SBI Cards and Payment Services Ltd is one of India’s leading credit card issuers. SBI Card Share Price on NSE as of 23 January 2025 is 759.95 INR. On this page, you will find SBI Card Share Price Target 2025, 2026, 2027 to 2030 as well as SBI Card share News, Sbi card share price target motilal oswal, SBI credit card share price NSE, SBI credit card share price today, Sbi card share price target tomorrow, and more Information.

SBI Cards and Payment Services Ltd

SBI Cards and Payment Services Ltd is one of India’s leading credit card issuers, offering a wide range of credit card products tailored to different customer needs. A subsidiary of the State Bank of India (SBI), it leverages SBI’s extensive customer base and strong brand presence. The company focuses on providing innovative card solutions, attractive reward programs, and seamless digital payment experiences.

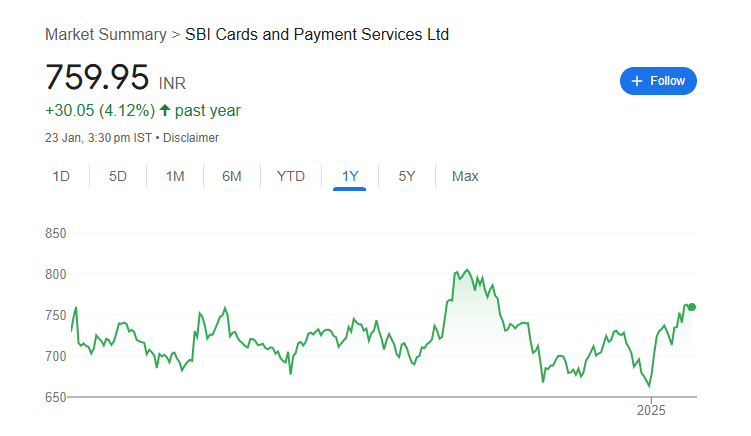

SBI Card Share Price Chart

Current Market Overview Of SBI Card Share Price

- Open: 755.00

- High: 769.00

- Low: 752.65

- Mkt cap: 72.38KCr

- P/E ratio: 32.71

- Div yield: 0.33%

- 52-wk high: 817.40

- 52-wk low: 647.95

SBI Card Shareholding Pattern

- Promoters: 68.6%

- FII: 9.51%

- DII: 16.48%

- Public: 5.41%

SBI Card Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| SBI Card Share Price Target Years | Share Price Target (₹) |

| SBI Card Share Price Target 2025 | ₹830 |

| SBI Card Share Price Target 2026 | ₹870 |

| SBI Card Share Price Target 2027 | ₹920 |

| SBI Card Share Price Target 2028 | ₹970 |

| SBI Card Share Price Target 2029 | ₹1031 |

| SBI Card Share Price Target 2030 | ₹1070 |

SBI Card Share Price Target 2025

SBI Card share price target 2025 Expected target could be between ₹800 to ₹830. Here are 3 3 Key Factors Affecting Growth for “SBI Card Share Price Target 2025”

-

Growing Digital Payments in India

With the increasing adoption of digital payments and credit cards in India, SBI Card is well-positioned to benefit from this shift. The company’s focus on expanding its user base and offering diverse card products to cater to various customer segments can drive revenue growth, positively influencing its share price. - Economic Recovery and Consumer Spending

As the economy recovers and consumer confidence improves, spending on credit cards is likely to increase. Higher card usage, especially for big-ticket purchases and travel, can boost transaction volumes and interest income, contributing to growth in the company’s financial performance. -

Strategic Partnerships and Innovations

SBI Card’s partnerships with e-commerce platforms, retail chains, and travel companies create additional opportunities for customer acquisition and spending. Innovations like reward programs and app-based services enhance user experience, making SBI Card more competitive and attractive to investors.

SBI Card Share Price Target 2030

SBI Card share price target 2030 Expected target could be between ₹1040 to ₹1070. Here are 3 3 Key Factors Affecting Growth for “SBI Card Share Price Target 2030”

-

Long-Term Expansion of the Credit Card Market

The credit card market in India is expected to grow significantly by 2030 due to increasing financial literacy, urbanization, and the rise of a tech-savvy population. As a leading player, SBI Card is well-positioned to capitalize on this growth, driving higher revenues and profitability over the long term. - Technological Advancements and Digital Transformation

By 2030, advancements in technology, such as artificial intelligence, big data, and blockchain, could revolutionize the credit card industry. SBI Card’s investment in cutting-edge technology and secure payment systems may improve customer experience and operational efficiency, leading to sustained growth and investor confidence. -

Increased Focus on Tier-2 and Tier-3 Markets

The untapped potential of Tier-2 and Tier-3 cities in India offers immense growth opportunities for SBI Card. Expanding into these regions through targeted marketing, partnerships, and customized card offerings can help the company diversify its revenue streams and grow its customer base significantly by 2030.

Risks and Challenges for SBI Card Share Price

Here are 5 Risks and Challenges for SBI Card Share Price:

- Increasing Competition in the Credit Card Market

The credit card industry is becoming highly competitive with the entry of new fintech players and aggressive strategies by other banks. This intense competition could pressure SBI Card to offer more rewards and discounts, which may reduce profit margins over time. - Regulatory Changes and Compliance Requirements

The financial sector is subject to evolving regulations, and any stringent compliance requirements imposed by regulatory bodies can impact SBI Card’s operations. Increased compliance costs or restrictions on fees and charges could affect the company’s profitability and, in turn, its share price. - Economic Slowdowns and Rising Delinquencies

During economic downturns, the risk of loan defaults and credit card delinquencies tends to increase. If a significant portion of SBI Card’s customers face financial hardships, it could lead to higher non-performing assets (NPAs), directly affecting the company’s financial performance. - Cybersecurity and Data Privacy Concerns

With the growing reliance on digital platforms, the risk of cyberattacks and data breaches is a significant concern for SBI Card. Any major security incident could damage its reputation and lead to financial losses, affecting investor confidence and share performance. -

Dependence on Consumer Spending Trends

SBI Card’s business heavily relies on consumer spending patterns. Any adverse changes, such as reduced discretionary spending due to inflation or rising interest rates, could impact the company’s transaction volumes and revenue, posing challenges to its share price growth.

Read Also:- Swan Energy Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Updates