MRPL (Mangalore Refinery and Petrochemicals Limited) is an oil refinery. MRPL Share Price on NSE as of 28 January 2025 is 123.39 INR. On this page, you will find MRPL Share Price Target 2025, 2026, 2027 to 2030 as well as MRPL share News today, MRPL share buy or sell, MRPL share price target next Week, Mrpl share price target motilal oswal, Mrpl share price target tomorrow, and more Information.

MRPL Ltd

MRPL (Mangalore Refinery and Petrochemicals Limited) is an oil refinery located in Mangalore, Karnataka, India. It is one of the major players in the Indian oil and gas sector, primarily focused on refining crude oil and producing a wide range of petroleum products such as petrol, diesel, kerosene, and petrochemicals. MRPL is a subsidiary of ONGC (Oil and Natural Gas Corporation), one of India’s largest oil exploration and production companies.

MRPL Share Price Chart

Current Market Overview Of MRPL Share Price

- Open: 127.10

- High: 128.90

- Low: 120.60

- Mkt cap: 21.57KCr

- P/E ratio: 26.29

- Div yield: 2.43%

- 52-wk high: 289.25

- 52-wk low: 120.60

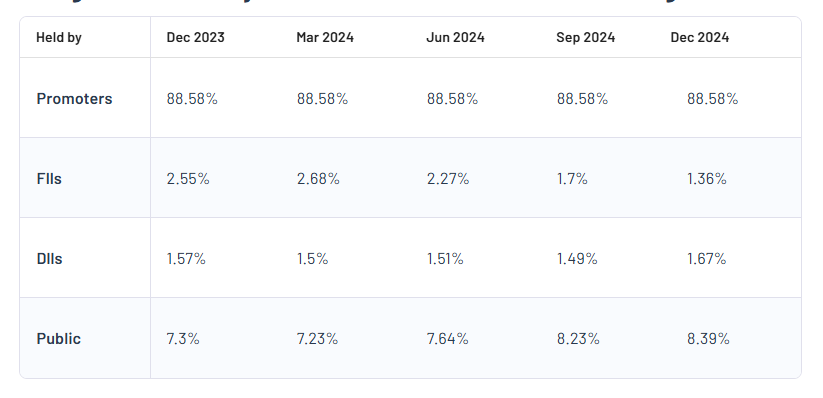

MRPL Shareholding Pattern

- Promoters: 88.58%

- FII: 1.36%

- DII: 1.67%

- Public: 8.39%

MRPL Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| MRPL Share Price Target Years | Share Price Target (₹) |

| MRPL Share Price Target 2025 | ₹300 |

| MRPL Share Price Target 2026 | ₹400 |

| MRPL Share Price Target 2027 | ₹500 |

| MRPL Share Price Target 2028 | ₹600 |

| MRPL Share Price Target 2029 | ₹700 |

| MRPL Share Price Target 2030 | ₹800 |

MRPL Share Price Target 2025

MRPL share price target 2025 Expected target could be between ₹290 to ₹300. Here are 3 Key Factors Affecting Growth for “MRPL Share Price Target 2025”

-

Crude Oil Price Volatility

Mangalore Refinery and Petrochemicals Limited (MRPL) operates in the oil refining and petrochemical sector, making its profitability highly sensitive to crude oil price fluctuations. Favorable crude oil prices and effective cost management can boost the company’s margins and positively impact its share price in 2025. - Demand for Petroleum and Petrochemical Products

The demand for refined petroleum products like diesel, petrol, and petrochemicals in domestic and international markets will play a crucial role in MRPL’s growth. Increasing energy consumption and industrial activity in India can drive higher sales, supporting share price appreciation. -

Expansion and Diversification Projects

MRPL’s ongoing and upcoming capacity expansion or diversification projects will significantly influence its growth prospects. Investments in modernization, enhancing production capacity, or entering new product segments can improve operational efficiency and profitability, positively impacting the stock price by 2025.

MRPL Share Price Target 2030

MRPL share price target 2030 Expected target could be between ₹780 to ₹800. Here are 3 Key Factors Affecting Growth for “MRPL Share Price Target 2030”

-

Shift Towards Cleaner Energy Solutions

With the global focus on renewable energy and clean fuel technologies, MRPL’s ability to adapt and invest in sustainable practices, such as producing cleaner fuels or exploring alternative energy sources, will be crucial for long-term growth. Transitioning to environmentally friendly solutions could attract more investors and drive share price growth by 2030. - Global Petrochemical Market Trends

MRPL’s performance will depend on its competitiveness in the global petrochemical market. Increasing demand for petrochemical products in sectors like construction, automotive, and consumer goods could create growth opportunities. Strategic alliances, technological advancements, and enhanced product offerings will likely strengthen its market position and affect its share price positively. -

Regulatory and Policy Environment

Changes in government policies and regulations regarding the oil and gas sector, including taxes, subsidies, and environmental norms, will impact MRPL’s growth trajectory. Supportive policies or incentives encouraging domestic production and refining could boost profitability, contributing to a higher share price target by 2030.

Risks and Challenges for MRPL Share Price

Here are 6 Risks and Challenges for MRPL Share Price:

- Fluctuating Crude Oil Prices

MRPL’s profitability is heavily linked to the price of crude oil. As a refinery, it processes crude oil into various products. A significant increase or decrease in crude oil prices can impact its margins and profitability. For instance, if crude prices rise sharply, the company may face higher operational costs, which could negatively affect its stock price. - Environmental Regulations and Compliance

The oil and gas industry faces strict environmental regulations. Any tightening of environmental laws, including those related to emissions and waste disposal, could lead to higher compliance costs for MRPL. Failure to meet these regulatory standards could result in fines or the need for expensive upgrades to their facilities, which may affect investor confidence and the share price. - Competition from Renewable Energy Sources

As the world shifts towards greener and more sustainable energy solutions, MRPL could face increased competition from renewable energy sources such as solar, wind, and electric vehicles. The growing demand for cleaner energy could reduce the long-term reliance on fossil fuels, posing a challenge for traditional refineries like MRPL. - Geopolitical Instability

MRPL operates in a global market, and geopolitical tensions or instability in key oil-producing regions can disrupt supply chains and increase operational risks. For instance, conflicts in the Middle East, sanctions on oil-exporting countries, or disruptions in global shipping could negatively affect MRPL’s ability to source crude oil efficiently, impacting its financial performance and share price. - Debt and Financial Health

A high debt load can be a significant risk for MRPL, especially in a volatile industry like oil refining. If the company struggles with servicing its debt or faces challenges in raising new capital, it may lead to a downgrade in its credit rating. This could negatively affect its stock price as investors may become concerned about the company’s financial stability. -

Technological Disruptions

Technological advancements, especially in energy production and refining, pose both an opportunity and a challenge for MRPL. Failure to invest in new technologies or modernize its operations could put the company at a disadvantage compared to its competitors. Staying competitive will require ongoing investment in innovation, which could strain resources if not managed carefully, affecting the share price.

Read Also:- United Spirits Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Update