Hyundai Motor Ventures Limited is the investment arm of Hyundai Motor Company, focused on supporting innovative startups and emerging technologies in the mobility sector. Hyundai Motor Share Price on KRX as of 18 January 2025 is 2,11,500 KRW. This article will provide more details on Hyundai Motor Share Price Target 2025, 2026 to 2030.

Hyundai Motor Ventures Limited

Hyundai Motor Ventures Limited is the investment arm of Hyundai Motor Company, focused on supporting innovative startups and emerging technologies in the mobility sector. The company invests in areas like electric vehicles (EVs), autonomous driving, smart mobility solutions, and sustainable energy. By funding cutting-edge ideas and collaborating with tech-driven companies, Hyundai Motor Ventures aims to drive future growth and stay ahead in the evolving automotive industry.

Hyundai Motor Share Price Chart

Current Market Overview Of Hyundai Motor Share Price

- Open: KRW2,17,500

- High: KRW2,18,000

- Low: KRW2,11,000

- Mkt cap: KRW53.71LCr

- P/E ratio: 4.46

- Div yield: 6.81%

- 52-wk high: KRW2,99,500

- 52-wk low: KRW1,79,800

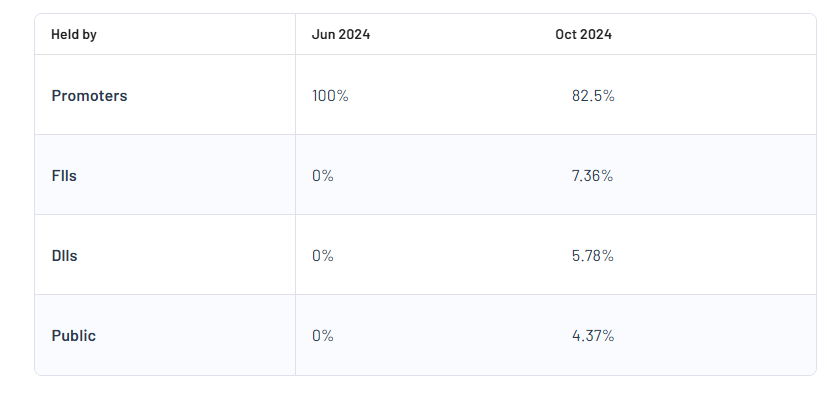

Hyundai Motor Shareholding Pattern

- Promoters: 82.5%

- FII: 7.36%

- DII: 5.78%

- Public: 4.37%

Hyundai Motor Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Hyundai Motor Share Price Target Years | Share Price Target (KRW) |

| Hyundai Motor Share Price Target 2025 | KRW 3,05,000 |

| Hyundai Motor Share Price Target 2026 | KRW 3,85,000 |

| Hyundai Motor Share Price Target 2027 | KRW 4,20,500 |

| Hyundai Motor Share Price Target 2028 | KRW 4,92,000 |

| Hyundai Motor Share Price Target 2029 | KRW 5,65,000 |

| Hyundai Motor Share Price Target 2030 | KRW 6,10,000 |

Hyundai Motor Share Price Target 2025

Hyundai Motor share price target 2025 Expected target could be between KRW2,99,500 to KRW3,05,000. Here are 3 Key Factors Affecting Growth for Hyundai Motor Share Price Target 2025:

-

Expansion in Electric Vehicle (EV) Market

Hyundai is heavily investing in electric vehicle technology to meet the rising global demand for sustainable transportation. Launching new EV models and expanding charging infrastructure can drive sales growth and positively impact the company’s share price by 2025. - Global Market Demand and Sales Performance

Hyundai’s global presence allows it to tap into various markets. Strong demand in emerging markets and consistent sales in developed regions can boost revenue. Economic recovery and increased automobile demand could further support share price growth. -

Innovation in Technology and Autonomous Vehicles

Hyundai’s focus on innovative technologies like autonomous driving, smart mobility solutions, and fuel-efficient vehicles will enhance its competitive edge. Successful adoption of these technologies can attract more customers and investors, contributing to stock growth by 2025.

Hyundai Motor Share Price Target 2030

Hyundai Motor share price target 2030 Expected target could be between KRW6,00,000 to KRW6,10,000. Here are 3 Key Factors Affecting Growth for Hyundai Motor Share Price Target 2030:

-

Long-Term Commitment to Electric and Hydrogen Vehicles

Hyundai’s strategic focus on expanding its electric and hydrogen fuel cell vehicle lineup will be crucial for long-term growth. As global demand for clean energy vehicles rises, Hyundai’s innovation in sustainable mobility could drive significant revenue and share price growth by 2030. - Global Expansion and Emerging Market Penetration

Hyundai’s efforts to strengthen its presence in emerging markets like India, Southeast Asia, and Africa can unlock new growth opportunities. Increasing demand for affordable and innovative vehicles in these regions could boost sales and positively impact the company’s stock performance. - Adoption of Autonomous and Smart Mobility Solutions

Advancements in autonomous driving technology and smart mobility services will be key drivers of Hyundai’s future growth. Strategic investments in self-driving cars, connected vehicles, and mobility-as-a-service (MaaS) could open new revenue streams and enhance shareholder value by 2030.

Risks and Challenges for Hyundai Motor Share Price

Here are 5 Risks and Challenges for Hyundai Motor Share Price:

- Intense Global Competition

The automotive industry is highly competitive, with major players like Toyota, Tesla, and Volkswagen constantly innovating. Hyundai must continuously invest in new technologies and designs to stay ahead. Failing to keep pace could result in market share loss and negatively affect its share price. - Economic Slowdowns and Market Demand

Global economic downturns or slow economic growth can reduce consumer spending on automobiles. If demand for vehicles drops, Hyundai’s sales and profitability may decline, leading to potential pressure on its stock performance. - Supply Chain Disruptions

Shortages of critical components like semiconductors and raw materials can disrupt Hyundai’s production. Supply chain issues may delay vehicle deliveries, increase manufacturing costs, and impact sales, which could harm the company’s financial results and stock value. - Regulatory and Environmental Compliance Costs

Stricter global emission regulations and safety standards require significant investment in technology and compliance. Rising regulatory costs or failure to meet these standards could lead to fines, recalls, or reputational damage, affecting Hyundai’s growth and stock performance. -

Slow Transition to Electric and Autonomous Vehicles

The shift towards electric and autonomous vehicles is accelerating. If Hyundai lags in developing advanced electric vehicles (EVs) or self-driving technology, it may lose its competitive edge, limiting future growth and negatively impacting its share price.

Read Also:- Waaree Energies Share Price Target Tomorrow 2025, 2026, 2027 To 2030 – More Details