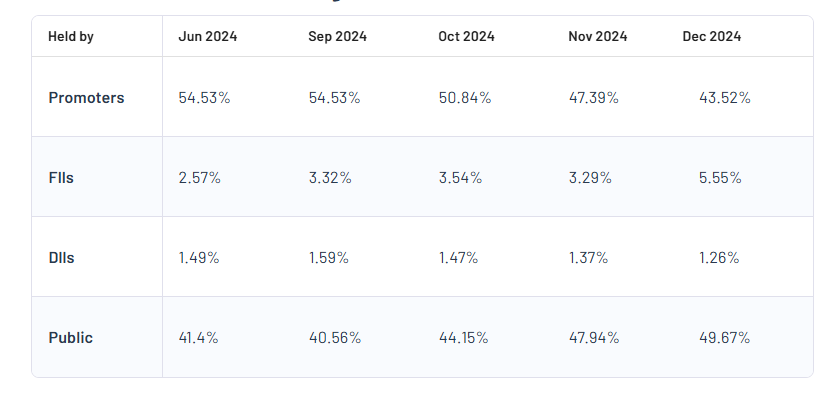

PC Jewellers Shareholding Pattern

- Promoters: 43.52%

- FII: 5.55%

- DII: 1.26%

- Public: 49.67%

PC Jewellers Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| PC Jewellers Share Price Target Years | Share Price Target (₹) |

| PC Jewellers Share Price Target 2025 | ₹20 |

| PC Jewellers Share Price Target 2026 | ₹40 |

| PC Jewellers Share Price Target 2027 | ₹60 |

| PC Jewellers Share Price Target 2028 | ₹80 |

| PC Jewellers Share Price Target 2029 | ₹100 |

| PC Jewellers Share Price Target 2030 | ₹120 |

PC Jewellers Share Price Target 2025

PC Jewellers share price target 2025 Expected target could be between ₹15 to ₹20. Here are 3 Key Factors Affecting Growth for “PC Jeweller Share Price Target 2025”:

-

Festive and Wedding Season Demand

India’s jewelry market heavily depends on the festive and wedding seasons. Strong sales during these periods can positively impact PC Jeweller’s revenue and profitability. A surge in consumer demand for gold and diamond jewelry can drive its share price growth. - Gold Price Volatility

Gold prices play a significant role in determining jewelry costs. Stable or decreasing gold prices can encourage higher customer spending, improving PC Jeweller’s sales. Conversely, high volatility in gold prices might affect its stock performance. -

Digital and Omni-Channel Strategy

The company’s adoption of digital platforms for online sales and a robust omnichannel strategy could attract tech-savvy customers. Expanding its reach through e-commerce while maintaining a strong offline presence can contribute to long-term growth in share prices.

PC Jewellers Share Price Target 2030

PC Jewellers share price target 2030 Expected target could be between ₹110 to ₹120. Here are 3 Key Factors Affecting Growth for “PC Jeweller Share Price Target 2030”:

-

Expansion into Global Markets

PC Jeweller’s efforts to expand its footprint into international markets could significantly contribute to its growth. By catering to a global audience, especially in countries with high demand for Indian jewelry, the company can boost its revenue and enhance its brand recognition. - Shift Toward Lightweight and Customizable Jewelry

Changing consumer preferences toward lightweight and customizable jewelry designs can open new avenues for growth. By adapting to these trends and offering innovative designs, PC Jeweller can attract younger customers and solidify its market position. -

Government Policies and Gold Monetization Schemes

Supportive government policies, including tax benefits and gold monetization schemes, can positively impact the jewelry sector. If PC Jeweller aligns with these initiatives, it could benefit from increased consumer confidence and reduced raw material costs, driving long-term growth in its share price.

Risks and Challenges for PC Jewellers Share Price

Here are 5 Risks and Challenges for PC Jeweller Share Price:

- Fluctuations in Gold Prices

The jewelry industry is heavily influenced by the prices of gold and other precious metals. Any significant volatility in gold prices due to global economic factors or geopolitical tensions can directly impact the company’s profitability and, consequently, its share price. - High Competition in the Jewelry Market

PC Jeweller faces intense competition from both organized players and unorganized local jewelers. This competition can affect market share, force price reductions, and impact margins, especially if competitors offer innovative designs or better customer experiences. - Regulatory Challenges

The jewelry industry is subject to stringent government regulations, including rules on gold imports, taxation policies like GST, and anti-money laundering laws. Non-compliance or sudden regulatory changes can disrupt operations and negatively impact the share price. - Changing Consumer Preferences

The evolving tastes of consumers, including a shift toward more minimalist and modern jewelry, can pose a challenge. If PC Jeweller fails to adapt to these trends, it risks losing relevance, which could affect its revenue and market value. -

Dependence on Seasonal Sales

A significant portion of the company’s sales comes during festive seasons and weddings. A weak season due to economic slowdowns, lower consumer spending, or unforeseen events like natural disasters or pandemics could hurt revenue and investor confidence in the stock.

Read Also:- Bank of Maharashtra Share Price Target Tomorrow 2025, 2026 To 2030- More Details