IIFL Finance India Ltd is one of the leading non-banking financial companies (NBFCs) in India. IIFL Finance Share Price on NSE as of 27 January 2025 is 358.00 INR. On this page, you will find IIFL Finance Share Price Target 2025, 2026, 2027 to 2030 as well as IIFL Finance RBI News, IIFL Finance share News, Why IIFL Finance share falling, IIFL Finance News Today, Iifl finance share price target tomorrow, IIFL Finance Share price target Motilal Oswal, and more Information.

IIFL Finance India Ltd

IIFL Finance India Ltd is one of the leading non-banking financial companies (NBFCs) in India. It provides a wide range of financial services, including home loans, gold loans, business loans, and microfinance. The company focuses on catering to the needs of retail and small business customers, ensuring accessible and quick financial solutions.

IIFL Finance Share Price Chart

Current Market Overview Of IIFL Finance Share Price

- Open: 374.85

- High: 374.85

- Low: 352.35

- Mkt cap: 15.20KCr

- P/E ratio: 14.57

- Div yield: 1.09%

- 52-wk high: 615.79

- 52-wk low: 304.25

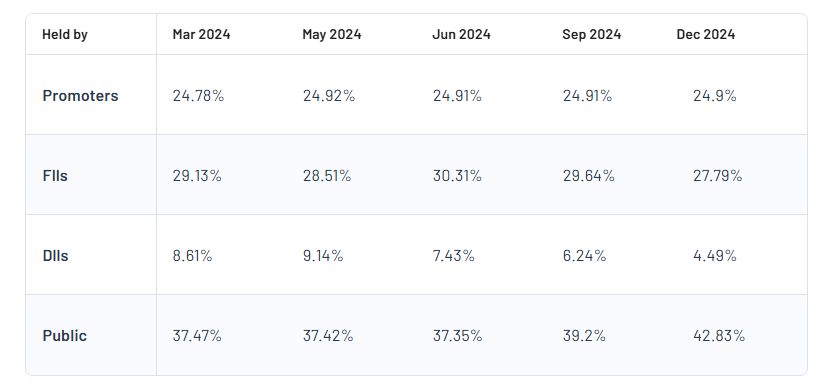

IIFL Finance Shareholding Pattern

- Promoters: 24.9%

- FII: 27.79%

- DII: 4.49%

- Public: 42.83%

IIFL Finance Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| IIFL Finance Share Price Target Years | Share Price Target (₹) |

| IIFL Finance Share Price Target 2025 | ₹630 |

| IIFL Finance Share Price Target 2026 | ₹700 |

| IIFL Finance Share Price Target 2027 | ₹760 |

| IIFL Finance Share Price Target 2028 | ₹820 |

| IIFL Finance Share Price Target 2029 | ₹900 |

| IIFL Finance Share Price Target 2030 | ₹960 |

IIFL Finance Share Price Target 2025

IIFL Finance share price target 2025 Expected target could be between ₹610 to ₹630. Here are 3 Key Factors Affecting Growth for IIFL Finance Share Price Target 2025:

-

Expansion of Loan Portfolio

IIFL Finance’s growth depends significantly on its ability to expand its loan portfolio across diverse sectors like home loans, gold loans, and microfinance. Increased penetration in rural and urban areas and tailored financial products can drive revenue growth, positively impacting its share price. - Digital Transformation and Technology Adoption

With increasing competition in the financial services sector, IIFL’s focus on leveraging technology for customer acquisition, risk management, and digital lending can enhance operational efficiency. This adoption of fintech solutions may improve customer experience and profitability, contributing to share price growth. -

Economic Recovery and Interest Rate Environment

The company’s performance is closely tied to macroeconomic conditions. A strong economic recovery, along with favorable interest rate policies by the Reserve Bank of India (RBI), could boost demand for loans and reduce non-performing assets (NPAs), improving investor confidence and driving the share price upward.

IIFL Finance Share Price Target 2030

IIFL Finance share price target 2030 Expected target could be between ₹950 to ₹960. Here are 3 Key Factors Affecting Growth for IIFL Finance Share Price Target 2030:

-

Diversification of Financial Services

By 2030, IIFL Finance’s growth will depend on how well it diversifies its product portfolio beyond traditional loans. Expanding into wealth management, insurance distribution, and asset management can create new revenue streams, making the company more resilient to market fluctuations and boosting its share price. - Rural and Semi-Urban Market Penetration

The long-term growth of IIFL Finance lies in tapping underserved rural and semi-urban markets. Providing tailored financial products to these regions, combined with government initiatives for financial inclusion, could significantly enhance the company’s customer base and profitability. - Sustainability and ESG Practices

Investors increasingly value companies that align with environmental, social, and governance (ESG) standards. IIFL Finance’s commitment to sustainable lending practices, such as financing renewable energy or green housing projects, could attract ESG-focused investors, positively impacting its share price in the long run.

Risks and Challenges for IIFL Finance Share Price

Here are 5 Risks and Challenges for IIFL Finance Share Price:

- Rising Interest Rates

Fluctuations in interest rates can increase the cost of borrowing for IIFL Finance, directly impacting its profit margins. If the company passes these costs onto customers, it might reduce demand for loans, negatively affecting its revenue and share price. - Non-Performing Assets (NPAs)

One of the biggest risks for any financial institution is the rise in non-performing assets. Economic slowdowns, job losses, or poor credit management could lead to higher defaults by borrowers, impacting the company’s financial health and investor confidence. - Regulatory Compliance

The financial sector is heavily regulated, and any sudden policy changes by regulatory authorities can impact the operations of IIFL Finance. Stricter compliance requirements or changes in tax laws may increase operational costs, limiting growth opportunities. - High Competition in Financial Services

The financial services market in India is competitive, with players ranging from banks to NBFCs and fintech companies. Increased competition could put pressure on IIFL Finance to offer lower interest rates or invest heavily in technology, which may reduce profitability. -

Dependence on Economic Conditions

The company’s growth is closely tied to the overall economic environment. During a slowdown or recession, borrowing reduces, repayment rates decline, and the company’s revenue growth can stagnate, leading to volatility in its share price.

Read Also:- Shreeram Proteins Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Update