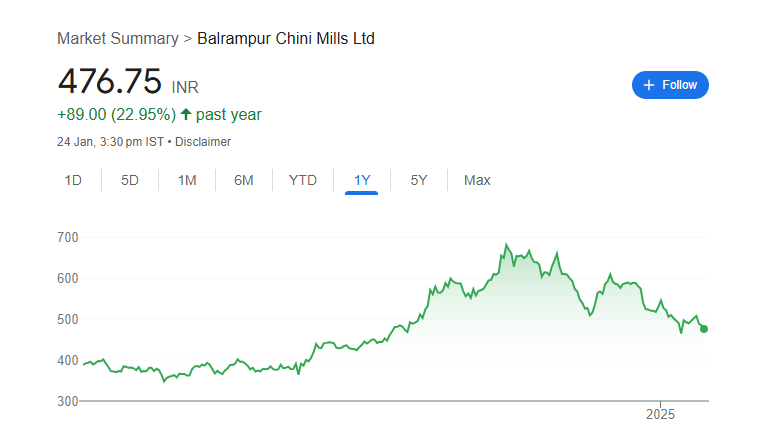

Balrampur Chini Mills Ltd is one of the largest integrated sugar manufacturing companies in India. Balrampur Chini Share Price on NSE as of 24 January 2025 is 476.75 INR. On this page, you will find Balrampur Chini Share Price Target 2025, 2026, 2027 to 2030 as well as Why Balrampur Chini going down today, Balrampur Chini latest News, Balrampur Chini share News, Balrampur chini share price target tomorrow, and more Information.

Balrampur Chini India Ltd

Balrampur Chini Mills Ltd is one of the largest integrated sugar manufacturing companies in India. Established in 1975, the company is engaged in producing sugar, ethanol, and power. It operates several sugar mills and distilleries across Uttar Pradesh, one of the largest sugarcane-growing states in India. The company produces high-quality sugar, which is distributed both domestically and internationally. In addition to sugar, Balrampur Chini Mills also focuses on renewable energy, producing power from bagasse, a by-product of sugar production.

Balrampur Chini Share Price Chart

Current Market Overview Of Balrampur Chini Share Price

- Open: 487.00

- High: 488.70

- Low: 473.30

- Mkt cap: 9.63KCr

- P/E ratio: 22.30

- Div yield: 0.94%

- 52-wk high: 691.80

- 52-wk low: 343.50

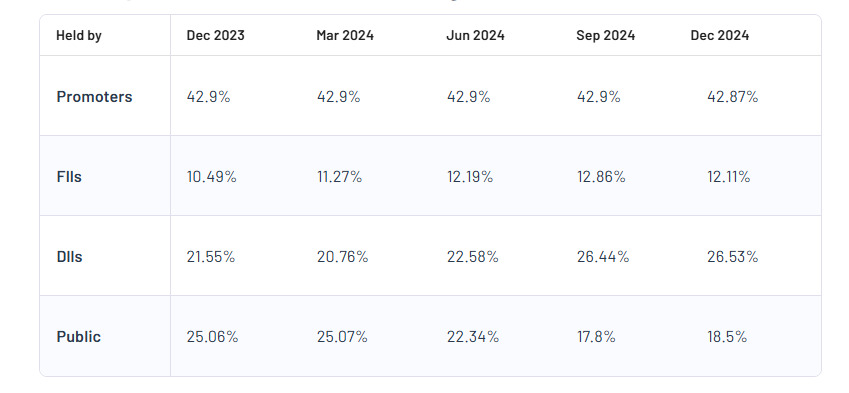

Balrampur Chini Shareholding Pattern

- Promoters: 42.87%

- FII: 12.11%

- DII: 26.53%

- Public: 18.5%

Balrampur Chini Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Balrampur Chini Share Price Target Years | Share Price Target (₹) |

| Balrampur Chini Share Price Target 2025 | ₹700 |

| Balrampur Chini Share Price Target 2026 | ₹780 |

| Balrampur Chini Share Price Target 2027 | ₹850 |

| Balrampur Chini Share Price Target 2028 | ₹965 |

| Balrampur Chini Share Price Target 2029 | ₹1010 |

| Balrampur Chini Share Price Target 2030 | ₹1070 |

Balrampur Chini Share Price Target 2025

Balrampur Chini share price target 2025 Expected target could be between ₹690 to ₹700. Here are 3 Key Factors Affecting Growth for “Balrampur Chini Share Price Target 2025”

