Central Depository Services (India) Ltd (CDSL) is an Indian leading provider of depository services. CDSL Share Price on NSE as of 18 January 2025 is 1,595.50 INR. On this page, you will find CDSL Share Price Target 2025, 2026, 2027 to 2030 as well as Cdsl share price target tomorrow, CDSL share price target 2025 Motilal Oswal, CDSL Share Price target 2040, and more Information.

Central Depository Services (India) Ltd

Central Depository Services (India) Ltd (CDSL) is a leading provider of depository services in India. It helps investors and financial institutions hold and transfer securities in electronic form, making trading and settlement processes easier and safer. CDSL acts as an intermediary between investors and stock exchanges, ensuring smooth and secure transactions. The company plays a crucial role in the Indian capital markets by offering services like demat accounts, securities lending, and settlement systems.

CDSL Share Price Chart

Current Market Overview Of CDSL Share Price

- Open: ₹1,606.95

- High: ₹1,616.35

- Low: ₹1,587.10

- Mkt cap: ₹33.35KCr

- P/E ratio: 62.59

- Div yield: 0.60%

- 52-wk high: ₹1,989.80

- 52-wk low: ₹811.00

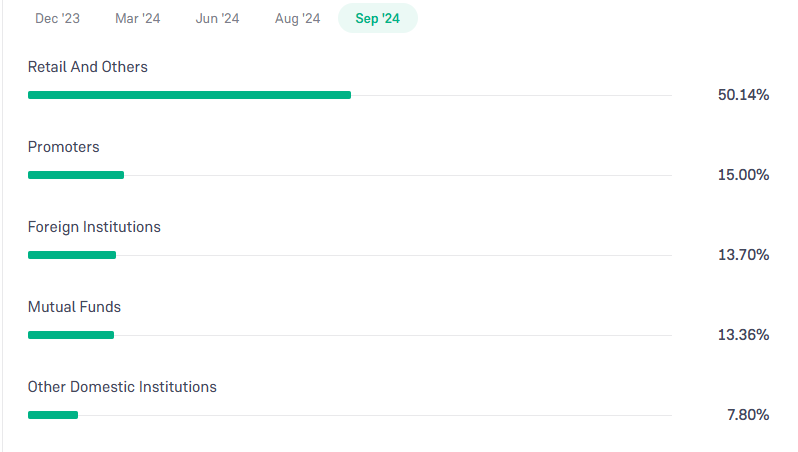

CDSL Shareholding Pattern

- Promoters: 15%

- Retail and Others: 50.14%

- FII: 13.70%

- Mutual Funds: 13.36%

- DII: 7.80%

CDSL Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| CDSL Share Price Target Years | Share Price Target (₹) |

| CDSL Share Price Target 2025 | ₹1990 |

| CDSL Share Price Target 2026 | ₹2350 |

| CDSL Share Price Target 2027 | ₹2710 |

| CDSL Share Price Target 2028 | ₹3030 |

| CDSL Share Price Target 2029 | ₹3465 |

| CDSL Share Price Target 2030 | ₹4079 |

CDSL Share Price Target 2025

CDSL share price target 2025 Expected target could be between ₹1980 to ₹1990. Here are 3 Key Factors Affecting Growth for CDSL Share Price Target 2025:

-

Increase in Stock Market Participation

As more retail investors participate in the stock market, the demand for demat accounts and depository services grows. CDSL, being a key player in providing these services, stands to benefit from the increase in market participation, which could positively impact its revenue and share price by 2025. - Expansion of Digital Services

CDSL’s focus on expanding its digital platforms and services, including the introduction of new technological tools for investors, can improve customer experience and attract more clients. The successful adoption of these services can drive long-term growth and positively influence its stock value. -

Strong Regulatory Environment

A stable and supportive regulatory environment for capital markets in India can provide growth opportunities for CDSL. Any changes that promote easier access to markets or increase the number of securities listed can boost the demand for depository services, benefiting CDSL’s revenue and share price.

CDSL Share Price Target 2030

CDSL share price target 2030 Expected target could be between ₹4000 to ₹4079. Here are 3 Key Factors Affecting Growth for CDSL Share Price Target 2030:

-

Expansion of Financial Markets and Product Offerings

As India’s financial markets continue to grow, CDSL can benefit from an increase in the number of listed companies and financial products. The expansion into areas like mutual funds, bonds, and international securities will likely increase the demand for depository services, driving long-term growth for the company and its share price by 2030. - Rise of Retail and Institutional Investment

The growing trend of both retail and institutional investors in the Indian capital market will create more demand for CDSL’s depository services. A larger customer base and more assets being held in demat accounts can significantly boost revenue, contributing to share price growth in the long run. -

Technological Advancements and Automation

The adoption of advanced technologies, such as blockchain for secure transactions and automated processes, can enhance CDSL’s operational efficiency and reduce costs. By staying at the forefront of technological advancements, CDSL can ensure a competitive edge and increase investor confidence, supporting its growth and share price by 2030.

Risks and Challenges for CDSL Share Price

Here are 6 Risks and Challenges for CDSL Share Price:

- Regulatory Changes and Compliance Risks

CDSL operates in a highly regulated environment, where changes in government policies or capital market regulations can impact its operations. Any sudden regulatory changes could lead to increased compliance costs or restrictions, which may affect its profitability and share price. - Competition from Other Depositories

CDSL faces competition from other depositories like National Securities Depository Limited (NSDL). If competitors offer better services, pricing, or technology, CDSL could lose market share. This may result in slower growth, which could negatively impact its stock performance. - Cybersecurity and Data Protection Risks

As a key player in the financial sector, CDSL manages sensitive data related to securities and investments. A major cybersecurity breach or data leak could damage the company’s reputation, leading to a loss of investor trust and a decline in its share price. - Economic Slowdown and Market Volatility

A slowdown in the economy or market volatility can reduce investor activity in the stock market. A drop in trading volumes and lower participation in the capital markets may reduce demand for CDSL’s services, which could negatively affect the company’s revenue and share price. - Operational and Technological Failures

Any technical glitches, system failures, or service interruptions could disrupt CDSL’s operations and result in financial losses. The company’s reliance on technology for its services makes it vulnerable to any operational issues, which could impact investor confidence and the share price. -

Limited Diversification of Revenue Sources

CDSL’s primary revenue comes from providing depository services to investors and market participants. If the company does not diversify its revenue streams or expand its offerings into new markets or services, it may face stagnation in growth, which could affect its long-term stock performance.

Read Also:- IDFC First Bank Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Update