Bank of Baroda Ltd is one of India’s largest public sector banks. Bank of Baroda Share Price on NSE as of 23 January 2025 is 759.95 INR. On this page, you will find Bank of Baroda Share Price Target 2025, 2026, 2027 to 2030 as well as BOB share price target tomorrow, BoB Share Price target tomorrow Moneycontrol, Bank of India share price target, Bank of Baroda Share Price Target 2040, and more Information.

Bank of Baroda Ltd

Bank of Baroda Ltd is one of India’s largest public sector banks, established in 1908. It offers a wide range of banking products and services, including personal, business, and corporate banking. The bank provides services like savings and current accounts, loans, investments, and insurance, both to individuals and businesses. Bank of Baroda operates across India and has a significant presence in international markets with branches in over 20 countries.

Bank of Baroda Share Price Chart

Current Market Overview Of Bank of Baroda Share Price

- Open: 227.50

- High: 231.25

- Low: 225.52

- Mkt cap: 1.18LCr

- P/E ratio: 5.92

- Div yield: 3.32%

- 52-wk high: 299.70

- 52-wk low: 216.35

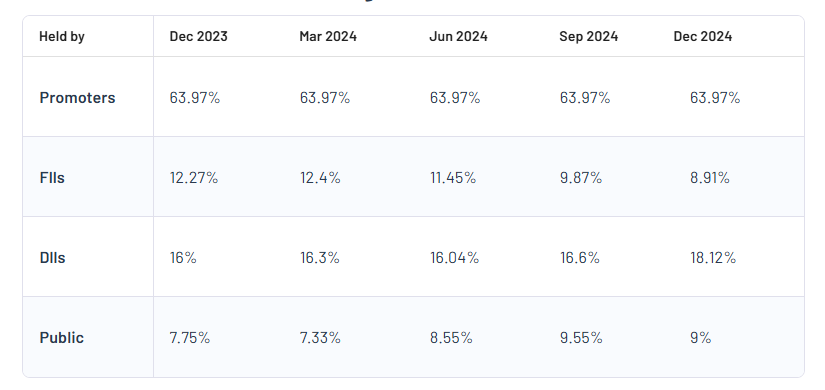

Bank of Baroda Shareholding Pattern

- Promoters: 63.97%

- FII: 8.91%

- DII: 18.12%

- Public: 9%

Bank of Baroda Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Bank of Baroda Share Price Target Years | Share Price Target (₹) |

| Bank of Baroda Share Price Target 2025 | ₹305 |

| Bank of Baroda Share Price Target 2026 | ₹335 |

| Bank of Baroda Share Price Target 2027 | ₹370 |

| Bank of Baroda Share Price Target 2028 | ₹400 |

| Bank of Baroda Share Price Target 2029 | ₹435 |

| Bank of Baroda Share Price Target 2030 | ₹470 |

Bank of Baroda Share Price Target 2025

Bank of Baroda share price target 2025 Expected target could be between ₹300 to ₹305. Here are three key factors that can affect the growth of Bank of Baroda’s share price by 2025:

-

Loan Growth and Asset Quality

The bank’s loan book expansion plays a crucial role in its profitability. As Bank of Baroda continues to grow its lending portfolio, especially in retail and MSME segments, it can boost its revenue. However, maintaining asset quality and controlling non-performing assets (NPAs) will be essential for its future growth and stability. A rise in bad loans could impact its share price negatively. - Digital Transformation and Technology Adoption

Bank of Baroda’s investment in digital banking, mobile apps, and AI-driven customer solutions can help attract a larger customer base. A stronger digital presence in an increasingly tech-savvy market can improve customer engagement and operational efficiency, driving long-term growth. Successful implementation of these technologies will be a key factor for its stock performance. -

Government Policies and Economic Conditions

The overall economic health of India, along with favorable government policies and regulations in the banking sector, can significantly impact Bank of Baroda’s share price. Measures like interest rate cuts, government spending on infrastructure, or fiscal stimulus can boost demand for loans, positively affecting the bank’s profitability and share price growth. Conversely, economic slowdowns or stricter regulations could pose challenges.

Bank of Baroda Share Price Target 2030

Bank of Baroda share price target 2030 Expected target could be between ₹450 to ₹470. Here are three key factors that could affect the growth of Bank of Baroda’s share price by 2030:

-

Long-Term Economic Growth and Financial Inclusion

As India continues to develop economically and focus on financial inclusion, Bank of Baroda could benefit significantly by expanding its customer base in rural and underserved areas. By offering more accessible banking services, particularly to small businesses and individuals who are new to banking, the bank could see substantial growth in deposits, loans, and overall revenue, driving long-term share price appreciation. - Global Expansion and Strategic Partnerships

Bank of Baroda’s growth prospects will also be influenced by its international presence and expansion into new markets. If the bank successfully increases its operations abroad and forms strategic partnerships with global financial institutions, it could benefit from higher revenues and diversification. Additionally, tapping into international markets with high growth potential could support strong share price growth in the long run. -

Sustainability and Green Finance Initiatives

As environmental, social, and governance (ESG) concerns become increasingly important, Bank of Baroda’s commitment to sustainability and financing green projects could play a key role in its future growth. The bank’s involvement in supporting renewable energy projects and green bonds could attract eco-conscious investors, enhance its reputation, and create long-term value. This trend could contribute to the bank’s positive growth trajectory and rising share price over the next decade.

Risks and Challenges for Bank of Baroda Share Price

Here are five risks and challenges that could affect the share price of Bank of Baroda:

- Economic Slowdown and Credit Risk

A slowdown in the Indian economy or global financial instability can increase credit risk for banks. If businesses and individuals face financial difficulties, it could lead to higher loan defaults. Bank of Baroda may experience a rise in bad loans (NPAs), which can negatively affect its profitability and, in turn, its share price. The bank’s ability to manage credit risk is crucial for its growth. - Regulatory Changes and Compliance Costs

Changes in government regulations and banking policies can create uncertainties. If the government imposes stricter regulations or increases compliance costs, the bank may face higher operational expenses. Such changes could affect the bank’s earnings and make its shares less attractive to investors, potentially impacting the stock price negatively. - Competition from Digital Banking and Fintech

With the rise of digital banking and fintech companies, traditional banks like Bank of Baroda face increasing competition. These new players often offer faster, cheaper, and more convenient services, which could cause the bank to lose customers, especially younger, tech-savvy ones. If Bank of Baroda does not keep up with technological advancements and customer demands, it may face challenges in maintaining its market position and growth potential. - High Dependence on Domestic Market

While Bank of Baroda has expanded internationally, it still heavily relies on the Indian market for most of its business. Economic or political instability in India could affect its business performance. Any significant downturn in the Indian economy or adverse government policies could lead to weaker growth prospects for the bank and lower its share price. -

Interest Rate Fluctuations

Bank of Baroda, like all banks, is sensitive to changes in interest rates set by the Reserve Bank of India (RBI). A sudden increase in interest rates could impact the bank’s lending and borrowing activities, leading to lower loan demand and reduced profitability. If the bank is unable to manage its interest rate risk effectively, its financial performance and stock price could be negatively impacted.

Read Also:- SBI Card Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Updates