Rajnish Retail Ltd is a growing company in the retail sector, catering to a wide range of consumer needs. Rajnish Retail Share Price on NSE as of 24 January 2025 is 16.23 INR. On this page, you will find Rajnish Retail Share Price Target 2025, 2026, 2027 to 2030 as well as Rajnish Retail share News, Rajnish retail share price target motilal oswal, Rajnish retail share price target tomorrow, Rajnish retail share price target 2030, and more Information.

Rajnish Retail Ltd

Rajnish Retail Ltd is a growing company in the retail sector, catering to a wide range of consumer needs. The company focuses on providing quality products at competitive prices, making it popular among customers. It operates in various segments, including clothing, lifestyle, and essentials, aiming to expand its presence in the market.

Rajnish Retail Share Price Chart

Current Market Overview Of Rajnish Retail Share Price

- Open: 16.23

- High: 16.27

- Low: 16.23

- Mkt cap: 248.81Cr

- P/E ratio: 124.22

- Div yield: N/A

- 52-wk high: 19.56

- 52-wk low: 7.57

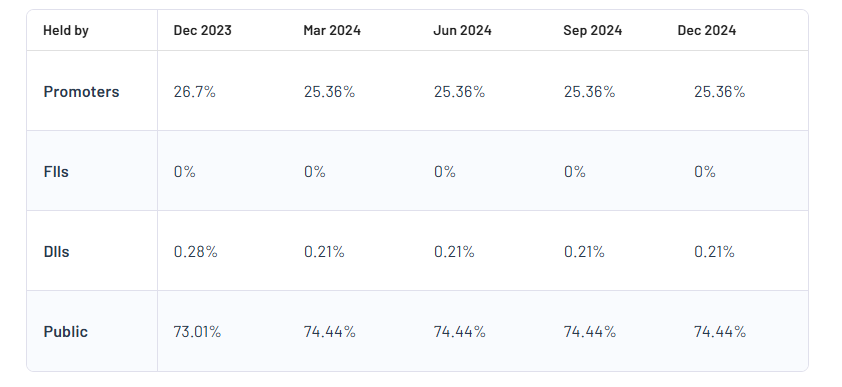

Rajnish Retail Shareholding Pattern

- Promoters: 25.36%

- FII: 0%

- DII: 0.21%

- Public: 74.44%

Rajnish Retail Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Rajnish Retail Share Price Target Years | Share Price Target (₹) |

| Rajnish Retail Share Price Target 2025 | ₹21 |

| Rajnish Retail Share Price Target 2026 | ₹23 |

| Rajnish Retail Share Price Target 2027 | ₹25 |

| Rajnish Retail Share Price Target 2028 | ₹27 |

| Rajnish Retail Share Price Target 2029 | ₹30 |

| Rajnish Retail Share Price Target 2030 | ₹33 |

Rajnish Retail Share Price Target 2025

Rajnish Retail share price target 2025 Expected target could be between ₹20 to ₹21. Here are 3 Key Factors Affecting Growth for Rajnish Retail Share Price Target 2025:

-

Expansion of Retail Footprint

Rajnish Retail’s share price growth heavily depends on its ability to expand its retail network. Opening new stores, entering untapped markets, and increasing its presence in Tier 2 and Tier 3 cities can drive sales and revenue growth, positively impacting the stock performance. - Adoption of E-commerce and Technology

The company’s investment in e-commerce platforms and digital technologies will be critical. By offering seamless online shopping experiences and leveraging data analytics to understand customer preferences, Rajnish Retail can attract more customers, thereby enhancing revenue and shareholder value. -

Consumer Spending Trends

Economic factors like rising disposable income and consumer confidence directly affect retail sales. A favorable shift in spending patterns toward branded and organized retail will benefit the company, driving its growth and positively influencing its share price.

Rajnish Retail Share Price Target 2030

Rajnish Retail share price target 2030 Expected target could be between ₹32 to ₹33. Here are 3 Key Factors Affecting Growth for Rajnish Retail Share Price Target 2030:

-

Sustainable Growth and Diversification

Long-term growth for Rajnish Retail will depend on its ability to diversify its product offerings and explore new categories such as electronics, home decor, or lifestyle products. A diversified portfolio can attract a broader customer base and drive consistent revenue growth over the years. - Global Expansion and Strategic Alliances

Expanding into international markets or forming strategic alliances with global brands could significantly boost the company’s presence and profitability. This would enhance brand recognition, increase market share, and positively influence its share price by 2030. -

Focus on Sustainability and Ethical Practices

As consumer preference shifts toward eco-friendly and ethically sourced products, Rajnish Retail’s focus on sustainable practices, such as green supply chains and environmentally friendly products, could position it as a preferred brand, driving long-term growth and stock performance.

Risks and Challenges for Rajnish Retail Share Price

Here are 5 Risks and Challenges for Rajnish Retail Share Price:

- Intense Market Competition

Rajnish Retail operates in a highly competitive industry, facing challenges from both established retail giants and smaller players offering niche products. This could affect its market share and profitability, especially if competitors implement aggressive pricing strategies or introduce innovative products. - Dependence on Consumer Spending

The company’s performance is directly linked to consumer spending habits. Economic downturns, inflation, or a drop in disposable income could lead to reduced demand, impacting Rajnish Retail’s sales and ultimately its share price. - Supply Chain Disruptions

Any disruption in the supply chain, whether due to geopolitical issues, natural disasters, or logistical challenges, could hinder the availability of products and increase costs. Such issues might lead to lower sales and reduced investor confidence. - Technological Advancements in E-Commerce

As online retail continues to evolve, staying ahead with technology and user experience is crucial. Failure to invest in modern e-commerce platforms or mobile applications could result in a loss of customers to tech-savvy competitors, impacting growth prospects. -

Regulatory and Policy Risks

Changes in government regulations, such as new tax policies, restrictions on imports/exports, or compliance with labor laws, could increase operational costs for Rajnish Retail. Adapting to these changes may require significant time and resources, potentially affecting profitability and stock performance.

Read Also:- KRN Heat Exchanger Share Price Target Tomorrow 2025, 2026 To 2030 – Share Market Updates