Indian Overseas Bank (IOB) is a leading public sector bank in India. IOB Share Price on NSE as of 24 January 2025 is 49.20 INR. On this page, you will find IOB Share Price Target 2025, 2026, 2027 to 2030 as well as IOB share price target tomorrow, IOB share price target next Week, IOB Share News, Should I buy IOB shares, IOB share Price Target 2040, IOB share price target 2050, and more Information.

IOB India Ltd

Indian Overseas Bank (IOB) is a leading public sector bank in India, founded in 1937 and headquartered in Chennai. It offers a wide range of banking and financial services, including savings and current accounts, loans, credit cards, and investment options.

The bank plays a significant role in providing financial support to individuals, businesses, and rural communities. With its extensive network of branches and ATMs across the country, IOB ensures accessibility and convenience for its customers.

IOB Share Price Chart

Current Market Overview Of IOB Share Price

- Open: 50.64

- High: 50.84

- Low: 48.86

- Mkt cap: 92.66KCr

- P/E ratio: 29.87

- Div yield: N/A

- 52-wk high: 83.75

- 52-wk low: 43.45

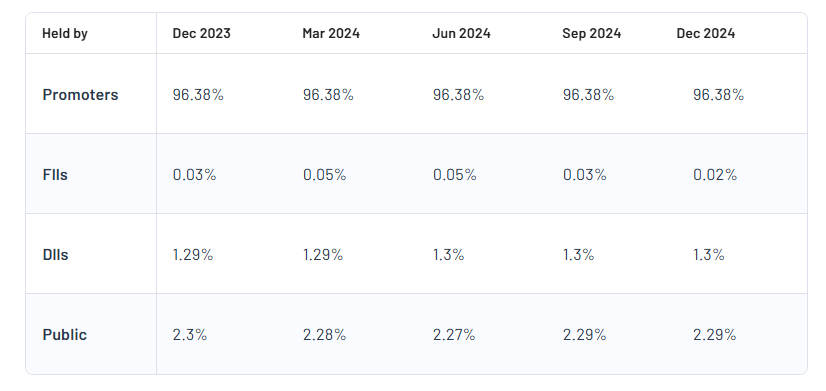

IOB Shareholding Pattern

- Promoters: 96.38%%

- FII: 0.02%

- DII: 1.3%

- Public: 2.29%

IOB Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| IOB Share Price Target Years | Share Price Target (₹) |

| IOB Share Price Target 2025 | ₹90 |

| IOB Share Price Target 2026 | ₹105 |

| IOB Share Price Target 2027 | ₹120 |

| IOB Share Price Target 2028 | ₹135 |

| IOB Share Price Target 2029 | ₹150 |

| IOB Share Price Target 2030 | ₹160 |

IOB Share Price Target 2025

IOB share price target 2025 Expected target could be between ₹85 to ₹90. Here are 3 Key Factors Affecting Growth for “IOB Share Price Target 2025”:

-

Focus on Strengthening Asset Quality

Indian Overseas Bank (IOB) has been actively working on reducing its Non-Performing Assets (NPAs) by improving credit monitoring and recovery efforts. A significant improvement in asset quality could boost investor confidence and positively impact the share price by 2025. - Government Support and Capital Infusion

Being a public sector bank, IOB often benefits from government support through capital infusions and policy initiatives. Any significant financial backing or reforms aimed at strengthening public sector banks can directly impact the bank’s growth and share price. -

Expansion of Digital Banking Services

IOB’s efforts to modernize its banking operations, including investing in digital technologies and mobile banking platforms, could attract more customers and improve operational efficiency. These advancements can contribute to higher profitability and influence the share price in the medium term.

IOB Share Price Target 2030

IOB share price target 2030 Expected target could be between ₹165 to ₹160. Here are 3 Key Factors Affecting Growth for “IOB Share Price Target 2030”:

-

Economic Growth and Banking Sector Reforms

The long-term performance of Indian Overseas Bank (IOB) will largely depend on India’s overall economic growth and reforms in the banking sector. Policies promoting credit expansion, infrastructure development, and financial inclusion can enhance IOB’s market position and drive its share price growth. - Diversification of Loan Portfolio

To reduce risks and ensure stable growth, IOB’s ability to diversify its loan portfolio across industries and geographies will be critical. Expanding its reach in retail, MSME, and agricultural loans while maintaining healthy asset quality could significantly contribute to the bank’s long-term growth. -

Technological Adoption and Innovation

By 2030, advanced technologies like AI, blockchain, and data analytics are expected to revolutionize the banking sector. IOB’s ability to adopt these innovations and improve customer service, operational efficiency, and cybersecurity will play a vital role in sustaining its competitive edge and influencing its share price trajectory.

Risks and Challenges for IOB Share Price

Here are 5 Risks and Challenges for IOB Share Price:

-

Asset Quality Concerns

Indian Overseas Bank (IOB) has faced issues with non-performing assets (NPAs) in the past. If the bank struggles to recover loans or maintain its asset quality, it could negatively impact profitability and investor confidence, putting downward pressure on its share price. - Dependence on Government Support

As a public sector bank, IOB heavily relies on government capital infusion during financial stress. Any delay or lack of adequate government support could hinder its ability to expand operations, affecting its financial performance and share value. - Economic Slowdowns

IOB’s growth is closely tied to India’s economic performance. During periods of economic slowdown or high inflation, the demand for loans and banking services may decrease, potentially reducing the bank’s revenue and share price growth. - Intense Competition

The banking sector in India is highly competitive, with private sector banks and fintech companies providing innovative solutions and better customer experiences. IOB’s ability to compete effectively and retain market share will be crucial to sustaining its share price. -

Regulatory and Policy Changes

Changes in banking regulations, interest rate policies, or taxation rules could pose challenges for IOB. Unfavorable regulatory changes may increase compliance costs or limit the bank’s ability to expand, impacting its profitability and stock market performance.

Read Also:- IRB Infra Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Update