United Spirits Ltd (USL) is one of India’s largest alcoholic beverage companies. United Spirits Share Price on NSE as of 28 January 2025 is 1,400.05 INR. On this page, you will find United Spirits Share Price Target 2025, 2026, 2027 to 2030 as well as United Spirits products, United Spirits Share Price Target 2040, United Spirits owner, United spirits share price target motilal oswal, United spirits share price target tomorrow, and more Information.

United Spirits Ltd

United Spirits Ltd (USL) is one of India’s largest alcoholic beverage companies and a subsidiary of Diageo, a global leader in premium spirits. Headquartered in Bengaluru, USL offers a diverse portfolio of products, including whisky, rum, vodka, gin, and wine, catering to various consumer preferences and budgets.

The company owns iconic brands like McDowell’s No. 1, Royal Challenge, and Antiquity, as well as globally renowned labels such as Johnnie Walker, Black Dog, and Smirnoff. With a strong distribution network across India, United Spirits serves millions of customers and is a dominant player in the liquor industry.

United Spirits Share Price Chart

Current Market Overview Of United Spirits Share Price

- Open: 1,415.00

- High: 1,415.00

- Low: 1,362.05

- Mkt cap: 1.02LCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 1,700.00

- 52-wk low: 1,065.10

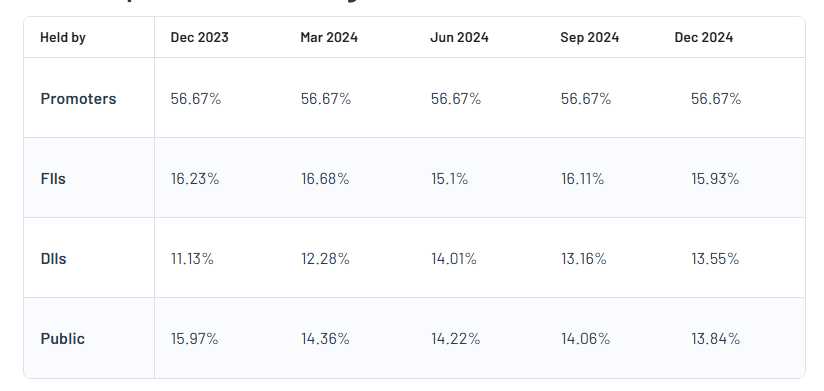

United Spirits Shareholding Pattern

- Promoters: 56.67%

- FII: 15.93%

- DII: 13.55%

- Public: 13.84%

United Spirits Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| United Spirits Share Price Target Years | Share Price Target (₹) |

| United Spirits Share Price Target 2025 | ₹1700 |

| United Spirits Share Price Target 2026 | ₹1800 |

| United Spirits Share Price Target 2027 | ₹1900 |

| United Spirits Share Price Target 2028 | ₹2000 |

| United Spirits Share Price Target 2029 | ₹2100 |

| United Spirits Share Price Target 2030 | ₹2200 |

United Spirits Share Price Target 2025

United Spirits share price target 2025 Expected target could be between ₹1650 to ₹1700. Here are 3 Key Factors Affecting Growth for “United Spirits Share Price Target 2025”:

-

Demand for Premium Alcohol Products

United Spirits is focusing on the premium and luxury segments of alcoholic beverages, as consumers increasingly prefer high-quality and branded products. The company’s growth in this segment could significantly boost revenue and improve profit margins, positively influencing its share price by 2025. - Government Policies and Taxation

Changes in government policies regarding alcohol production, distribution, and taxation will play a key role. Any reduction in taxes or relaxed regulations could benefit the company’s operational efficiency and bottom line, driving share price growth. Conversely, stricter policies could pose challenges. -

Expansion of Distribution Network

Expanding its reach into rural areas and Tier-2 and Tier-3 cities is a key growth driver. With increased accessibility to United Spirits’ products in these regions, the company could tap into a larger consumer base, leading to higher sales and positively affecting its share price.

United Spirits Share Price Target 2030

United Spirits share price target 2030 Expected target could be between ₹2150 to ₹2200. Here are 3 Key Factors Affecting Growth for “United Spirits Share Price Target 2030”

-

Shift Towards Premiumization

By 2030, the demand for premium and super-premium alcohol brands is expected to grow significantly as consumer preferences evolve and disposable incomes increase. United Spirits’ focus on expanding its high-end portfolio could drive long-term revenue growth and positively impact its share price. - Global Market Penetration

Expansion into international markets could become a major growth driver. Strategic partnerships, exports, and acquiring a stronger presence in high-demand regions like Asia-Pacific and Europe could increase revenue streams and enhance the company’s global reputation, boosting investor confidence. -

Sustainability and Innovation

Consumers are increasingly leaning towards brands that focus on sustainability and innovative practices. United Spirits’ efforts in adopting eco-friendly production methods and introducing unique product offerings (like low-calorie or non-alcoholic options) could cater to these demands, ensuring consistent growth and a competitive edge in the market.

Risks and Challenges for United Spirits Share Price

Here are 5 Risks and Challenges for United Spirits Share Price:

- Regulatory Restrictions

The liquor industry in India is heavily regulated, with state-specific laws and taxation policies. Frequent changes in excise duties, licensing norms, or prohibition laws in certain states could negatively impact United Spirits’ revenue and profitability, causing fluctuations in its share price. - Fluctuations in Raw Material Costs

The cost of key raw materials, such as grains and packaging materials, can be volatile due to factors like inflation, climate change, and global supply chain issues. Rising input costs may pressure profit margins and affect the company’s financial performance. - Intense Market Competition

United Spirits faces strong competition from domestic and international players in the alcoholic beverages industry. Competitors launching premium products at competitive pricing could limit market share growth and hinder price appreciation of the company’s shares. - Changing Consumer Preferences

There is a growing trend toward health consciousness and reduced alcohol consumption in some demographics. If United Spirits fails to adapt to these changes, such as offering low-alcohol or non-alcoholic beverages, it risks losing a segment of its customer base. -

Economic Slowdowns

The demand for alcoholic beverages is linked to economic conditions and consumer spending power. During periods of economic uncertainty or downturns, discretionary spending may decline, leading to reduced sales and affecting the company’s stock performance.

Read Also:- Hindustan Copper Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Update