-

Government Policies on Sugar Industry

Balrampur Chini’s performance is closely tied to government regulations, such as subsidies for sugar exports, ethanol blending programs, and minimum support prices for sugarcane. The government’s push toward ethanol blending, aimed at reducing oil imports, can boost the company’s revenue through ethanol production, positively impacting its share price by 2025. - Global Sugar Market Trends

Fluctuations in global sugar demand and supply can influence sugar prices, affecting Balrampur Chini’s profitability. Rising global demand for sugar, particularly in emerging markets, may create export opportunities, providing the company with an additional revenue stream and growth potential. -

Operational Efficiency and Capacity Expansion

Investments in technology and capacity expansion for sugar and ethanol production are key growth drivers. If Balrampur Chini continues improving operational efficiency and increasing ethanol production capacity, it can strengthen its revenue streams and position itself well for 2025 growth targets.

Balrampur Chini Share Price Target 2030

Balrampur Chini share price target 2030 Expected target could be between ₹1050 to ₹1070. Here are 3 Key Factors Affecting Growth for “Balrampur Chini Share Price Target 2030”

-

Ethanol Blending and Renewable Energy Transition

The Indian government’s ethanol blending program is expected to reach 20% blending by 2030. As Balrampur Chini invests in expanding its ethanol production capacity, the increasing demand for ethanol as a green fuel alternative can significantly boost the company’s revenue, contributing to long-term growth and share price appreciation. - Diversification into Value-Added Products

Balrampur Chini’s ability to diversify its portfolio into value-added products like specialty sugars, energy generation from bagasse, and bio-based products can enhance profitability. This diversification strategy can reduce dependence on traditional sugar markets and provide stable revenue streams by 2030. -

Impact of Climate Change on Agriculture

As climate change poses challenges to traditional farming, companies like Balrampur Chini that adopt sustainable practices, such as water-efficient farming and precision agriculture, will likely have a competitive edge. Their ability to secure sustainable sugarcane supplies will directly influence their long-term growth and market stability.

Risks and Challenges for Balrampur Chini Share Price

Here are 5 Risks and Challenges for Balrampur Chini Share Price:

- Fluctuations in Sugar Prices

The sugar industry is highly sensitive to global and domestic price fluctuations. Any decline in sugar prices can negatively impact the profitability of companies like Balrampur Chini. This volatility can result in unstable financial performance, affecting investor confidence and the share price. - Government Policies and Regulations

The sugar industry in India is heavily influenced by government policies such as minimum support prices (MSP), export controls, and subsidies. Any sudden changes or unfavorable government policies could lead to increased production costs or reduced profit margins, thereby posing a challenge to the company’s growth and share value. - Dependency on Weather Conditions

Balrampur Chini’s operations rely on the successful cultivation of sugarcane, which is highly dependent on favorable weather conditions. Droughts, floods, or irregular rainfall patterns can severely affect sugarcane yields, thereby impacting production volumes and the company’s financial performance, which could result in a fall in share prices. - Rising Input Costs

The increasing cost of raw materials such as fertilizers, fuel, and labor can put pressure on profit margins for sugar manufacturers. If these costs rise without a corresponding increase in sugar or ethanol prices, Balrampur Chini could face profitability challenges, potentially harming its stock performance. -

Competition from Domestic and International Markets

Balrampur Chini faces stiff competition not only from other Indian sugar producers but also from international markets. A rise in global sugar production or an increase in sugar imports could reduce domestic prices and affect market share. Intense competition may lower the company’s profitability and lead to a decrease in share price.

Read Also:- IOB Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Update