IRB Infra India Ltd is one of India’s leading infrastructure development companies. IRB Infra Share Price on NSE as of 24 January 2025 is 52.00 INR. On this page, you will find IRB Infra Share Price Target 2025, 2026, 2027 to 2030 as well as Irb infra share price target tomorrow, IRB Infra Share Price target moneycontrol, IRB Infra Share Price Target 2025 pdf, Irb infra share price target 2030, and more Information.

IRB Infra India Ltd

IRB Infra India Ltd is one of India’s leading infrastructure development companies, specializing in the construction, operation, and maintenance of roads and highways. Established in 1998, the company has played a significant role in developing the country’s transportation network. IRB Infra operates under a public-private partnership (PPP) model and has an extensive portfolio of projects, including toll roads and build-operate-transfer (BOT) ventures.

IRB Infra Share Price Chart

Current Market Overview Of IRB Infra Share Price

- Open: 53.09

- High: 53.50

- Low: 51.69

- Mkt cap: 31.31KCr

- P/E ratio: 50.81

- Div yield: 0.77%

- 52-wk high: 78.15

- 52-wk low: 45.06

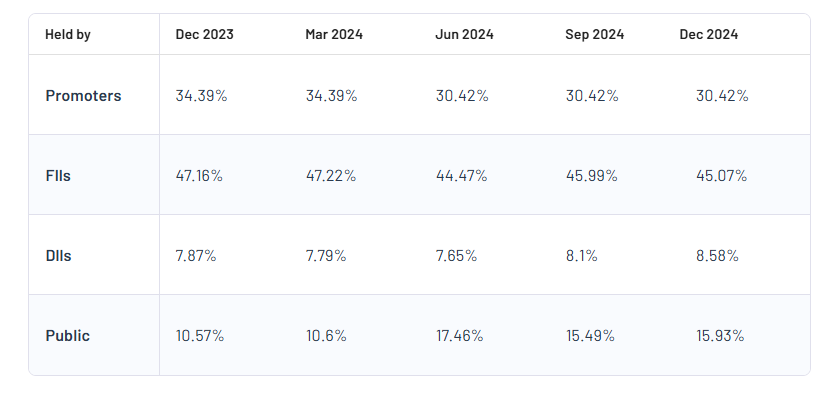

IRB Infra Shareholding Pattern

- Promoters: 30.42%%

- FII: 45.07%

- DII: 8.58%

- Public: 15.93%

IRB Infra Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| IRB Infra Share Price Target Years | Share Price Target (₹) |

| IRB Infra Share Price Target 2025 | ₹80 |

| IRB Infra Share Price Target 2026 | ₹100 |

| IRB Infra Share Price Target 2027 | ₹120 |

| IRB Infra Share Price Target 2028 | ₹140 |

| IRB Infra Share Price Target 2029 | ₹160 |

| IRB Infra Share Price Target 2030 | ₹180 |

IRB Infra Share Price Target 2025

IRB Infra share price target 2025 Expected target could be between ₹55 to ₹80. Here are 3 Key Factors Affecting Growth for “IRB Infra Share Price Target 2025”

-

Government Infrastructure Spending

The Indian government’s push for infrastructure development, including highway construction and modernization projects, is a major driver for IRB Infra. Increased government spending on projects under initiatives like Bharatmala and Gati Shakti can positively impact the company’s revenue and growth trajectory by 2025. - Strong Order Book and Project Execution

IRB Infra’s ability to secure large Build-Operate-Transfer (BOT) and Hybrid Annuity Model (HAM) projects, coupled with efficient project execution, will be crucial for its growth. Timely completion of projects and operational efficiency can boost investor confidence and drive share price growth. -

Traffic Growth and Toll Revenue

Toll collections form a significant portion of IRB Infra’s income. An increase in vehicle traffic on its toll roads due to economic growth and urbanization can lead to higher revenue. Efficient toll operations and consistent traffic growth will play a key role in driving the company’s financial performance by 2025.

IRB Infra Share Price Target 2030

IRB Infra share price target 2030 Expected target could be between ₹170 to ₹180. Here are 3 Key Factors Affecting Growth for “IRB Infra Share Price Target 2030”

-

Expansion of National Highway Projects

The Indian government’s long-term focus on expanding and modernizing the country’s highway network is expected to create significant opportunities for IRB Infra. The company’s ability to secure high-value contracts under initiatives like Bharatmala Phase II can drive sustained growth, positively impacting its share price by 2030. - Adoption of Advanced Technologies

Innovations in toll collection systems, such as FASTag and other automated solutions, can enhance operational efficiency and reduce costs for IRB Infra. Adopting advanced infrastructure technologies may help the company maintain its competitive edge, thereby influencing long-term profitability and investor confidence. -

Diversification into Emerging Markets

Expanding operations beyond India, particularly in high-growth international markets, could open new revenue streams for IRB Infra. Diversification into allied sectors, such as renewable energy for road projects or urban infrastructure, could further strengthen its business portfolio and support long-term growth.

Risks and Challenges for IRB Infra Share Price

Here are 5 Risks and Challenges for IRB Infra Share Price:

- Economic Slowdowns

IRB Infra’s growth heavily depends on infrastructure development, which can slow down during economic uncertainties or recessions. Reduced government spending or delays in project approvals due to financial constraints could negatively affect the company’s revenue and share price. - Regulatory and Policy Risks

Changes in government policies, such as taxation or environmental regulations, could impact project execution timelines and costs. Any unfavorable regulatory changes may lead to financial losses or increased operational challenges, creating pressure on the share price. - High Debt Levels

Infrastructure projects often require significant capital, and IRB Infra carries substantial debt to fund its operations. Rising interest rates or an inability to manage debt effectively could strain the company’s financials, affecting investor sentiment and the stock’s performance. - Project Execution Delays

Large infrastructure projects are prone to delays due to land acquisition issues, environmental clearances, or legal disputes. Prolonged delays can increase costs, reduce profitability, and impact the company’s reputation, which could harm its share price. -

Competition in the Sector

The infrastructure sector is highly competitive, with numerous players vying for government contracts. Intense competition can lead to pricing pressures, reduced margins, and potential loss of projects, making it harder for IRB Infra to sustain steady growth in its market valuation.

Read Also:- Tata Elxsi Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Update