Waaree Energies Ltd is a leading Indian solar energy company. Waaree Energies Share Price on NSE as of 17 January 2025 is 2,606.00 INR. On this page, you will find Waaree Energies Share Price Target 2025, 2026, 2027 to 2030 as well as Waaree energies share price target 2025, Waaree energies share price target 2030, Waaree energies share price target tomorrow, and more Information.

Waaree Energies Ltd

Waaree Energies Ltd is a leading solar energy company in India, known for manufacturing solar panels and providing solar power solutions. Established in 2007, the company is focused on producing high-quality, efficient solar products to meet the growing demand for renewable energy. Waaree Energies is also involved in the installation and maintenance of solar power systems for residential, commercial, and industrial clients.

Waaree Energies Share Price Chart

Current Market Overview Of Waaree Energies Share Price

- Open: ₹2,656.00

- High: ₹2,656.00

- Low: ₹2,595.00

- Mkt cap: ₹74.83KCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: ₹3,743.00

- 52-wk low: ₹2,300.00

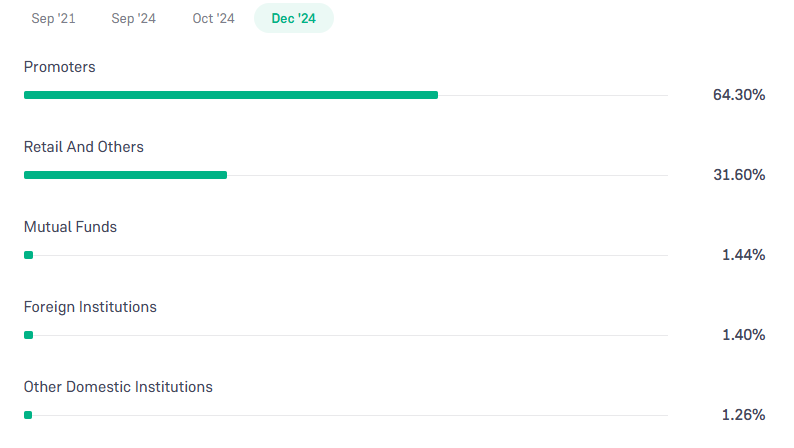

Waaree Energies Shareholding Pattern

- Promoters: 64.30%

- Retail and Others: 31.60%

- Mutual Funds: 1.44%

- FII: 1.40%

- DII: 1.26%

Waaree Energies Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Waaree Energies Share Price Target Years | Share Price Target (₹) |

| Waaree Energies Share Price Target 2025 | ₹3,750 |

| Waaree Energies Share Price Target 2026 | ₹4,235 |

| Waaree Energies Share Price Target 2027 | ₹5,667 |

| Waaree Energies Share Price Target 2028 | ₹6,400 |

| Waaree Energies Share Price Target 2029 | ₹7,665 |

| Waaree Energies Share Price Target 2030 | ₹8,250 |

Waaree Energies Share Price Target 2025

Waaree Energies share price target 2025 Expected target could be between ₹3,650 to ₹3,750. Here are 3 Key Factors Affecting Growth for Waaree Energies Share Price Target 2025

-

Expansion in Renewable Energy Market

Waaree Energies is focusing on the growing demand for solar energy in India and globally. The company’s efforts to expand its solar panel manufacturing capacity and increase its market share in renewable energy will play a significant role in boosting its growth and share price. - Government Policies and Incentives

Government support for renewable energy, including subsidies, tax incentives, and long-term sustainability goals, can significantly impact Waaree Energies’ business. Favorable policies for solar energy projects could lead to increased demand and revenue growth, positively influencing its stock price. -

Technological Innovation and Efficiency

Waaree Energies’ commitment to research and development in solar technology, along with improvements in panel efficiency and production techniques, will enhance its competitiveness. Technological advancements can help reduce costs, increase profit margins, and support long-term growth in the solar energy market.

Waaree Energies Share Price Target 2030

Waaree Energies share price target 2030 Expected target could be between ₹8,100 to ₹8,250. Here are 3 Key Factors Affecting Growth for Waaree Energies Share Price Target 2030

-

Global Shift Towards Renewable Energy

As the world increasingly focuses on sustainability and reducing carbon emissions, the demand for renewable energy, particularly solar power, will continue to rise. Waaree Energies’ growth in this expanding market can drive significant revenue and contribute to its share price growth by 2030. - Government Support for Clean Energy Initiatives

Ongoing government incentives, such as subsidies, tax breaks, and renewable energy targets, will continue to support Waaree Energies’ growth. Policies favoring green energy projects can lead to increased demand for solar panels and solutions, helping the company achieve long-term growth. -

Innovation in Solar Technology and Expansion

Waaree Energies’ investment in research and development to improve solar panel efficiency and storage solutions will be crucial for its growth. By leading advancements in solar technology and expanding its market reach, the company is poised to strengthen its competitive position and enhance shareholder value by 2030.

Risks and Challenges for Waaree Energies Share Price

Here are 5 Risks and Challenges for Waaree Energies Share Price:

- Fluctuations in Raw Material Prices

Waaree Energies relies on raw materials like silicon and aluminum for manufacturing solar panels. Any increase in the prices of these materials can increase production costs, which may squeeze profit margins and negatively affect the company’s share price. - Regulatory and Policy Changes

The renewable energy sector is heavily influenced by government policies and regulations. Any sudden changes, such as a reduction in solar subsidies or new restrictions, could impact Waaree Energies’ growth prospects, leading to uncertainty and potential volatility in its stock price. - Intense Competition in the Solar Industry

The solar energy market is highly competitive, with numerous domestic and international players. If Waaree Energies fails to maintain its market position through innovation or pricing strategies, it may lose market share, which could negatively impact its financial performance and share value. - Technological Risks

The success of Waaree Energies depends on its ability to stay ahead of technological advancements in solar energy. If the company struggles to innovate or if competitors develop more efficient technologies, it could impact its growth and make its stock less attractive to investors. -

Economic Slowdowns and Market Demand

Economic downturns can lead to lower demand for renewable energy projects, as businesses and governments may reduce their investments. This can affect Waaree Energies’ revenue streams and future growth, leading to potential declines in its share price.

Read Also:- HAL Share Price Target Tomorrow 2025, 2026, 2027 To 2030 – Stock Market Update