Bank of Maharashtra Ltd is an Indian leading public sector bank. Bank of Maharashtra Share Price on NSE as of 20 January 2025 is 52.10 INR. On this page, you will find Bank of Maharashtra Share Price Target 2025, 2026, 2027 to 2030 as well as Bank of Maharashtra share price target tomorrow, Bank of Maharashtra share News, Bank of Maharashtra Share Price target 2040, Bank of Maharashtra Share Price Target 2050, and more Information.

Bank of Maharashtra Ltd

Bank of Maharashtra Ltd is a leading public sector bank in India, established in 1935. Headquartered in Pune, it offers a wide range of banking services including personal banking, corporate banking, and rural banking. The bank has a strong presence across India with a focus on serving underbanked and rural populations, contributing to financial inclusion. Bank of Maharashtra is also involved in various government schemes to support small businesses and agriculture.

Bank of Maharashtra Share Price Chart

Current Market Overview Of Bank of Maharashtra Share Price

- Open: ₹51.60

- High: ₹52.85

- Low: ₹51.12

- Mkt cap: ₹40.52KCr

- P/E ratio: 7.15

- Div yield: 2.69%

- 52-wk high: ₹73.50

- 52-wk low: ₹46.11

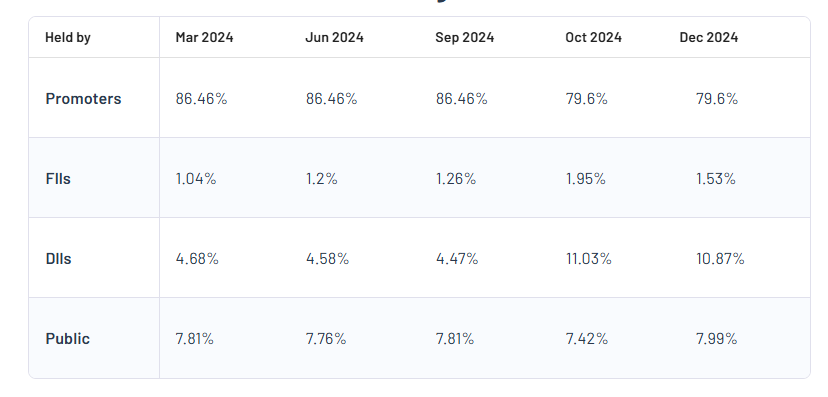

Bank of Maharashtra Shareholding Pattern

- Promoters: 79.6%

- FII: 1.52%

- DII: 10.87%

- Public: 7.99%

Bank of Maharashtra Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| Bank of Maharashtra Share Price Target Years | Share Price Target (₹) |

| Bank of Maharashtra Share Price Target 2025 | ₹75 |

| Bank of Maharashtra Share Price Target 2026 | ₹85 |

| Bank of Maharashtra Share Price Target 2027 | ₹95 |

| Bank of Maharashtra Share Price Target 2028 | ₹115 |

| Bank of Maharashtra Share Price Target 2029 | ₹125 |

| Bank of Maharashtra Share Price Target 2030 | ₹137 |

Bank of Maharashtra Share Price Target 2025

Bank of Maharashtra share price target 2025 Expected target could be between ₹70 to ₹75. Here are 3 Key Factors Affecting Growth for “Bank of Maharashtra Share Price Target 2025”

-

Improved Asset Quality

Bank of Maharashtra’s efforts to reduce non-performing assets (NPAs) and enhance its loan recovery mechanisms can significantly impact its growth. A healthier balance sheet will boost investor confidence and positively influence the bank’s share price. - Expansion of Credit Portfolio

The bank’s focus on increasing its credit portfolio, particularly in high-growth sectors like retail, MSMEs, and agriculture, can drive revenue growth. Strategic lending and competitive interest rates can enhance profitability and support share price growth. -

Government Support and Policies

As a public sector bank, Bank of Maharashtra benefits from government-backed initiatives like capital infusion and financial inclusion programs. Continued support from government policies aimed at strengthening public sector banks will play a crucial role in driving the bank’s growth and market performance.

Bank of Maharashtra Share Price Target 2030

Bank of Maharashtra share price target 2030 Expected target could be between ₹130 to ₹137. Here are 3 Key Factors Affecting Growth for “Bank of Maharashtra Share Price Target 2030”

-

Digital Transformation and Fintech Integration

The bank’s adoption of digital banking services and integration with fintech platforms will be a key driver for growth. A robust digital infrastructure, including mobile banking and AI-driven solutions, will help expand the customer base and improve operational efficiency, positively influencing the share price over the next decade. - Strong Capital Position and Financial Health

Bank of Maharashtra’s ability to maintain a strong capital position, reduce bad loans, and enhance its profitability will be crucial for its growth trajectory. A focus on prudent lending practices and capital raising will improve investor confidence and contribute to long-term share price appreciation. - Rural and Semi-Urban Expansion

With the government’s push for financial inclusion, Bank of Maharashtra’s expansion into rural and semi-urban areas can play a significant role in boosting growth. A larger customer base, driven by increased access to banking services, will contribute to revenue growth and positively impact the bank’s share price over the long term.

Risks and Challenges for Bank of Maharashtra Share Price

Here are 5 Risks and Challenges for Bank of Maharashtra Share Price:

- High Non-Performing Assets (NPAs)

A significant risk for Bank of Maharashtra is the potential increase in non-performing assets (NPAs), which are loans that borrowers fail to repay. High NPAs reduce the bank’s profitability and can negatively affect its stock price. If the bank struggles to manage bad loans or delays in recoveries, it could lead to lower investor confidence and a decline in share value. - Economic Slowdown Impacting Loan Demand

An economic slowdown can reduce demand for loans, particularly in sectors like MSMEs, retail, and agriculture, which are key areas for the bank. Lower loan disbursements during periods of weak economic growth can result in reduced revenues and lower stock performance. - Government Influence and Policy Changes

As a public sector bank, Bank of Maharashtra is influenced by government policies and changes. While government support is often beneficial, any policy shifts or budget cuts can lead to funding challenges or restructuring, which may harm the bank’s growth prospects and impact its share price negatively. - Intense Competition in the Banking Sector

The banking industry in India is highly competitive, with both private sector banks and other public sector banks offering similar products and services. If Bank of Maharashtra fails to differentiate itself or effectively compete on customer service, interest rates, or digital solutions, it may lose market share, which can affect its profitability and share price growth. -

Regulatory Compliance and Legal Risks

Banks, including Bank of Maharashtra, are heavily regulated by the Reserve Bank of India (RBI) and other authorities. Non-compliance with changing regulations or any legal issues (such as fraud or disputes) could lead to fines, reputational damage, and loss of investor trust, negatively impacting the bank’s share price.

Read Also:- Aarti Industries Share Price Target Tomorrow 2025, 2026, 2027 To 2030- More Details