Delhivery India Ltd is a leading logistics and supply chain company in India. Delhivery Share Price on NSE as of 27 January 2025 is 315.60 INR. On this page, you will find Delhivery Share Price Target 2025, 2026, 2027 to 2030 as well as Delhivery share price target tomorrow, Delhivery share News today, Delhivery share hold or sell, Delhivery share price screener, Delhivery IPO share Price, and more Information.

Delhivery India Ltd

Delhivery India Ltd is a leading logistics and supply chain company in India, offering a wide range of services such as express parcel delivery, freight, warehousing, and supply chain solutions. Established in 2011, the company has grown rapidly, supported by advanced technology and an extensive network across the country. Delhivery primarily serves industries like e-commerce, retail, and FMCG, making it a key player in India’s fast-growing logistics market.

Delhivery Share Price Chart

Current Market Overview Of Delhivery Share Price

- Open: 318.20

- High: 319.00

- Low: 308.15

- Mkt cap: 23.47KCr

- P/E ratio: 3,395.01

- Div yield: N/A

- 52-wk high: 488.00

- 52-wk low: 308.15

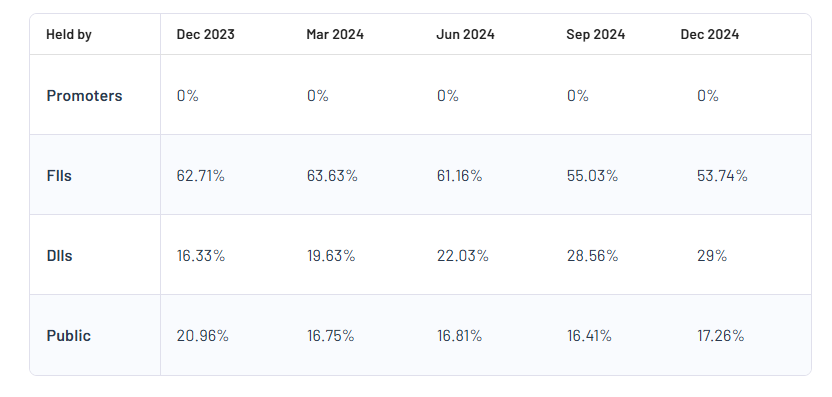

Delhivery Shareholding Pattern

- Promoters: 0%

- FII: 53.74%

- DII: 29%

- Public: 17.26%

Delhivery Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Delhivery Share Price Target Years | Share Price Target (₹) |

| Delhivery Share Price Target 2025 | ₹490 |

| Delhivery Share Price Target 2026 | ₹540 |

| Delhivery Share Price Target 2027 | ₹590 |

| Delhivery Share Price Target 2028 | ₹645 |

| Delhivery Share Price Target 2029 | ₹690 |

| Delhivery Share Price Target 2030 | ₹750 |

Delhivery Share Price Target 2025

Delhivery share price target 2025 Expected target could be between ₹470 to ₹490. Here are 3 Key Factors Affecting Growth for “Delhivery Share Price Target 2025”:

-

E-commerce Growth in India

The rapid expansion of e-commerce in India is a key driver for Delhivery’s growth. As more consumers shift to online shopping, the demand for efficient logistics and delivery services is increasing. Delhivery’s strong network and focus on technology position it to benefit from this trend, boosting its revenue and share price. - Focus on Technological Advancements

Delhivery’s use of advanced technologies like artificial intelligence, automation, and data analytics to improve logistics efficiency can enhance operational performance. Better service quality, reduced costs, and improved customer satisfaction could contribute positively to the company’s growth prospects by 2025. -

Expansion of Logistics Infrastructure

Delhivery’s ongoing investment in expanding its warehouses, transportation fleet, and supply chain capabilities strengthens its market presence. By reaching more regions and offering faster delivery services, the company can capture a larger share of the growing logistics market, driving potential growth in its share price.

Delhivery Share Price Target 2030

Delhivery share price target 2030 Expected target could be between ₹730 to ₹750. Here are 3 Key Factors Affecting Growth for “Delhivery Share Price Target 2030”:

-

India’s Booming E-commerce and Retail Market

By 2030, India’s e-commerce and retail sectors are expected to grow significantly, creating massive demand for logistics and delivery services. Delhivery’s ability to scale operations, improve delivery speed, and expand into Tier 2 and Tier 3 cities will likely position it as a leader, driving long-term revenue and share price growth. - Global Expansion Opportunities

Delhivery’s potential entry into international markets or cross-border logistics could open up new revenue streams. Expanding its operations beyond India will diversify its income sources and reduce dependence on domestic markets, supporting sustainable growth over the long term. -

Sustainability and Green Logistics Initiatives

By 2030, sustainability is expected to be a key factor in business operations. Delhivery’s adoption of eco-friendly practices, such as using electric vehicles and optimizing delivery routes, could not only enhance its brand reputation but also attract environmentally conscious clients, boosting its market competitiveness and profitability.

Risks and Challenges for Delhivery Share Price

Here are 5 Risks and Challenges for Delhivery Share Price:

- Intense Competition in the Logistics Industry

The logistics and supply chain industry in India is highly competitive, with both established players and new entrants fighting for market share. Companies like Blue Dart, Gati, and Amazon’s in-house logistics services pose significant challenges. This competition may lead to price wars, reducing profit margins and potentially impacting Delhivery’s share price. - Economic Slowdowns or Market Volatility

Logistics is closely tied to overall economic activity. Any slowdown in the Indian economy or disruptions in industries like e-commerce and retail could reduce demand for Delhivery’s services. Market volatility and lower investor confidence during such periods could negatively affect its share price. - Operational Challenges and Rising Costs

Managing large-scale logistics operations efficiently requires significant investment in technology, infrastructure, and workforce. Rising fuel costs, labor expenses, or inefficiencies in the supply chain can increase operational costs, putting pressure on profitability and limiting growth. - Dependence on E-commerce Growth

Delhivery relies heavily on the e-commerce sector for a substantial portion of its business. Any stagnation or slowdown in e-commerce growth, changes in consumer behavior, or regulatory restrictions on online retail could directly impact its revenue and market performance. -

Technological Disruptions and Cybersecurity Risks

The logistics industry is increasingly dependent on advanced technology for tracking, routing, and warehouse management. Any delays in adopting the latest technology or cybersecurity breaches could damage customer trust, disrupt operations, and result in financial losses, thereby affecting Delhivery’s share price.

Read Also:- IIFL Finance Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Update