Hindustan Copper Ltd (HCL) is a government-owned company and the only vertically integrated copper producer in India. Hindustan Copper Share Price on NSE as of 28 January 2025 is 227.97 INR. On this page, you will find Hindustan Copper Share Price Target 2025, 2026, 2027 to 2030 as well as Hindustan copper share price target tomorrow, Hindustan copper share price target motilal oswal, Hindustan Copper Share Price Target 2025 in Hindi, and more Information.

Hindustan Copper Ltd

Hindustan Copper Ltd (HCL) is a government-owned company and the only vertically integrated copper producer in India. Established in 1967, the company is involved in activities like mining, beneficiation, smelting, and refining of copper and its by-products. Headquartered in Kolkata, HCL operates across multiple states with key mining units like Khetri in Rajasthan and Malanjkhand in Madhya Pradesh.

Hindustan Copper Share Price Chart

Current Market Overview Of Hindustan Copper Share Price

- Open: 232.05

- High: 234.65

- Low: 223.49

- Mkt cap: 22.03KCr

- P/E ratio: 54.91

- Div yield: 0.40%

- 52-wk high: 415.80

- 52-wk low: 216.76

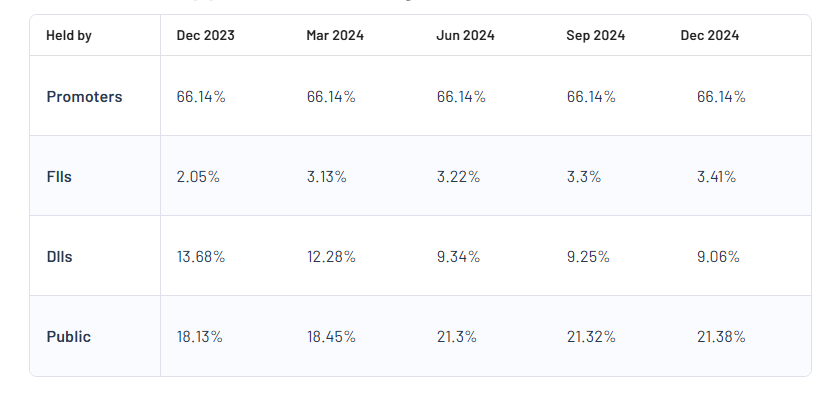

Hindustan Copper Shareholding Pattern

- Promoters: 66.14%

- FII: 3.41%

- DII: 9.06%

- Public: 21.38%

Hindustan Copper Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Hindustan Copper Share Price Target Years | Share Price Target (₹) |

| Hindustan Copper Share Price Target 2025 | ₹430 |

| Hindustan Copper Share Price Target 2026 | ₹470 |

| Hindustan Copper Share Price Target 2027 | ₹510 |

| Hindustan Copper Share Price Target 2028 | ₹550 |

| Hindustan Copper Share Price Target 2029 | ₹600 |

| Hindustan Copper Share Price Target 2030 | ₹640 |

Hindustan Copper Share Price Target 2025

Hindustan Copper share price target 2025 Expected target could be between ₹420 to ₹430. Here are 3 Key Factors Affecting Growth for Hindustan Copper Share Price Target 2025:

-

Copper Demand in Renewable Energy

The global push for renewable energy and electric vehicles (EVs) is driving up copper demand. Hindustan Copper, being a key producer, stands to benefit from this trend. Increased usage of copper in EVs, solar panels, and wind turbines can lead to higher revenues and positively impact its share price. - Expansion and Modernization Efforts

Hindustan Copper’s ongoing expansion and modernization plans to increase mining capacity and enhance operational efficiency could contribute significantly to its growth. If these projects are executed as planned, the company’s production capacity will rise, potentially boosting profitability and investor confidence. -

Fluctuations in Global Copper Prices

The company’s performance is heavily influenced by global copper prices. If copper prices remain strong due to higher demand and limited supply, Hindustan Copper’s revenues and profitability will improve, supporting a positive trend in its share price by 2025.

Hindustan Copper Share Price Target 2030

Hindustan Copper share price target 2030 Expected target could be between ₹620 to ₹640. Here are 3 Key Factors Affecting Growth for Hindustan Copper Share Price Target 2030:

-

Long-Term Demand for Copper in Green Technologies

By 2030, the demand for copper is expected to increase significantly due to its critical role in green technologies like electric vehicles, renewable energy systems, and power infrastructure. Hindustan Copper’s strategic position as one of India’s largest copper producers can help it capitalize on this growing demand, driving revenue and share price growth. - Government Policies and Initiatives

Supportive government policies aimed at promoting domestic mining and reducing dependence on copper imports will play a crucial role in Hindustan Copper’s growth. Policies encouraging self-reliance in critical minerals and investments in infrastructure could boost the company’s production and profitability over the long term. -

Technological Advancements in Mining and Refining

Adoption of advanced mining and refining technologies could significantly improve Hindustan Copper’s operational efficiency and reduce production costs. These improvements can enhance profitability and attract long-term investors, positively influencing the share price by 2030.

Risks and Challenges for Hindustan Copper Share Price

Here are 5 Risks and Challenges for Hindustan Copper Share Price:

- Volatility in Copper Prices

The global copper market is highly volatile and influenced by demand-supply dynamics, international trade policies, and economic conditions. A significant drop in copper prices could hurt Hindustan Copper’s revenues and profitability, directly impacting its share price. - Dependence on Global Markets

Hindustan Copper relies heavily on export markets for its copper products. Any global economic slowdown, trade restrictions, or geopolitical tensions could disrupt demand for copper, leading to reduced earnings and fluctuations in its stock performance. - Operational and Environmental Risks

Mining activities come with inherent operational risks, including accidents, equipment failures, and environmental compliance issues. Hindustan Copper faces strict environmental regulations, and any violation or delay in meeting these standards could result in penalties or production halts, affecting its financial health. - Competition from Imports and Private Players

Despite being a major player in India, Hindustan Copper faces competition from imported copper and private sector companies. This competition can limit market share and put pressure on margins, especially if production costs are not managed efficiently. -

Capital-Intensive Nature of the Business

Mining and refining operations require significant capital investments for exploration, technology upgrades, and capacity expansion. Delays in obtaining funding or inefficient allocation of resources could hinder growth plans, affecting investor confidence and the company’s share price.

Read Also:- Castrol India Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Update