Manba Finance India Ltd is a financial services company based in India. Manba Finance Share Price on NSE as of 27 January 2025 is 150.00 INR. On this page, you will find Manba Finance Share Price Target 2025, 2026, 2027 to 2030 as well as Manba finance share price target tomorrow, Manba finance share price target 2025, Manba finance share price target 2030, and more Information.

Manba Finance India Ltd

Manba Finance India Ltd is a financial services company based in India. It specializes in providing various types of loans, including vehicle financing, to individuals and businesses. The company aims to cater to the growing demand for affordable financial solutions, especially in rural and semi-urban areas. Manba Finance is known for offering competitive interest rates and flexible repayment options to its customers.

Manba Finance Share Price Chart

Current Market Overview Of Manba Finance Share Price

- Open: 153.00

- High: 161.10

- Low: 144.00

- Mkt cap: 753.59Cr

- P/E ratio: 3,395.01

- Div yield: 23.78

- 52-wk high: 199.80

- 52-wk low: 128.00

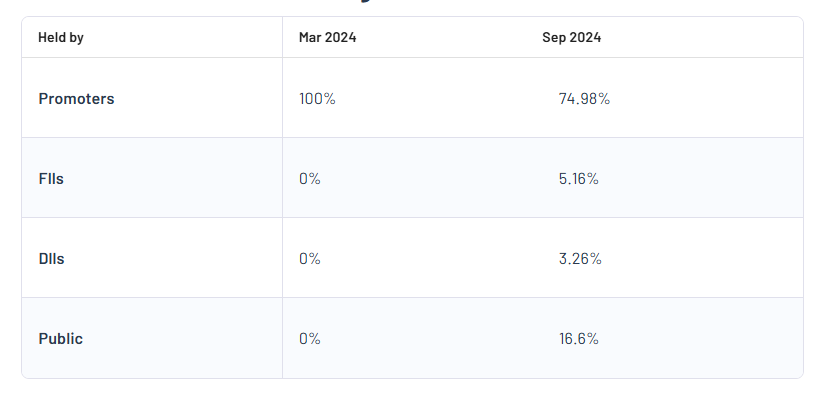

Manba Finance Shareholding Pattern

- Promoters: 74.98%

- FII: 5.16%

- DII: 3.26%

- Public: 16.6%

Manba Finance Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Manba Finance Share Price Target Years | Share Price Target (₹) |

| Manba Finance Share Price Target 2025 | ₹210 |

| Manba Finance Share Price Target 2026 | ₹240 |

| Manba Finance Share Price Target 2027 | ₹270 |

| Manba Finance Share Price Target 2028 | ₹300 |

| Manba Finance Share Price Target 2029 | ₹330 |

| Manba Finance Share Price Target 2030 | ₹270 |

Manba Finance Share Price Target 2025

Manba Finance share price target 2025 Expected target could be between ₹200 to ₹210. Here are 3 Key Factors Affecting Growth for “Manba Finance Share Price Target 2025”:

-

Growth in Demand for Vehicle Financing

Manba Finance specializes in vehicle loans, particularly two-wheeler financing. With rising demand for affordable vehicles in India and increasing adoption of personal mobility solutions, the company could see strong growth in its loan book. This demand is expected to positively influence its revenue and, in turn, its share price performance. - Economic Recovery and Purchasing Power

As the Indian economy continues to recover post-pandemic, increased consumer confidence and higher disposable incomes may boost loan disbursements. A stable economic environment could lead to better repayment rates, lower NPAs (non-performing assets), and improved profitability for Manba Finance. -

Digitalization of Services

The company’s focus on leveraging technology to streamline operations, improve customer experience, and reduce costs could be a significant growth driver. Adoption of digital platforms for loan processing and customer engagement may increase efficiency and attract more customers, positively impacting its market valuation.

Manba Finance Share Price Target 2030

Manba Finance share price target 2030 Expected target could be between ₹260 to ₹270. Here are 3 Key Factors Affecting Growth for “Manba Finance Share Price Target 2030”:

-

Expansion into New Markets

Over the long term, Manba Finance has the potential to expand its presence beyond its current focus areas, targeting tier-2 and tier-3 cities where demand for two-wheeler and small vehicle financing is high. Geographic expansion could diversify its revenue streams and significantly increase its customer base, driving sustained growth. - Adoption of Electric Vehicles (EVs)

With India transitioning toward electric mobility, the financing needs for EVs are expected to rise. Manba Finance’s ability to adapt and offer customized financing solutions for EV buyers could position it as a leader in the growing EV financing segment, boosting its long-term revenue potential and share price. -

Regulatory and Policy Support

Favorable government policies promoting financial inclusion and vehicle ownership, along with initiatives to strengthen the NBFC (Non-Banking Financial Company) sector, could support the company’s growth. Consistent regulatory backing and improved financial infrastructure could help Manba Finance scale its operations and improve profitability by 2030.

Risks and Challenges for Manba Finance Share Price

Here are 5 Risks and Challenges for Manba Finance Share Price:

- High Competition in the Financial Sector

Manba Finance operates in a highly competitive market with numerous players offering similar products. Larger and more established financial institutions may have better resources and more extensive customer bases. The increased competition could lead to pricing pressures, reduced margins, and slower growth, which may negatively impact the share price. - Credit Risk and Default Rates

As a financial institution providing loans, Manba Finance is exposed to the risk of loan defaults by borrowers. If customers fail to repay their loans, it could lead to higher non-performing assets (NPAs) and affect the company’s profitability. Poor asset quality can result in investor concerns and a decrease in share price. - Regulatory Changes

The financial sector in India is heavily regulated, and changes in government policies or regulations could pose challenges for Manba Finance. For example, stricter lending norms, higher capital requirements, or changes in tax laws could increase operational costs or limit growth potential, putting pressure on the company’s share price. - Economic Slowdown

Any downturn in the Indian economy or an economic slowdown could lead to a decline in demand for vehicle financing, as fewer consumers may be able to afford new vehicles. A reduction in credit demand and overall economic uncertainty can directly affect the growth prospects of the company and, in turn, its share price. -

Interest Rate Fluctuations

Interest rates have a significant impact on the cost of borrowing for consumers and the profitability of financial institutions. If interest rates rise, it could make loans more expensive for customers, reducing the demand for financing. Higher interest rates could also lead to higher borrowing costs for the company, squeezing profit margins and potentially affecting the share price negatively.

Read Also:- Delhivery Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Update