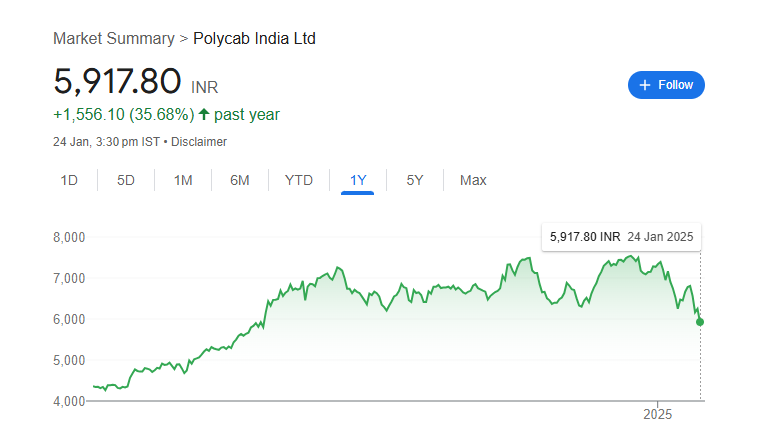

Polycab India Ltd is one of the leading manufacturers of electrical products in India. Polycab Share Price on NSE as of 24 January 2025 is 5,917.80 INR. On this page, you will find Polycab Share Price Target 2025, 2026, 2027 to 2030 as well as Polycab share price target tomorrow, Polycab share price target motilal oswal, Polycab Share Price target 2031 moneycontrol, Polycab Share Price Target 2040, and more Information.

Polycab India Ltd

Polycab India Ltd is one of the leading manufacturers of electrical products in India. Founded in 1996, the company is best known for its high-quality wires and cables, which make up a significant part of its business. Over the years, Polycab has diversified its portfolio to include electrical appliances like fans, lights, switches, and solar products. The company has a strong presence across domestic and international markets, supported by an extensive distribution network and robust manufacturing capabilities.

Polycab Share Price Chart

Current Market Overview Of Polycab Share Price

- Open: 6,293.90

- High: 6,407.85

- Low: 5,891.20

- Mkt cap: 89.16KCr

- P/E ratio: 48.52

- Div yield: 0.51%

- 52-wk high: 7,605.00

- 52-wk low: 4,125.40

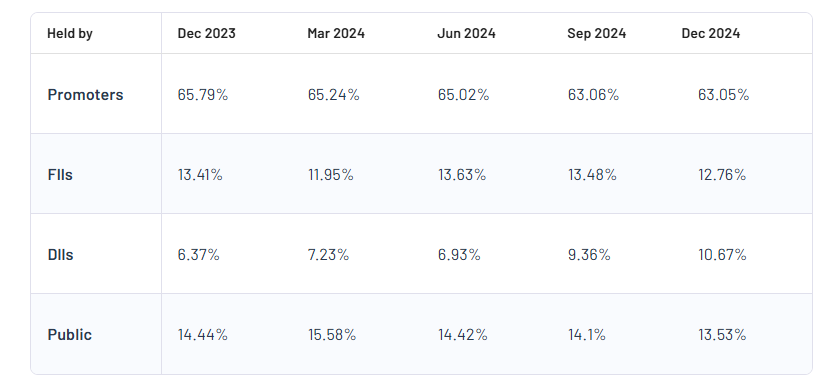

Polycab Shareholding Pattern

- Promoters: 63.05%

- FII: 12.78%

- DII: 10.67%

- Public: 13.53%

Polycab Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Polycab Share Price Target Years | Share Price Target (₹) |

| Polycab Share Price Target 2025 | ₹7610 |

| Polycab Share Price Target 2026 | ₹8925 |

| Polycab Share Price Target 2027 | ₹10,457 |

| Polycab Share Price Target 2028 | ₹11,640 |

| Polycab Share Price Target 2029 | ₹12,555 |

| Polycab Share Price Target 2030 | ₹13,733 |

Polycab Share Price Target 2025

Polycab share price target 2025 Expected target could be between ₹7600 to ₹7610. Here are 3 Key Factors Affecting Growth for “Polycab Share Price Target 2025”:

-

Rising Demand for Electrical Products

The increasing urbanization and infrastructure development across India are driving the demand for wires, cables, and other electrical products. Polycab, being a leading player in this segment, is well-positioned to benefit from these growth opportunities, which could positively impact its share price in 2025. - Expansion in FMEG (Fast-Moving Electrical Goods) Segment

Polycab has been focusing on expanding its presence in the FMEG segment, including products like fans, lights, and switches. Continued diversification and strong branding in this segment could lead to higher revenues and sustained growth, influencing its share price positively. -

Government Initiatives in Power and Infrastructure

Policies like “Make in India,” electrification projects, and investments in smart cities are expected to boost the power and infrastructure sectors. As a major supplier of electrical solutions, Polycab could experience increased demand, enhancing its market performance and share price growth prospects.

Polycab Share Price Target 2030

Polycab share price target 2030 Expected target could be between ₹13,600 to ₹13,733. Here are 3 Key Factors Affecting Growth for “Polycab Share Price Target 2030”:

-

Adoption of Green and Sustainable Technologies

With the global focus on renewable energy and sustainability, the demand for energy-efficient and eco-friendly electrical products is expected to grow. Polycab’s investments in developing innovative and green technologies can help the company tap into this trend, driving long-term growth and positively impacting its share price by 2030. - International Market Expansion

Polycab has been increasing its presence in global markets. By expanding exports and entering new regions, the company could significantly boost its revenue streams. A strong international footprint will diversify its risks and support sustained growth, influencing its share price over the decade. -

Digital Transformation and Smart Solutions

The increasing demand for smart homes and IoT-enabled devices offers significant growth opportunities. Polycab’s focus on introducing technologically advanced products, such as smart switches and automated solutions, could cater to this growing market and solidify its position as a market leader, boosting its share value in the long term.

Risks and Challenges for Polycab Share Price

Here are 5 Risks and Challenges for Polycab Share Price:

- Fluctuating Raw Material Prices

Polycab relies heavily on raw materials like copper and aluminum for its products. Any sudden increase in the prices of these materials due to market volatility or supply chain disruptions can impact profit margins, posing a challenge to the company’s financial performance and share price stability. - Intense Market Competition

The electrical goods industry is highly competitive, with many established players and new entrants. This competition can lead to pricing pressure, potentially affecting Polycab’s market share and revenue growth, which may, in turn, impact its stock performance. - Dependence on Infrastructure and Real Estate Growth

Polycab’s business is closely linked to the performance of infrastructure, construction, and real estate sectors. Any slowdown in these sectors, caused by economic downturns or policy changes, could reduce demand for its products and limit its growth prospects. - Regulatory and Policy Risks

Changes in government regulations, import/export duties, or tax structures can create challenges for Polycab. Compliance with environmental norms and other industry-specific rules can also lead to higher operational costs, which may affect its profitability and share price. -

Global Economic Conditions

As Polycab expands into international markets, it becomes more vulnerable to global economic uncertainties. Currency fluctuations, geopolitical tensions, or economic recessions in key export regions can negatively impact its revenue from overseas operations and overall business performance.

Read Also:- Rajnish Retail Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Updates