NHPC Ltd (National Hydroelectric Power Corporation) is a leading government-owned company in India focused on developing and operating hydropower projects. NHPC Share Price on NSE as of 19 January 2025 is 80.11 INR. On this page, you will find NHPC Share Price Target 2025, 2026, 2027 to 2030 as well as NHPC Share price target 2025 Moneycontrol, Nhpc share price target tomorrow, NHPC Share price target 2040, NHPC Share Price Target 2026, NHPC bonus share, and more Information.

NHPC Ltd

NHPC Ltd (National Hydroelectric Power Corporation) is a leading government-owned company in India focused on developing and operating hydropower projects. Established in 1975, NHPC plays a crucial role in generating clean and sustainable energy to support the country’s growing electricity demand. The company also explores renewable energy sources like solar and wind, aiming to contribute to India’s renewable energy goals.

NHPC Share Price Chart

Current Market Overview Of NHPC Share Price

- Open: ₹78.41

- High: ₹81.00

- Low: ₹78.00

- Mkt cap: ₹80.82KCr

- P/E ratio: 27.08

- Div yield: 2.37%

- 52-wk high: ₹118.40

- 52-wk low: ₹68.55

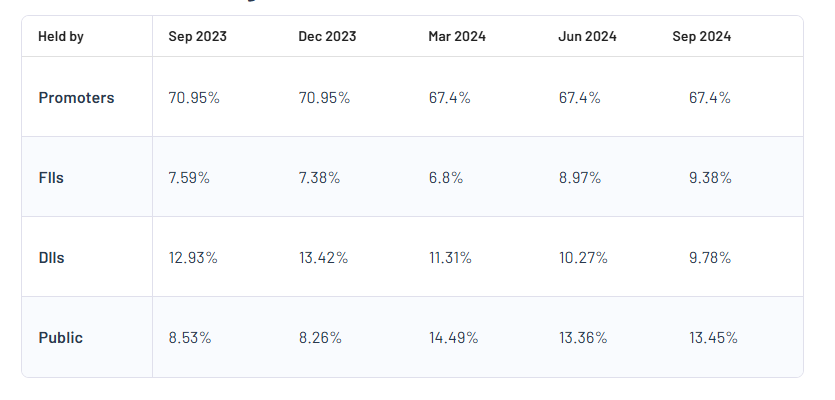

NHPC Shareholding Pattern

- Promoters: 67.4%

- FII: 9.38%

- DII: 9.38%

- Public: 13.45%

NHPC Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| NHPC Share Price Target Years | Share Price Target (₹) |

| NHPC Share Price Target 2025 | ₹120 |

| NHPC Share Price Target 2026 | ₹140 |

| NHPC Share Price Target 2027 | ₹160 |

| NHPC Share Price Target 2028 | ₹180 |

| NHPC Share Price Target 2029 | ₹200 |

| NHPC Share Price Target 2030 | ₹320 |

NHPC Share Price Target 2025

NHPC share price target 2025 Expected target could be between ₹115 to ₹120. Here are 3 Key Factors Affecting Growth for NHPC Share Price Target 2025:

-

Increased Focus on Hydropower Development

With the government prioritizing clean and renewable energy sources, NHPC, as a leading hydropower company, is expected to benefit from new project approvals and enhanced capacity. This focus can drive revenue growth and positively impact its share price by 2025. - Expansion of Renewable Energy Portfolio

NHPC is diversifying into solar and wind energy projects, alongside its core hydropower operations. This strategic move into renewable energy markets broadens its revenue base and positions the company for steady growth, supporting its share price potential. -

Government Policies and Support

Favorable policies, such as financial incentives for renewable energy projects and emphasis on achieving India’s green energy goals, can boost NHPC’s operations. Continued government backing will ensure consistent project funding, which can contribute to share price growth in the near term.

NHPC Share Price Target 2030

NHPC share price target 2030 Expected target could be between ₹315 to ₹320. Here are 3 Key Factors Affecting Growth for NHPC Share Price Target 2030:

-

Government’s Long-Term Renewable Energy Goals

India’s ambitious target of achieving net-zero emissions by 2070 and increasing the share of renewable energy in the power mix will drive significant growth in clean energy projects. NHPC’s continued expansion in hydropower and renewable energy sources like solar and wind will be key to its growth, making it a vital player in India’s energy transition by 2030. - Technological Advancements in Hydropower

The implementation of new technologies for better efficiency and cost reduction in hydropower plants can significantly boost NHPC’s performance. Innovations in energy storage, grid connectivity, and turbine technology will help the company improve its output and reduce operational costs, positively influencing its growth trajectory by 2030. -

Strategic Partnerships and International Expansion

NHPC’s potential to collaborate with global energy companies and explore international markets can open new revenue streams. Entering emerging renewable energy markets outside India will not only diversify its operations but also increase its global presence, enhancing its growth prospects and supporting its share price in the long run.

Risks and Challenges for NHPC Share Price

Here are 5 Risks and Challenges for NHPC Share Price:

- Dependence on Hydropower Projects

NHPC relies heavily on hydropower for its revenue. This dependence makes it vulnerable to seasonal and climatic variations, such as reduced rainfall or drought conditions, which can lower water availability and limit power generation, directly impacting its financial performance. - Delays in Project Execution

Hydropower projects often face delays due to issues like land acquisition, environmental clearances, and logistical challenges. These delays can lead to increased costs, missed revenue opportunities, and a negative impact on investor sentiment. - Regulatory and Environmental Challenges

Hydropower projects must comply with strict environmental and regulatory requirements. Any changes in government policies, taxation, or stricter environmental norms can create additional hurdles, increasing project costs and uncertainty. - Market Competition

NHPC faces growing competition from private renewable energy companies and other public-sector firms expanding in solar and wind energy. This competition could limit NHPC’s market share and profitability, especially as solar and wind energy become more cost-effective. -

Impact of Climate Change

Climate change poses a significant risk to NHPC’s operations. Changes in rainfall patterns, melting glaciers, or extreme weather events could affect the long-term availability of water resources, disrupting power generation and creating uncertainties for its future projects.

Read Also:- IREDA Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Updates