Swan Energy Ltd is an Indian company primarily involved in the energy and infrastructure sectors. Swan Energy Share Price on NSE as of 23 January 2025 is 599.00 INR. On this page, you will find Swan Energy Share Price Target 2025, 2026, 2027 to 2030 as well as Swan Energy share price screener, Swan energy share price target motilal oswal, Why Swan Energy share is falling, Swan Energy Latest News, Swan energy share price target tomorrow, and more Information.

Swan Energy Ltd

Swan Energy Ltd is an Indian company primarily involved in the energy and infrastructure sectors. It focuses on developing and managing projects related to liquefied natural gas (LNG) terminals, gas-based power generation, and renewable energy. Swan Energy aims to play a significant role in India’s energy transition by focusing on cleaner energy solutions. The company is also involved in textile manufacturing through its subsidiary, contributing to its diversified business portfolio.

Swan Energy Share Price Chart

Current Market Overview Of Swan Energy Share Price

- Open: 603.00

- High: 617.35

- Low: 593.85

- Mkt cap: 18.74KCr

- P/E ratio: 37.24

- Div yield: 0.017%

- 52-wk high: 809.80

- 52-wk low: 437.10

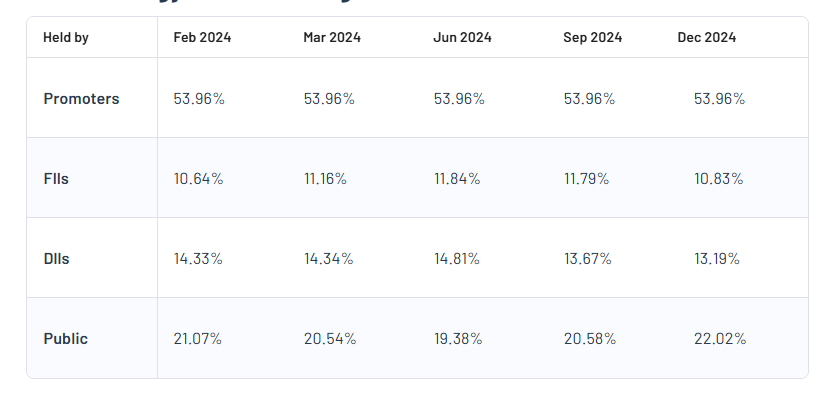

Swan Energy Shareholding Pattern

- Promoters: 53.96%

- FII: 10.83%

- DII: 13.19%

- Public: 22.02%

Swan Energy Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Swan Energy Share Price Target Years | Share Price Target (₹) |

| Swan Energy Share Price Target 2025 | ₹820 |

| Swan Energy Share Price Target 2026 | ₹870 |

| Swan Energy Share Price Target 2027 | ₹920 |

| Swan Energy Share Price Target 2028 | ₹970 |

| Swan Energy Share Price Target 2029 | ₹1031 |

| Swan Energy Share Price Target 2030 | ₹1080 |

Swan Energy Share Price Target 2025

Swan Energy share price target 2025 Expected target could be between ₹800 to ₹820. Here are 3 Key Factors Affecting Growth for Swan Energy Share Price Target 2025:

-

Expansion in the LNG Business

Swan Energy’s focus on developing its liquefied natural gas (LNG) business, including Floating Storage and Regasification Units (FSRUs), will play a major role in its growth. Increasing global demand for LNG as a cleaner energy source positions the company to benefit from this transition if it successfully expands its infrastructure and operations. - Government Policies and Support

Favorable policies promoting clean energy and LNG adoption in India can significantly influence Swan Energy’s performance. Supportive initiatives, tax benefits, and subsidies for companies operating in the renewable and clean energy sector can drive growth opportunities and enhance the company’s market position. -

Strategic Partnerships and Contracts

Securing long-term contracts and forming strategic alliances with key players in the energy industry will be vital. Such collaborations can enhance Swan Energy’s market presence, improve revenue streams, and provide stability, contributing to its share price growth by 2025.

Swan Energy Share Price Target 2030

Swan Energy share price target 2030 Expected target could be between ₹1050 to ₹1080. Here are 3 Key Factors Affecting Growth for Swan Energy Share Price Target 2030:

-

Diversification into Renewable Energy Projects

Swan Energy’s growth in the long-term will depend on how effectively it diversifies into renewable energy sectors like solar and wind power. As global energy demand shifts towards sustainable solutions, successful integration of green energy initiatives could drive the company’s revenue and support its share price growth by 2030. - Global LNG Market Expansion

The expansion of Swan Energy’s LNG infrastructure and its ability to tap into global LNG markets will be a key growth driver. If the company successfully establishes itself as a prominent player in the global LNG trade and regasification services, it could experience substantial growth by 2030, helping to boost the share price. -

Technological Advancements and Innovation

Swan Energy’s ability to leverage technological advancements in energy production and transportation will play a significant role in its future growth. Investments in cutting-edge technologies such as digitalization, AI in energy management, and improved efficiency in LNG operations could strengthen its competitive position and help increase its value in the market over the next decade.

Risks and Challenges for Swan Energy Share Price

Here are 3 Risks and Challenges for Swan Energy Share Price:

- Fluctuations in Global Energy Prices

Swan Energy’s operations are highly impacted by global energy prices, especially natural gas. Any significant decline in oil or LNG prices can lead to lower revenues and affect the company’s profitability. This could result in volatility in its stock price, making it sensitive to shifts in global energy market conditions. - Regulatory and Policy Changes

The energy sector is heavily regulated, and any sudden changes in government policies, tax regulations, or environmental standards can pose a risk to Swan Energy’s growth. These changes could potentially increase operational costs or delay projects, negatively impacting investor sentiment and share price. - Infrastructure Development Delays

Swan Energy is investing in large-scale infrastructure projects, particularly related to LNG terminals and renewable energy. Delays in the construction or execution of these projects due to logistical, financial, or regulatory challenges can slow down growth and lead to uncertainty in the stock market, affecting the company’s share price. - Competition in the Energy Market

As the energy sector becomes more competitive, Swan Energy faces risks from other well-established players and new entrants, especially in renewable energy and LNG sectors. Intense competition could put pressure on profit margins and limit market share expansion, which may affect investor confidence in the stock price. -

Environmental and Climate Change Concerns

As global awareness about climate change rises, companies in the energy sector face increasing scrutiny regarding their environmental impact. If Swan Energy is unable to transition quickly enough to cleaner energy solutions or address environmental concerns, it could face reputational damage, regulatory penalties, and a decline in stock value.

Read Also:- ATGL Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Updates