Bajaj Housing Finance Ltd is an Indian leading housing finance company. Bajaj Housing Finance Share Price on NSE as of 19 January 2025 is 113.50 INR. On this page, you will find Bajaj Housing Finance Share Price Target 2025, 2026, 2027 to 2030 as well as Bajaj housing finance share price target tomorrow, Bajaj Housing Finance Share price Target 2034, Bajaj Housing Finance share price target 2026, and more Information.

Bajaj Housing Finance Ltd

Bajaj Housing Finance Ltd is a leading housing finance company in India, offering a wide range of loan products, including home loans, loans against property, and construction finance. It is a subsidiary of Bajaj Finance Ltd and is known for its competitive interest rates, quick approvals, and customer-centric services. The company focuses on providing financing solutions to individuals and businesses, supporting their housing and real estate needs.

Bajaj Housing Finance Share Price Chart

Current Market Overview Of Bajaj Housing Finance Share Price

- Open: ₹114.25

- High: ₹114.76

- Low: ₹111.93

- Mkt cap: ₹94.45KCr

- P/E ratio: 43.13

- Div yield: N/A

- 52-wk high: ₹188.50

- 52-wk low: ₹111.52

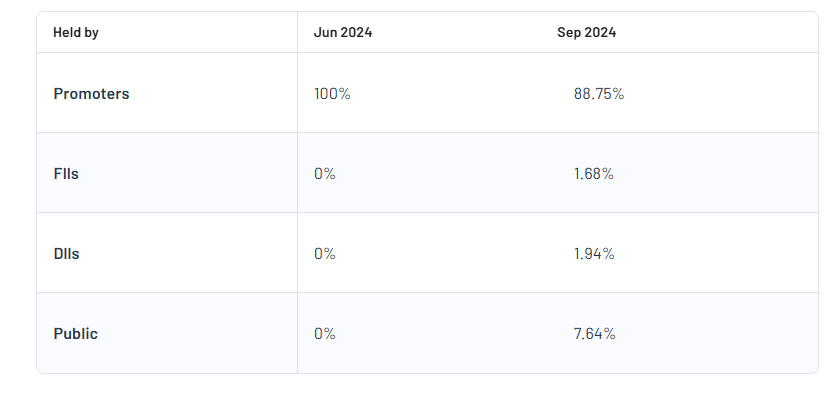

Bajaj Housing Finance Shareholding Pattern

- Promoter: 88.75%

- FII: 1.68%

- DII: 1.94%

- Public: 7.64%

Bajaj Housing Finance Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Bajaj Housing Finance Share Price Target Years | Share Price Target (₹) |

| Bajaj Housing Finance Share Price Target 2025 | ₹190 |

| Bajaj Housing Finance Share Price Target 2026 | ₹250 |

| Bajaj Housing Finance Share Price Target 2027 | ₹310 |

| Bajaj Housing Finance Share Price Target 2028 | ₹370 |

| Bajaj Housing Finance Share Price Target 2029 | ₹435 |

| Bajaj Housing Finance Share Price Target 2030 | ₹497 |

Bajaj Housing Finance Share Price Target 2025

Bajaj Housing Finance share price target 2025 Expected target could be between ₹185 to ₹190. Here are 3 Key Factors Affecting Growth for Bajaj Housing Finance Share Price Target 2025:

-

Rising Demand for Housing Loans

With urbanization and the government’s push for affordable housing, the demand for home loans is expected to grow. Bajaj Housing Finance, as a major player in the housing finance sector, can benefit from this trend, driving its revenue growth and positively influencing its share price by 2025. - Competitive Interest Rates and Attractive Loan Products

By offering competitive interest rates and innovative loan products, Bajaj Housing Finance can attract more customers. A diversified product portfolio catering to various customer needs, such as home loans, loan refinancing, and construction loans, can strengthen its market position and support its stock performance. -

Digital Transformation and Customer Experience

Bajaj Housing Finance’s investment in digital platforms and automation can streamline loan approvals, enhance customer service, and reduce operational costs. This focus on technology and customer satisfaction can increase market share and boost investor confidence, contributing to share price growth by 2025.

Bajaj Housing Finance Share Price Target 2030

Bajaj Housing Finance share price target 2030 Expected target could be between ₹490 to ₹497. Here are 3 Key Factors Affecting Growth for Bajaj Housing Finance Share Price Target 2030:

-

Expanding Housing Market and Infrastructure Development

With India’s growing population and urbanization, the demand for housing and real estate is expected to increase significantly by 2030. Bajaj Housing Finance is well-positioned to benefit from these trends by providing financing solutions for residential and commercial properties, which can drive long-term revenue and share price growth. - Focus on Affordable Housing Segment

Government initiatives like “Housing for All” and subsidies under Pradhan Mantri Awas Yojana (PMAY) will continue to promote the affordable housing segment. By tapping into this growing market, Bajaj Housing Finance can expand its customer base and strengthen its financial performance, positively impacting its share price over the decade. -

Adoption of Advanced Technologies

As digitalization transforms the financial services industry, Bajaj Housing Finance’s ability to leverage technologies like artificial intelligence (AI), big data, and machine learning for risk assessment, personalized services, and operational efficiency will be crucial. Embracing these innovations can improve customer retention, reduce costs, and support sustainable growth in its share price by 2030.

Risks and Challenges for Bajaj Housing Finance Share Price

Here are 6 Risks and Challenges for Bajaj Housing Finance Share Price

- Economic Slowdowns and Market Volatility

Housing finance businesses are highly sensitive to economic conditions. A slowdown in the economy or fluctuations in the real estate market can reduce the demand for loans, impacting Bajaj Housing Finance’s growth and profitability. This could lead to a decline in its share price. - Rising Interest Rates

An increase in interest rates can make home loans more expensive for borrowers, leading to a slowdown in loan disbursements. This can affect the company’s revenue and profitability, potentially putting downward pressure on its share price. - Regulatory and Policy Changes

Housing finance companies operate in a heavily regulated environment. Changes in government policies, taxation, or compliance requirements can increase operational costs or limit growth opportunities, negatively impacting Bajaj Housing Finance’s financial performance and stock value. - Non-Performing Assets (NPAs)

A rise in non-performing assets, where borrowers fail to repay their loans, can hurt the company’s financial health. Higher NPAs lead to increased provisioning requirements, reducing profitability and investor confidence in the company’s stock. - Competition from Banks and NBFCs

Bajaj Housing Finance faces stiff competition from banks and other non-banking financial companies (NBFCs) offering similar loan products. Intense competition can lead to pricing pressures, impacting the company’s market share and profitability, which could affect its share price. -

Dependence on Real Estate Sector Performance

The company’s success is closely tied to the real estate sector. Any slowdown or crisis in the housing and construction industry can directly affect loan demand and repayment rates, posing a significant risk to its revenue and share price.

Read Also:- CDSL Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Updates