IDFC First Bank Ltd is an Indian private sector bank. IDFC First Bank Share Price on NSE as of 18 January 2025 is 62.69 INR. On this page, you will find IDFC First Bank Share Price Target 2025, 2026, 2027 to 2030 as well as IDFC First Bank share News, IDFC First Bank News Today, IDFC First Bank Share Price Target 2040, IDFC Bank Share price target for 5 years, and more Information.

IDFC First Bank Ltd

IDFC First Bank Ltd is a private sector bank in India, known for offering a wide range of banking services, including personal loans, home loans, and savings accounts. It was established in 2015 after the merger of IDFC Bank and Capital First, creating a strong foundation in retail banking. The bank focuses on delivering customer-centric services through digital platforms and is committed to financial inclusion by serving both urban and rural customers.

IDFC First Bank Share Price Chart

Current Market Overview Of IDFC First Bank Share Price

- Open: ₹62.55

- High: ₹62.77

- Low: ₹61.55

- Mkt cap: ₹45.78KCr

- P/E ratio: 19.37

- Div yield: N/A

- 52-wk high: ₹89.65

- 52-wk low: ₹59.05

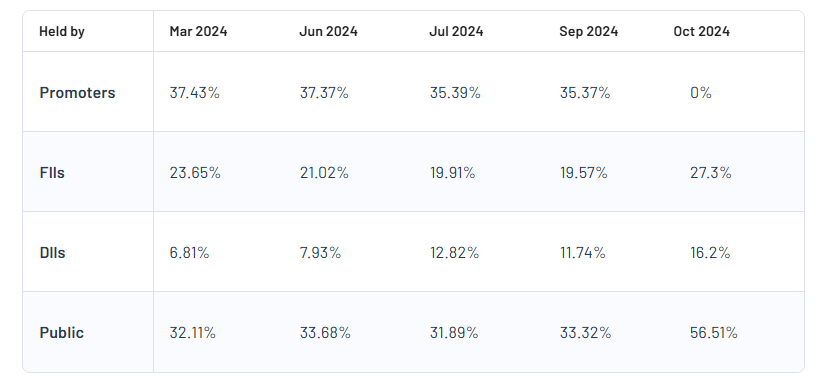

IDFC First Bank Shareholding Pattern

- Promoters: 0%

- FII: 27.3%

- DII: 16.2%

- Public: 56.51%

IDFC First Bank Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| IDFC First Bank Share Price Target Years | Share Price Target (₹) |

| IDFC First Bank Share Price Target 2025 | ₹90 |

| IDFC First Bank Share Price Target 2026 | ₹110 |

| IDFC First Bank Share Price Target 2027 | ₹130 |

| IDFC First Bank Share Price Target 2028 | ₹150 |

| IDFC First Bank Share Price Target 2029 | ₹170 |

| IDFC First Bank Share Price Target 2030 | ₹190 |

IDFC First Bank Share Price Target 2025

IDFC First Bank share price target 2025 Expected target could be between ₹86 to ₹90. Here are 3 Key Factors Affecting Growth for IDFC First Bank Share Price Target 2025:

-

Strong Growth in Retail Banking Segment

IDFC First Bank is expanding its retail banking operations, focusing on personal loans, home loans, and small business lending. A steady rise in retail loan demand and diversified income sources can boost the bank’s revenue and positively impact its share price by 2025. - Improved Asset Quality and Reduced NPAs

Effective management of Non-Performing Assets (NPAs) and improving asset quality are crucial for sustainable growth. Lower bad loans and stronger risk management practices can enhance profitability and increase investor confidence, driving the stock upward. -

Digital Banking Expansion

The bank’s investment in digital banking and technology-driven services is enhancing customer experience and operational efficiency. Expanding its digital presence can attract more customers, reduce costs, and contribute to the overall growth of IDFC First Bank’s share price by 2025.

IDFC First Bank Share Price Target 2030

IDFC First Bank share price target 2030 Expected target could be between ₹180 to ₹190. Here are 3 Key Factors Affecting Growth for IDFC First Bank Share Price Target 2030:

-

Long-Term Economic Growth and Financial Inclusion

India’s growing economy and focus on financial inclusion offer significant opportunities for IDFC First Bank. Expanding banking services in rural and underserved areas can increase the customer base and drive sustainable growth, positively influencing the bank’s share price by 2030. - Diversification of Financial Products and Services

Introducing a wider range of financial products like wealth management, insurance, and investment services can help IDFC First Bank diversify its revenue streams. This diversification can reduce business risks and support consistent growth over the long term. -

Strategic Partnerships and Technological Advancements

Forming strategic partnerships with fintech companies and adopting advanced technologies like artificial intelligence (AI) and blockchain can improve operational efficiency. These innovations can enhance customer experience and give the bank a competitive edge, leading to stronger financial performance and share price growth by 2030.

Risks and Challenges for IDFC First Bank Share Price

Here are 5 Risks and Challenges for IDFC First Bank Share Price

- Rising Non-Performing Assets (NPAs)

Non-Performing Assets (NPAs) are loans that borrowers fail to repay. If IDFC First Bank faces an increase in NPAs, it could lead to higher provisions and losses. This could negatively impact profitability and investor confidence, resulting in a decline in the bank’s share price. - Intense Competition in the Banking Sector

The banking industry in India is highly competitive, with both public and private sector banks vying for market share. Increased competition from traditional banks and new fintech companies may limit IDFC First Bank’s growth prospects, affecting its ability to attract customers and leading to stagnant share price growth. - Regulatory Changes and Compliance Risks

The banking sector is subject to frequent changes in regulations and government policies. If IDFC First Bank fails to adapt to new rules, or faces regulatory fines and penalties, its financial performance could be impacted, which may affect its stock price. - Economic Slowdown and Rising Inflation

Economic slowdowns, rising inflation, or a financial crisis can reduce demand for loans and affect the bank’s asset quality. Slower economic growth can also lower consumer spending and business investment, which might negatively impact the bank’s earnings and stock price. -

Technological Disruptions and Cybersecurity Risks

As IDFC First Bank continues to invest in digital banking, there is always a risk of cybersecurity threats, data breaches, or system failures. If the bank faces any major security breaches or technological disruptions, it could damage its reputation and result in a loss of customer trust, affecting its stock price.

Read Also:- Waaree Energies Share Price Target Tomorrow 2025, 2026, 2027 To 2030 – More Details