Nykaa, officially known as FSN E-Commerce Ventures Ltd, is a leading Indian beauty, fashion, and lifestyle company. Nykaa Share Price on NSE as of 24 January 2025 is 168.00 INR. On this page, you will find Nykaa Share Price Target 2025, 2026, 2027 to 2030 as well as NYKAA share price target tomorrow, Nykaa share price BSE, FSN Nykaa share price target, Nayak share price NSE, Nykaa share News, and more Information.

Nykaa India Ltd

Nykaa, officially known as FSN E-Commerce Ventures Ltd, is a leading Indian beauty, fashion, and lifestyle company. Founded in 2012 by Falguni Nayar, Nykaa started as an online platform offering cosmetics, skincare, and wellness products. Over time, it expanded into fashion and launched its private-label brands to cater to diverse customer needs.

Nykaa operates through its e-commerce platform and physical retail stores across India, ensuring a seamless omnichannel experience. It offers a wide range of products from global and domestic brands, making it a go-to destination for beauty and fashion enthusiasts.

Nykaa Share Price Chart

Current Market Overview Of Nykaa Share Price

- Open: 170.30

- High: 173.26

- Low: 166.61

- Mkt cap: 48.01KCr

- P/E ratio: 1,096.96

- Div yield: N/A

- 52-wk high: 229.80

- 52-wk low: 139.80

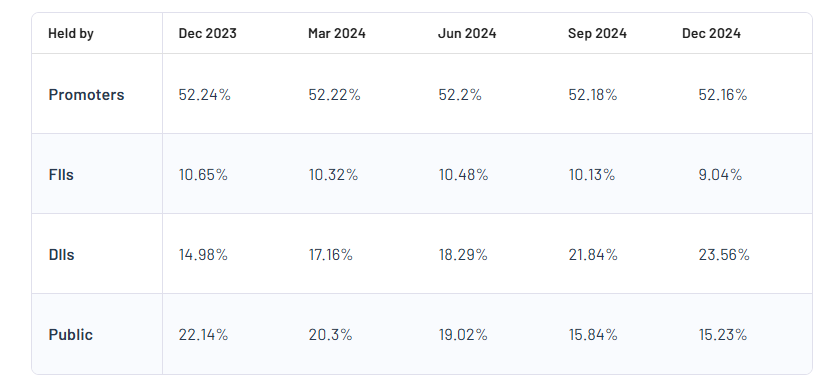

Nykaa Shareholding Pattern

- Promoters: 96.38%%

- FII: 0.02%

- DII: 1.3%

- Public: 2.29%

Nykaa Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Nykaa Share Price Target Years | Share Price Target (₹) |

| Nykaa Share Price Target 2025 | ₹250 |

| Nykaa Share Price Target 2026 | ₹280 |

| Nykaa Share Price Target 2027 | ₹320 |

| Nykaa Share Price Target 2028 | ₹370 |

| Nykaa Share Price Target 2029 | ₹410 |

| Nykaa Share Price Target 2030 | ₹450 |

Nykaa Share Price Target 2025

Nykaa share price target 2025 Expected target could be between ₹230 to ₹250. Here are 3 Key Factors Affecting Growth for “Nykaa Share Price Target 2025”

-

Expansion of Product Portfolio

Nykaa’s ability to introduce diverse products and expand its offerings across beauty, personal care, and fashion categories will be a significant factor in driving growth. By catering to a broader range of customer preferences, Nykaa can strengthen its market presence, boost sales, and enhance its brand loyalty. - Digital Penetration and E-commerce Growth

With the increasing adoption of online shopping and digital platforms in India, Nykaa stands to benefit from this growing trend. Continued investments in user-friendly interfaces, personalized customer experiences, and robust logistics will likely contribute to revenue growth and higher market valuation by 2025. -

Strategic Partnerships and Offline Expansion

Nykaa’s collaboration with top global brands and the expansion of its physical store network can be critical drivers of growth. By increasing its reach across Tier 2 and Tier 3 cities, Nykaa can tap into untapped customer bases, driving long-term business growth and positively influencing its share price.

Nykaa Share Price Target 2030

Nykaa share price target 2030 Expected target could be between ₹430 to ₹450. Here are 3 Key Factors Affecting Growth for “Nykaa Share Price Target 2030”

-

Technological Advancements and Personalization

Nykaa’s investment in advanced technologies like AI and machine learning to offer personalized shopping experiences will play a crucial role in long-term growth. Tailored recommendations, seamless customer service, and innovative marketing can help Nykaa retain and attract a loyal customer base, boosting its market value. - Sustainability and Ethical Practices

As consumers increasingly prioritize sustainability, Nykaa’s focus on eco-friendly and cruelty-free products could significantly impact its growth by 2030. Aligning with global sustainability trends and partnering with environmentally conscious brands can strengthen Nykaa’s reputation and customer trust, positively influencing its share price. -

Global Market Expansion

Venturing into international markets and establishing a global presence will be a key driver for Nykaa’s growth. Expanding its footprint beyond India, particularly in regions like Southeast Asia and the Middle East, can open up new revenue streams and enhance its brand recognition on a global scale, ensuring sustained growth by 2030.

Risks and Challenges for Nykaa Share Price

Here are 5 Risks and Challenges for Nykaa Share Price:

-

Intense Competition in the Market

Nykaa faces strong competition from both established players and emerging startups in the beauty and fashion space. Companies like Amazon, Flipkart, and Myntra are also expanding their beauty and personal care segments, which could impact Nykaa’s market share. Intense competition may force Nykaa to reduce prices or spend more on marketing, affecting profitability. - Changing Consumer Preferences

The beauty and fashion industry is heavily influenced by changing trends and customer preferences. If Nykaa fails to adapt quickly to evolving demands, such as a shift towards organic products or new fashion styles, it could lose customers to competitors. Staying relevant requires continuous innovation and market research. - Dependence on E-commerce Growth

As an online-first business, Nykaa relies heavily on the growth of e-commerce in India. Any slowdown in internet penetration, digital payment adoption, or government regulations affecting e-commerce could hinder its sales growth and directly impact its share price. - High Operational Costs

Nykaa’s business model involves significant spending on marketing, technology, logistics, and maintaining physical stores. Rising operational costs, coupled with thin margins in the beauty and fashion categories, could reduce profitability and pose a challenge to sustaining shareholder confidence. -

Regulatory and Economic Risks

Nykaa is subject to various regulatory and tax policies that could impact its operations. Changes in government regulations, such as e-commerce restrictions or increased taxes, can create uncertainties for the company. Additionally, economic slowdowns or inflation can reduce consumer spending on discretionary items like beauty and fashion products, negatively affecting revenue growth.

Read Also:- IOB Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Update