Yes Bank Ltd is an Indian private-sector bank. Yes Bank Share Price on NSE as of 16 January 2025 is 18.30 INR. On this page, you will find Yes Bank Share Price Target 2025, 2026, 2027 to 2030 as well as Yes bank share price target 2025, Yes bank share price target 2030, Yes Bank Share Price target 2025 Moneycontrol, Yes Bank share price target tomorrow, Is it good to buy Yes Bank shares for long term, Yes Bank Share Price Target 2040, and more Information.

Yes Bank Ltd

Yes Bank Ltd is a private-sector bank in India, founded in 2004. It offers a wide range of banking services, including savings accounts, loans, and investment options, to both individuals and businesses. Over the years, Yes Bank has grown to become one of the leading banks in India. However, it faced some financial challenges in recent years, which impacted its reputation.

Yes Bank Share Price Chart

Current Market Overview Of Yes Bank Share Price

- Open: ₹18.24

- High: ₹18.56

- Low: ₹18.19

- Mkt cap: ₹57.28KCr

- P/E ratio: 31.26

- Div yield: N/A

- 52-wk high: ₹32.85

- 52-wk low: ₹17.06

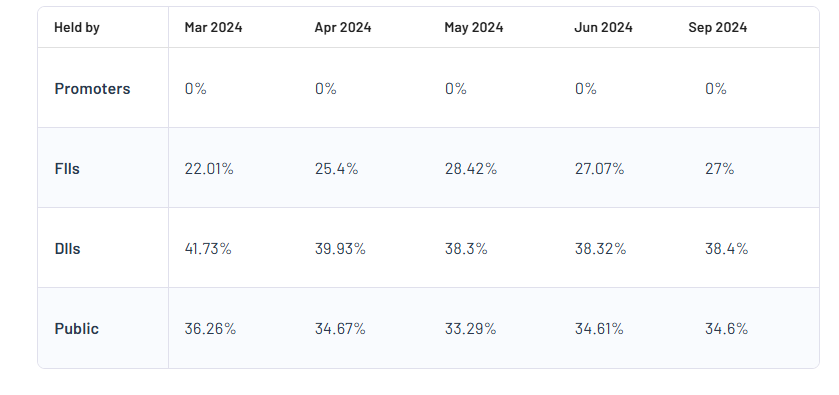

Yes Bank Shareholding Pattern

- Promoter: 0%

- FII: 27%

- DII: 38.4%

- Public: 34.6%

Yes Bank Share Price Target Tomorrow 2025 To 2030

| Yes Bank Share Price Target Years | Expected Share Price Target (₹) |

|---|---|

| Yes Bank Share Price Target 2025 | ₹33 |

| Yes Bank Share Price Target 2026 | ₹40 |

| Yes Bank Share Price Target 2027 | ₹47 |

| Yes Bank Share Price Target 2028 | ₹54 |

| Yes Bank Share Price Target 2029 | ₹60 |

| Yes Bank Share Price Target 2030 | ₹67 |

Yes Bank Share Price Target 2025

Yes Bank share price target 2025 Expected target could be between ₹30 to ₹33. By 2025, Yes Bank’s share price is expected to show gradual growth as the bank continues to recover and strengthen its financial position. However, investors should carefully research and consider market risks before investing in Yes Bank shares.

Yes Bank Share Price Target 2030

Yes Bank share price target 2030 Expected target could be between ₹64 to ₹67. By 2030, Yes Bank’s share price is expected to grow as the bank continues to recover and strengthen its operations. Key factors driving this growth may include improved asset quality, higher profits, and overall economic development.

Key Factors Affecting Yes Bank Share Price Growth

Here are 6 Key Factors Affecting Yes Bank Share Price Growth

- Bank’s Financial Health

Yes Bank’s financial performance, including profits, loan quality, and asset growth, plays a major role in its stock price. Strong financial health leads to investor confidence and can drive the share price up. - Loan and Deposit Growth

The growth of loans and deposits is crucial for Yes Bank’s profitability. A steady increase in both areas shows the bank’s ability to attract customers and generate income, positively affecting its share price. - Government and Regulatory Policies

Government actions and changes in banking regulations can impact Yes Bank’s operations. Positive policies, like support for the banking sector, can boost confidence in the bank and its stock. - Market Sentiment and Investor Confidence

General market trends and investor confidence in the banking sector influence Yes Bank’s share price. Positive news about the bank’s recovery or expansion can push the stock price higher. - Economic Conditions

The overall economic situation in India, such as growth in GDP, inflation rates, and interest rates, affects the banking industry. A strong economy often leads to higher demand for banking services, benefiting Yes Bank’s stock. -

Risk Management and Non-Performing Assets (NPAs)

The ability of Yes Bank to manage risks and reduce non-performing assets (bad loans) is important. A reduction in NPAs shows the bank’s improvement and can lead to an increase in its share price.

Risks and Challenges for Yes Bank Share Price

Here are 5 Risks and Challenges for Yes Bank Share Price

- Market Volatility

Stock prices can be influenced by changes in the overall market. Economic downturns, political instability, or global events can cause the stock price of Yes Bank to fluctuate. - Competition

The company may face stiff competition from other players in the same industry. Strong competitors can affect its market share and impact its growth potential, which could lead to a decline in share price. - Regulatory Changes

Any changes in government policies or regulations that affect the industry could harm Yes Bank’s operations. New rules can increase costs or limit opportunities, which might negatively impact the share price. - Financial Performance

If Yes Bank faces challenges in generating revenue, managing costs, or dealing with rising debts, it could lead to lower profits, affecting investor confidence and the stock price. -

Investor Sentiment

Negative news or rumors about the company can hurt investor sentiment. If investors lose confidence, they may sell their shares, leading to a drop in the share price.

Read Also:- IRFC Share Price Target Tomorrow 2025, 2026, 2027 To 2030 and More Details