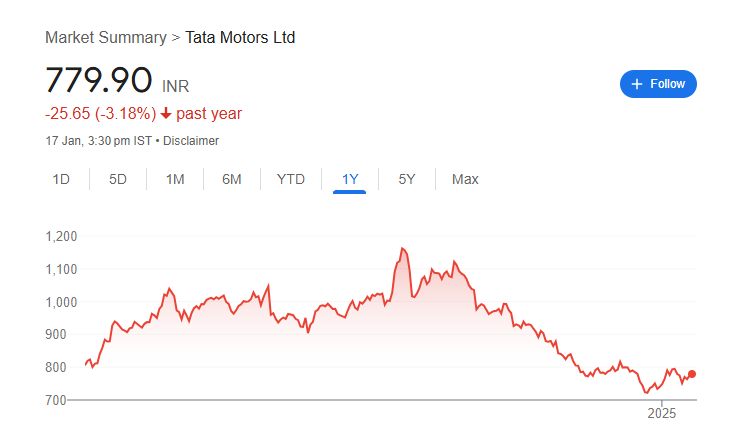

Tata Motors Company Ltd is one of India’s largest and most trusted automobile manufacturers. Tata Moters Share Price on NSE as of 17 January 2025 is 779.90 INR. On this page, you will find Tata Moters Share Price Target 2025, 2026, 2027 to 2030 as well as Tata Motors share price target 2025, Tata Motors share price Target 2030, Tata Motors share price target tomorrow, Tata Motors share price target this week, Tata Motors share News, and more Information.

Tata Moters Company Ltd

Tata Motors Company Ltd is one of India’s largest and most trusted automobile manufacturers. It is part of the Tata Group, a leading global business group. Founded in 1945, Tata Motors produces a wide range of vehicles, including cars, SUVs, trucks, buses, and electric vehicles. The company owns popular brands like Tata Motors Passenger Vehicles and Jaguar Land Rover (JLR). Tata Motors is known for its focus on innovation, safety, and sustainability.

Tata Moters Share Price Chart

Current Market Overview Of Tata Moters Share Price

- Open: ₹773.90

- High: ₹785.50

- Low: ₹772.25

- Mkt cap: ₹2.87LCr

- P/E ratio: 6.83

- Div yield: 0.38%

- 52-wk high: ₹1,179.00

- 52-wk low: ₹717.70

Tata Moters Shareholding Pattern

- Promoters: 42.58%

- FII: 20.55%

- DII: 16.37%

- Public: 20.5%

Tata Moters Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Tata Moters Share Price Target Years | Share Price Target (₹) |

| Tata Moters Share Price Target 2025 | ₹1200 |

| Tata Moters Share Price Target 2026 | ₹1400 |

| Tata Moters Share Price Target 2027 | ₹1600 |

| Tata Moters Share Price Target 2028 | ₹1800 |

| Tata Moters Share Price Target 2029 | ₹2000 |

| Tata Moters Share Price Target 2030 | ₹2250 |

Tata Moters Share Price Target 2025

Tata Moters share price target 2025 Expected target could be between ₹1180 to ₹1200. Here are 5 Key Factors Affecting Tata Motors Share Price Growth

-

Electric Vehicle (EV) Expansion

Tata Motors is aggressively expanding its electric vehicle lineup, especially in passenger and commercial segments. Growing demand for EVs in India and globally, along with government incentives for clean energy, could significantly boost the company’s revenue and share price. - Global and Domestic Market Demand

Tata Motors has a strong presence in both domestic and international markets through brands like Jaguar Land Rover (JLR). Increased vehicle sales, especially in emerging markets and luxury segments, can positively impact overall earnings and share performance. - Raw Material and Production Costs

Fluctuations in the prices of key raw materials like steel, aluminum, and semiconductor chips can influence Tata Motors’ production costs. Efficient cost management can help maintain profit margins and support stock growth. - Technological Innovation and Product Development

Tata Motors’ continuous investment in new technologies, safety features, and fuel-efficient vehicles enhances its competitive edge. Launching innovative models can attract more customers and drive sales, pushing the share price upward. -

Global Economic Conditions

Economic growth in major markets, interest rates, and fuel prices directly affect automobile demand. A stable or growing global economy encourages higher vehicle sales, benefiting Tata Motors’ revenue and stock value.

Tata Moters Share Price Target 2030

Tata Moters share price target 2030 Expected target could be between ₹2190 to ₹2250. Here are 4 Key Factors Affecting Growth for Tata Motors Share Price Target 2030

-

Strong Electric Vehicle (EV) Strategy

Tata Motors is heavily investing in electric mobility, aiming to lead India’s EV market. Expanding its EV lineup and infrastructure by 2030 can drive long-term growth and significantly boost its share price. - Global Expansion of Jaguar Land Rover (JLR)

Tata Motors’ luxury brand, Jaguar Land Rover, is focusing on electric models and expanding in key global markets. Strong global sales and brand innovation can contribute to higher revenues and share price growth. - Adoption of Sustainable and Smart Technologies

Investment in autonomous driving, connected cars, and green technologies will position Tata Motors as a future-ready company. These advancements can open new revenue streams and enhance market competitiveness. -

Economic Growth and Consumer Demand

Rising incomes, urbanization, and increasing demand for personal and commercial vehicles in India and emerging markets will drive sales. A strong economic environment globally can support Tata Motors’ expansion and stock performance by 2030.

Risks and Challenges for Tata Moters Share Price

Here are 7 Risks and Challenges for Tata Motors Share Price

- High Competition in the Auto Industry

Tata Motors faces strong competition from global and local automobile companies like Maruti Suzuki, Hyundai, Mahindra, and international brands. Intense competition can impact market share, pricing strategies, and profit margins. - Rising Raw Material Costs

The prices of essential materials like steel, aluminum, and semiconductor chips directly affect production costs. A sharp increase in these costs can reduce profit margins and put pressure on Tata Motors’ share price. - Global Economic Slowdowns

Economic downturns or slow growth in major markets like India, China, and Europe can weaken vehicle demand. Lower sales during tough economic times could negatively impact Tata Motors’ revenue and stock performance. - Supply Chain Disruptions

Tata Motors relies on a global supply chain for parts and materials. Disruptions caused by geopolitical tensions, pandemics, or transportation issues can delay production and deliveries, affecting sales and profits. - Regulatory and Environmental Compliance

Stringent environmental laws and safety regulations in India and international markets can increase production costs. Failure to meet these regulations could lead to penalties, product recalls, or loss of market access. - Foreign Exchange Fluctuations

Tata Motors earns significant revenue from global markets, especially through Jaguar Land Rover. Currency exchange rate fluctuations can impact profits, particularly when foreign income is converted into Indian Rupees. -

Technological Disruptions

Rapid changes in automotive technology, such as autonomous vehicles and connected cars, require continuous innovation. Falling behind competitors in adopting new technologies could impact Tata Motors’ market position and long-term growth.

Read Also:- Reliance Power Share Price Target Tomorrow 2025, 2026 To 2030 – Stock Market Update