Tata Power Company Ltd is one of India’s largest and most trusted power companies. Tata Power Share Price on NSE as of 17 January 2025 is 373.50 INR. On this page, you will find Tata Power Share Price Target 2025, 2026, 2027 to 2030 as well as Tata power share price target 2025, Tata power share price target tomorrow, Tata Power Share Price Target 2030, Tata Power share price in next 5 years, Tata Power share News, Tata Power Share price target 2025 Moneycontrol, and more Information.

Tata Power Company Ltd

Tata Power Company Ltd is one of India’s largest and most trusted power companies. It is part of the Tata Group and has been serving the country for over 100 years. The company generates and supplies electricity through various sources, including thermal, hydro, solar, and wind energy. Tata Power is a leader in renewable energy and is actively expanding its clean energy projects to support India’s sustainable growth.

Tata Power Share Price Chart

Current Market Overview Of Tata Power Share Price

- Open: ₹368.45

- High: ₹375.40

- Low: ₹365.30

- Mkt cap: ₹1.19LCr

- P/E ratio: 31.93

- Div yield: 0.54%

- 52-wk high: ₹494.85

- 52-wk low: ₹335.30

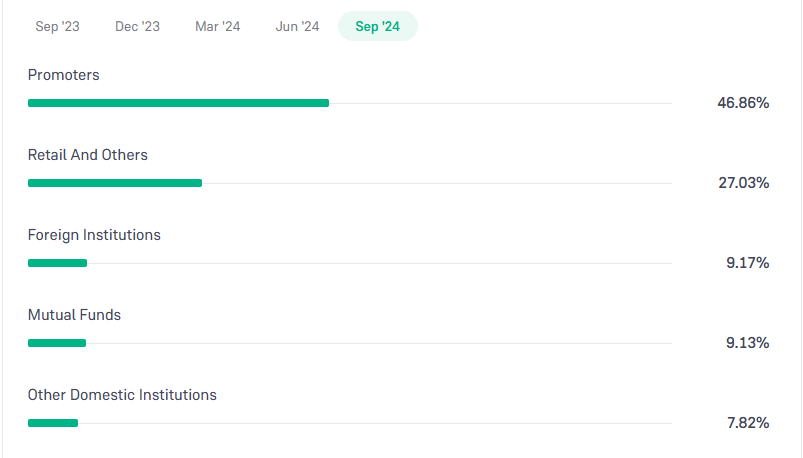

Tata Power Shareholding Pattern

- Promoters: 46.86%

- Retail and others: 27.03%

- FII: 9,17%

- Mutual Funds: 9.13%

- DII: 7.82%

Tata Power Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Tata Power Share Price Target Years | Share Price Target (₹) |

| Tata Power Share Price Target 2025 | ₹500 |

| Tata Power Share Price Target 2026 | ₹650 |

| Tata Power Share Price Target 2027 | ₹800 |

| Tata Power Share Price Target 2028 | ₹950 |

| Tata Power Share Price Target 2029 | ₹1100 |

| Tata Power Share Price Target 2030 | ₹1250 |

Tata Power Share Price Target 2025

Tata Power share price target 2025 Expected target could be between ₹450 to ₹500. By 2025, Tata Power’s share price is expected to grow steadily due to its strong focus on renewable energy and sustainable projects.

Tata Power Share Price Target 2030

Tata Power share price target 2030 Expected target could be between ₹1210 to ₹1250. By 2030, Tata Power’s share price is projected to experience significant growth, driven by the company’s expansion in renewable energy and infrastructure projects.

Key Factors Affecting Tata Power Share Price Growth

Here are 7 Key Factors Affecting Tata Power Share Price Growth:

- Expansion in Renewable Energy

Tata Power is heavily investing in renewable energy sources like solar, wind, and hydro power. As global demand for clean energy grows, this transition can boost the company’s revenue and positively impact its share price. - Government Policies and Support

Supportive government policies, such as subsidies and tax benefits for green energy projects, can accelerate Tata Power’s growth. Environmental regulations encouraging sustainable energy also create opportunities for expansion. - Economic Growth and Power Demand

India’s growing economy increases the demand for electricity in industries, businesses, and households. As one of the leading energy providers, Tata Power stands to benefit, which can drive its stock price higher. - Debt Management and Financial Health

Efficient management of debts and strong financial performance are crucial for Tata Power. Reducing debt levels and improving profit margins can strengthen investor confidence and support share price growth. - Technological Innovations

Investments in smart grids, electric vehicle (EV) charging infrastructure, and energy storage solutions position Tata Power as a forward-thinking company. These innovations can open new revenue streams and improve long-term growth prospects. - Global Energy Market Trends

Fluctuations in global energy prices and demand, along with supply chain challenges, can affect Tata Power’s operational costs. A stable and growing global energy market can favorably impact its profitability. -

Competition in the Energy Sector

The power industry is highly competitive, with both private and government players. Tata Power’s ability to outperform its competitors through innovation and efficiency will directly influence its market share and stock performance.

Risks and Challenges for Tata Power Share Price

Here are 6 Risks and Challenges for Tata Power Share Price:

- High Project Costs and Debt Burden

Tata Power is involved in large-scale energy projects that require significant investments. If the company takes on too much debt or faces cost overruns, it can strain financial resources and negatively impact its share price. - Regulatory and Policy Changes

Changes in government policies, environmental regulations, or taxation laws can affect Tata Power’s operations. Stricter environmental norms or reduced government support for renewable energy may increase costs and slow down growth. - Market Competition

The energy sector in India is highly competitive, with several private and public players. Increased competition can lead to pricing pressures and lower profit margins, which might affect Tata Power’s market position and stock performance. - Fluctuations in Energy Prices

Variations in coal, oil, and gas prices can impact Tata Power’s production costs. Higher input costs or supply disruptions could reduce profits, especially in its thermal power segment, affecting the stock price. - Project Delays and Execution Risks

Large infrastructure projects are prone to delays due to regulatory hurdles, environmental clearances, and funding issues. Any delay in project completion can increase costs and hurt Tata Power’s revenue growth. -

Global Economic Slowdown

A slowdown in the global or Indian economy could reduce industrial and commercial energy demand. This decline in demand may impact Tata Power’s earnings and slow down future expansion, putting pressure on its share price.

Read Also:- Yes Bank Share Price Target Tomorrow 2025, 2026, 2027 To 2030 – Prediction