Adani Total Gas Ltd (ATGL) is one of India’s leading players in the city gas distribution (CGD) sector. ATGL Share Price on NSE as of 23 January 2025 is 656.00 INR. On this page, you will find ATGL Share Price Target 2025, 2026, 2027 to 2030 as well as Atgl share price target tomorrow, Atgl share price target motilal oswal, ATGL share News, Adani Total Gas Share Price Target 2025 Moneycontrol, and more Information.

Adani Total Gas Ltd

Adani Total Gas Ltd (ATGL) is one of India’s leading players in the city gas distribution (CGD) sector. It is a joint venture between the Adani Group and TotalEnergies, a global energy giant. The company focuses on providing clean and affordable energy through piped natural gas (PNG) and compressed natural gas (CNG) to residential, industrial, and commercial customers across India.

ATGL Share Price Chart

Current Market Overview Of ATGL Share Price

- Open: 656.00

- High: 664.45

- Low: 651.60

- Mkt cap: 72.40KCr

- P/E ratio: 102.67

- Div yield: 0.038%

- 52-wk high: 1,190.00

- 52-wk low: 545.75

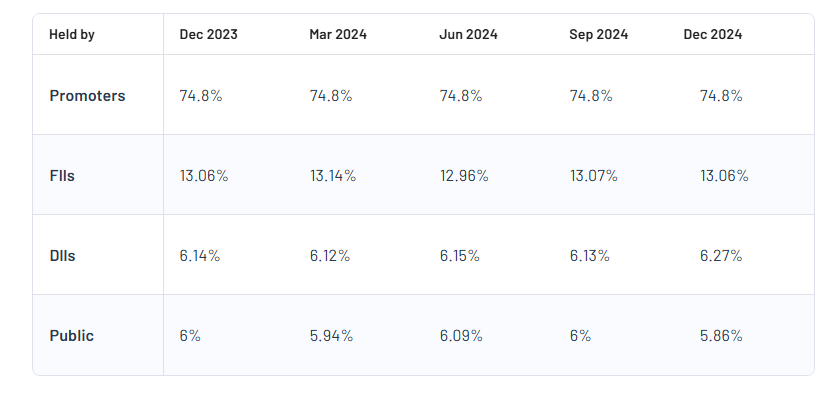

ATGL Shareholding Pattern

- Promoters: 74.8%

- FII: 13.06%

- DII: 6.27%

- Public: 5.86%

ATGL Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| ATGL Share Price Target Years | Share Price Target (₹) |

| ATGL Share Price Target 2025 | ₹1200 |

| ATGL Share Price Target 2026 | ₹1510 |

| ATGL Share Price Target 2027 | ₹1820 |

| ATGL Share Price Target 2028 | ₹2015 |

| ATGL Share Price Target 2029 | ₹2331 |

| ATGL Share Price Target 2030 | ₹2540 |

ATGL Share Price Target 2025

ATGL share price target 2025 Expected target could be between ₹1170 to ₹1200. Here are 3 Key Factors Affecting Growth for “Adani Total Gas Limited (ATGL) Share Price Target 2025”:

-

Expansion of Gas Distribution Network

ATGL’s aggressive expansion of its city gas distribution (CGD) network across India can significantly impact its growth. With increasing demand for natural gas as a cleaner energy alternative, the company’s ability to secure licenses for new regions and expand infrastructure will drive revenue and profitability, positively affecting its share price. - Government Policies and Push for Clean Energy

The Indian government’s emphasis on clean energy and plans to increase the share of natural gas in the energy mix from 6% to 15% by 2030 is a major growth factor for ATGL. Supportive policies, subsidies, and infrastructure development will likely benefit the company and its share price. -

Strategic Partnership with TotalEnergies

ATGL’s partnership with TotalEnergies, a global energy leader, provides access to advanced technology, international expertise, and financial support. This collaboration strengthens ATGL’s position in the Indian energy market, enhancing its growth prospects and investor confidence.

ATGL Share Price Target 2030

ATGL share price target 2030 Expected target could be between ₹2500 to ₹2540. Here are 3 Key Factors Affecting Growth for “Adani Total Gas Limited (ATGL) Share Price Target 2030”:

-

Growing Adoption of Natural Gas as a Cleaner Fuel

With India’s increasing focus on reducing carbon emissions, the adoption of natural gas as a cleaner and more sustainable fuel source is expected to grow significantly. This transition will drive demand for ATGL’s city gas distribution services, contributing to long-term revenue growth and share price appreciation. - Technological Advancements in Gas Distribution

Investments in advanced technologies, such as smart metering systems and efficient gas distribution infrastructure, can enhance ATGL’s operational efficiency. By reducing costs and improving service quality, the company can attract more customers and gain a competitive edge in the market, positively influencing its share price. -

Expansion into New Markets and Global Collaborations

By expanding its footprint into untapped domestic and international markets, ATGL can diversify its revenue streams. Additionally, continued collaborations with global players like TotalEnergies will provide access to innovative solutions, funding, and expertise, fueling its growth trajectory up to 2030.

Risks and Challenges for ATGL Share Price

Here are 5 Risks and Challenges for ATGL Share Price:

- Regulatory and Policy Risks

The natural gas sector in India is heavily regulated, and changes in government policies, tax structures, or pricing mechanisms can directly impact ATGL’s operations and profitability. Any unfavorable decisions, such as price caps or increased taxes, may put pressure on the company’s margins and affect its share price. - Dependence on Global Gas Prices

ATGL relies on imported liquefied natural gas (LNG) for its operations. Fluctuations in global gas prices due to geopolitical tensions, supply chain disruptions, or market demand can lead to increased costs. Such volatility could impact ATGL’s financial performance and investor confidence. - Competition in the Gas Distribution Sector

The gas distribution market in India is becoming increasingly competitive, with new players entering and established companies expanding their operations. If ATGL cannot maintain its market share or improve its services, it may face challenges in sustaining its growth and profitability, affecting its stock performance. - Infrastructure and Project Execution Risks

Delays in infrastructure development, such as setting up pipelines and gas distribution networks, can hinder ATGL’s growth plans. Issues related to land acquisition, regulatory approvals, or technical failures could result in increased costs and missed revenue opportunities, impacting the share price. -

Transition to Renewable Energy

While natural gas is considered a cleaner fuel, the global push towards renewable energy sources like solar and wind power poses a long-term challenge. If ATGL does not diversify its energy portfolio or adapt to this transition, it may face reduced demand for its products, which could negatively impact investor sentiment and stock valuation.

Read Also:- Moil Share Price Target Tomorrow 2025, 2026, 2027 To 2030- Share Market Updates