UCO Bank Ltd is a prominent public sector bank in India with its headquarters in Kolkata. UCO Bank Share Price on NSE as of 20 January 2025 is 44.47 INR. On this page, you will find UCO Bank Share Price Target 2025, 2026, 2027 to 2030 as well as Uco bank share price target tomorrow, UCO Bank Share Price Target 2040, UCO Bank Share Price Target 2025 in Hindi, and more Information.

UCO Bank Ltd

UCO Bank Ltd, established in 1943, is a prominent public sector bank in India with its headquarters in Kolkata. It provides a wide range of banking and financial services, including loans, deposits, insurance, and wealth management. The bank has a strong presence across the country, particularly in rural and semi-urban areas, making financial services accessible to diverse communities. UCO Bank is known for its efforts in promoting financial inclusion and supporting small businesses and agriculture.

UCO Bank Share Price Chart

Current Market Overview Of UCO Bank Share Price

- Open: ₹43.25

- High: ₹45.12

- Low: ₹43.07

- Mkt cap: ₹53.26KCr

- P/E ratio: 24.34

- Div yield: 0.63%

- 52-wk high: ₹70.65

- 52-wk low: ₹38.01

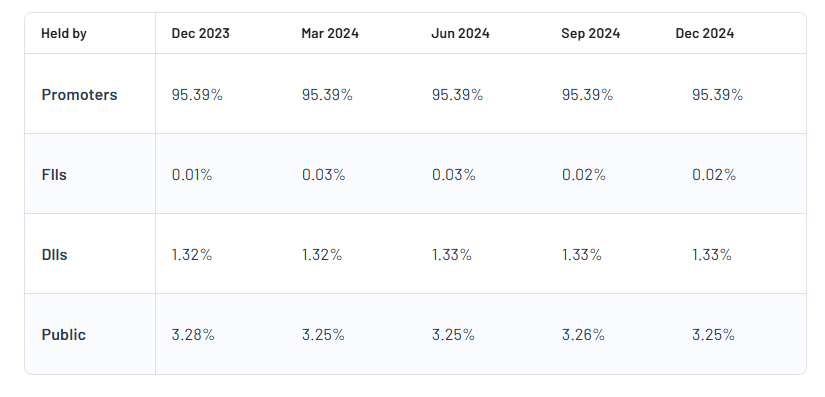

UCO Bank Shareholding Pattern

- Promoters: 95.39%

- FII: 0.02%

- DII: 1.33%

- Public: 3.25%

UCO Bank Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| UCO Bank Share Price Target Years | Share Price Target (₹) |

| UCO Bank Share Price Target 2025 | ₹80 |

| UCO Bank Share Price Target 2026 | ₹90 |

| UCO Bank Share Price Target 2027 | ₹100 |

| UCO Bank Share Price Target 2028 | ₹110 |

| UCO Bank Share Price Target 2029 | ₹120 |

| UCO Bank Share Price Target 2030 | ₹130 |

UCO Bank Share Price Target 2025

UCO Bank share price target 2025 Expected target could be between ₹70 to ₹80. Here are 3 Key Factors Affecting Growth for UCO Bank Share Price Target 2025:

-

Improved Asset Quality

UCO Bank’s efforts to reduce non-performing assets (NPAs) and strengthen its loan portfolio can significantly impact its growth. If the bank continues to focus on recovery from bad loans and prudent lending practices, it can improve investor confidence and drive share price growth by 2025. - Expansion of Digital Banking Services

The growing adoption of digital banking presents an opportunity for UCO Bank to enhance its service offerings. Investing in technology to provide seamless digital experiences, such as mobile banking and payment solutions, can help attract younger customers, boost profitability, and positively influence the share price. -

Economic Growth and Lending Opportunities

A favorable economic environment in India, with rising demand for loans in sectors like retail, MSMEs, and infrastructure, can fuel UCO Bank’s growth. By effectively leveraging these opportunities and increasing its loan disbursement, the bank can strengthen its revenue streams, benefiting its share price in the medium term.

UCO Bank Share Price Target 2030

UCO Bank share price target 2030 Expected target could be between ₹125 to ₹130. Here are 3 Key Factors Affecting Growth for UCO Bank Share Price Target 2030:

-

Technological Advancements and Digital Transformation

By 2030, the adoption of advanced technologies like artificial intelligence, machine learning, and blockchain could redefine banking operations. If UCO Bank continues to invest in and leverage these technologies, it can enhance efficiency, customer experience, and overall competitiveness, driving long-term growth in its share price. - Focus on Rural and Semi-Urban Markets

UCO Bank’s strong presence in rural and semi-urban areas provides a unique growth opportunity. Expanding financial inclusion initiatives and offering specialized services tailored to these regions can help the bank capture a larger market share and boost its profitability, contributing positively to its stock performance. -

Government Initiatives and Policy Support

Supportive government policies, such as initiatives to promote public sector banks, infrastructure development, and financial inclusion, can act as a catalyst for UCO Bank’s growth. Timely capitalization from the government and participation in large-scale development projects can significantly enhance the bank’s financial health and market position, positively impacting its share price.

Risks and Challenges for UCO Bank Share Price

Here are 6 Risks and Challenges for UCO Bank Share Price:

-

High Non-Performing Assets (NPAs)

UCO Bank, like many public sector banks, faces the challenge of managing NPAs. A high level of bad loans can strain profitability, reduce investor confidence, and negatively affect the bank’s share price. Addressing this issue requires effective recovery strategies and prudent lending practices. - Dependency on Government Support

As a public sector bank, UCO Bank relies on government recapitalization for maintaining its capital adequacy. Any delays or insufficient funding could limit its ability to lend and expand, impacting growth and share price performance. - Intense Competition in Banking Sector

UCO Bank competes with private sector banks and new-age fintech companies offering better customer service and innovative products. Failing to match these competitors in terms of efficiency and technology could result in losing market share, which may affect the bank’s valuation. - Economic Slowdowns and External Factors

Economic downturns, inflation, or global financial crises can negatively impact UCO Bank’s operations, particularly in lending and asset quality. External factors like currency fluctuations or changes in interest rates may also pose risks to the bank’s profitability and stock value. - Cybersecurity and Operational Risks

With increased reliance on digital banking, UCO Bank is exposed to cybersecurity threats. Data breaches or technical failures could lead to reputational damage, financial losses, and regulatory penalties, which might deter investors. -

Regulatory and Compliance Risks

Strict banking regulations and compliance requirements can pose challenges for UCO Bank. Non-compliance with Reserve Bank of India (RBI) guidelines or changes in regulatory policies can lead to penalties and disruptions, adversely affecting the bank’s growth and share price.

Read Also:- Vodafone Idea Share Price Target Tomorrow 2025, 2026, 2027 To 2030- Share Market Updates