Jaiprakash Power Ventures Limited (JPVL) is a part of the Jaypee Group. Jaiprakash Power Share Price on NSE as of 18 January 2025 is 16.69 INR. On this page, you will find Jaiprakash Power Share Price Target 2025, 2026, 2027 to 2030 as well as Jaiprakash power share price target 2025, Jaiprakash power share price target 2030, Jaiprakash power share price target tomorrow, JP Power Share Price Target 2040, Why JP Power share price falling, JP Power screener share price target, and more Information.

Jaiprakash Power Ventures Limited

Jaiprakash Power Ventures Limited (JPVL) is a part of the Jaypee Group and operates in the power generation sector in India. The company focuses on producing thermal and hydroelectric power to meet the country’s growing energy needs. JPVL owns and operates several power plants across India, contributing significantly to the nation’s electricity supply. The company is also exploring opportunities in renewable energy to align with sustainable growth.

Jaiprakash Power Share Price Chart

Current Market Overview Of Jaiprakash Power Share Price

- Open: ₹16.64

- High: ₹16.84

- Low: ₹16.43

- Mkt cap: ₹11.44KCr

- P/E ratio: 9.39

- Div yield: N/A

- 52-wk high: ₹24.00

- 52-wk low: ₹14.35

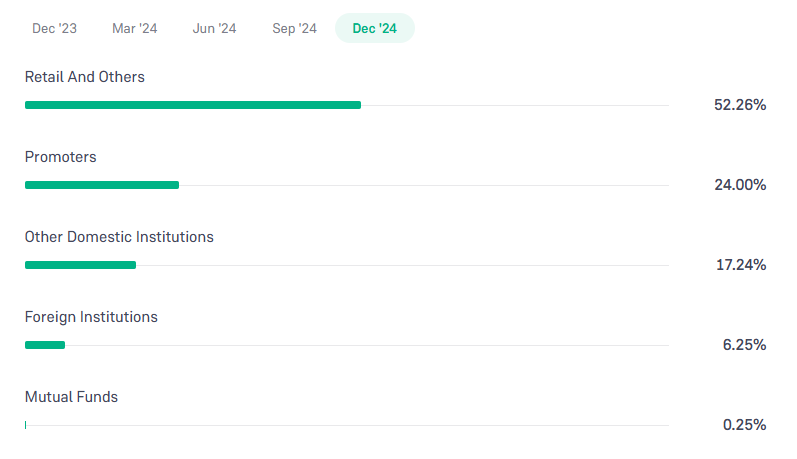

Jaiprakash Power Shareholding Pattern

- Promoters: 24%

- Retail and Others: 52.26%

- DII: 17.24%

- FII: 6.25%

- Mutual Funds: 0.25%

Jaiprakash Power Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Jaiprakash Power Share Price Target Years | Share Price Target (₹) |

| Jaiprakash Power Share Price Target 2025 | ₹25 |

| Jaiprakash Power Share Price Target 2026 | ₹28 |

| Jaiprakash Power Share Price Target 2027 | ₹31 |

| Jaiprakash Power Share Price Target 2028 | ₹35 |

| Jaiprakash Power Share Price Target 2029 | ₹38 |

| Jaiprakash Power Share Price Target 2030 | ₹42 |

Jaiprakash Power Share Price Target 2025

Jaiprakash Power share price target 2025 Expected target could be between ₹24 to ₹25. Here are 3 Key Factors Affecting Growth for Jaiprakash Power Share Price Target 2025:

-

Increasing Demand for Power in India

With India’s growing population and rapid industrialization, the demand for electricity is rising steadily. Jaiprakash Power Ventures can benefit from this increasing energy demand by expanding its generation capacity, which could positively impact its revenue and share price by 2025. - Debt Management and Financial Stability

Jaiprakash Power has faced challenges due to high debt levels in the past. Effective debt reduction and improved financial management can strengthen investor confidence, leading to better financial health and potential share price growth. -

Government Policies and Renewable Energy Push

Supportive government policies, including incentives for clean energy and infrastructure development, can boost the company’s growth. If Jaiprakash Power invests in renewable energy projects, it could open new growth opportunities and enhance its stock performance by 2025.

Jaiprakash Power Share Price Target 2030

Jaiprakash Power share price target 2030 Expected target could be between ₹40 to ₹42. Here are 3 Key Factors Affecting Growth for Jaiprakash Power Share Price Target 2030:

-

Expansion into Renewable Energy

As the global energy sector shifts towards sustainability, Jaiprakash Power’s investment in renewable energy sources like solar, wind, and hydroelectric power can drive long-term growth. Expanding its clean energy portfolio will help the company stay competitive and positively impact its share price by 2030. - Debt Restructuring and Financial Improvement

Effective management of its existing debt and improving overall financial stability will be crucial for Jaiprakash Power’s growth. Lower debt levels and stronger cash flows can boost investor confidence, leading to a more stable and growing share price over the next decade. -

Government Infrastructure and Energy Policies

Favorable government policies focused on infrastructure development and energy demand growth can support Jaiprakash Power’s expansion. Continued investments in the power sector and government support for public-private partnerships could create new business opportunities and drive the company’s stock performance by 2030.

Risks and Challenges for Jaiprakash Power Share Price

Here are 5 Risks and Challenges for Jaiprakash Power Share Price:

- High Debt Levels

Jaiprakash Power has struggled with high debt in the past, which can limit its ability to invest in new projects and expansions. If the company fails to effectively manage or reduce its debt, it could impact profitability and lower investor confidence, leading to pressure on its share price. - Regulatory and Policy Changes

The power sector is heavily influenced by government policies and regulations. Any changes in electricity tariffs, environmental regulations, or energy policies could affect Jaiprakash Power’s operations and financial performance, causing uncertainty for its stock value. - Fluctuating Fuel and Energy Costs

Jaiprakash Power depends on resources like coal and water for energy production. Rising fuel costs or supply disruptions can increase operational expenses, reducing profit margins and negatively impacting the company’s share price. - Slow Transition to Renewable Energy

As the global focus shifts toward clean energy, companies that fail to adapt may fall behind. If Jaiprakash Power does not invest enough in renewable energy projects, it could miss out on growth opportunities and face long-term challenges in staying competitive. -

Operational and Project Delays

Delays in completing power projects due to financial, regulatory, or technical issues can harm the company’s growth prospects. Project delays lead to higher costs and lower revenues, which can negatively affect Jaiprakash Power’s financial health and share performance.

Read Also:- HAL Share Price Target Tomorrow 2025, 2026, 2027 To 2030 – Stock Market Update