OLA Electric Ltd is a leading Indian company in the electric vehicle (EV) industry, focused on revolutionizing transportation with sustainable solutions. OLA Electric Share Price on NSE as of 19 January 2025 is 74.41 INR. On this page, you will find OLA Electric Share Price Target 2025, 2026, 2027 to 2030 as well as Ola Electric share price NSE, Ola Electric share price chart, Ola Electric share price target tomorrow, Ola Electric share price Live, Ola Electric share News, and more Information.

OLA Electric Ltd

OLA Electric Ltd is a leading Indian company in the electric vehicle (EV) industry, focused on revolutionizing transportation with sustainable solutions. Founded in 2017, the company is known for its popular electric scooters, such as the Ola S1 series, which combine cutting-edge technology with affordability. OLA Electric is also investing heavily in renewable energy infrastructure, like fast-charging networks and advanced battery technologies, to support EV adoption.

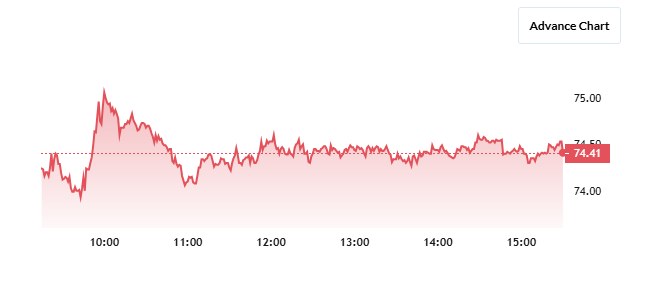

OLA Electric Share Price Chart

Current Market Overview Of OLA Electric Share Price

- Open: ₹74.50

- High: ₹75.18

- Low: ₹73.91

- Previous Close: ₹74.81

- Mkt Cap (Rs. Cr.): ₹32,820

- UC Limit: ₹89.77

- LC Limit: ₹59.84

- 52 Week High: ₹157.40

- 52 Week Low: ₹66.66

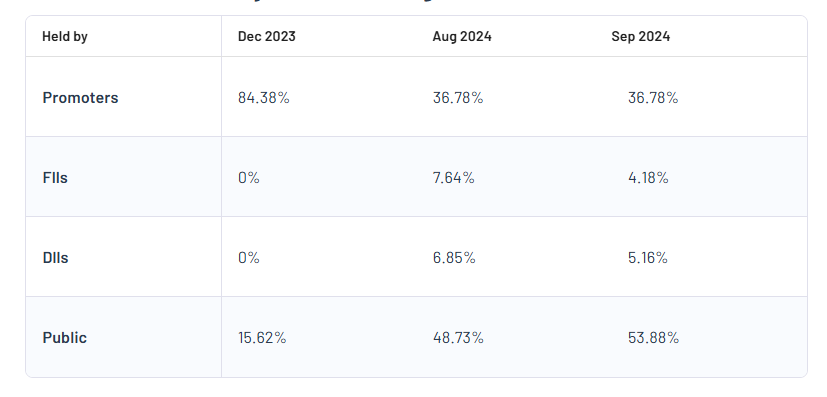

OLA Electric Shareholding Pattern

- Promoters: 36.78%

- FII: 4.18%

- DII: 5.16%

- Public: 53.88%

OLA Electric Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| OLA Electric Share Price Target Years | Share Price Target (₹) |

| OLA Electric Share Price Target 2025 | ₹160 |

| OLA Electric Share Price Target 2026 | ₹190 |

| OLA Electric Share Price Target 2027 | ₹220 |

| OLA Electric Share Price Target 2028 | ₹250 |

| OLA Electric Share Price Target 2029 | ₹280 |

| OLA Electric Share Price Target 2030 | ₹310 |

OLA Electric Share Price Target 2025

OLA Electric share price target 2025 Expected target could be between ₹₹155 to ₹160. Here are 3 Key Factors Affecting Growth for OLA Electric Share Price Target 2025:

-

Increased Demand for Electric Vehicles (EVs)

With growing environmental awareness and government incentives, the demand for EVs is expected to rise significantly. OLA Electric’s focus on affordable and efficient electric scooters and upcoming electric cars positions the company well to capture a significant market share, boosting its revenue and share price by 2025. - Expansion of Charging Infrastructure

OLA Electric is investing in setting up an extensive charging network across India, including fast chargers and battery-swapping stations. This infrastructure will enhance customer confidence and adoption of EVs, contributing to the company’s growth and positively impacting its share price. -

Technological Innovations and Cost Efficiency

By investing in advanced battery technology and localizing manufacturing, OLA Electric is reducing production costs and improving product efficiency. These innovations will help the company maintain competitive pricing and attract more customers, driving share price growth by 2025.

OLA Electric Share Price Target 2030

OLA Electric share price target 2030 Expected target could be between ₹300 to ₹310. Here are 3 Key Factors Affecting Growth for OLA Electric Share Price Target 2030:

-

Expansion into Global Markets

OLA Electric’s potential entry into international markets can significantly boost its revenue. By targeting regions with high EV adoption, such as Europe and Southeast Asia, the company can diversify its revenue streams and strengthen its global presence, contributing to long-term share price growth. - Focus on Sustainable Energy Solutions

OLA Electric’s integration of renewable energy, such as solar-powered charging stations and sustainable manufacturing practices, aligns with global efforts to reduce carbon footprints. These initiatives will enhance the company’s brand image and attract eco-conscious investors, supporting growth by 2030. -

Development of Electric Cars and Advanced EV Models

The launch of electric cars and continuous improvement in EV technology, such as enhanced battery life and autonomous driving features, will attract a broader customer base. Expanding its product portfolio will ensure sustained growth and position OLA Electric as a leader in the EV industry, positively impacting its share price by 2030.

Risks and Challenges for OLA Electric Share Price

Here are 5 Risks and Challenges for OLA Electric Share Price:

- Intense Competition in the EV Market

OLA Electric faces competition from established automakers and emerging EV startups in India and globally. Companies offering similar products with competitive pricing and advanced features could limit OLA’s market share and impact its financial performance. - Reliance on Battery Technology and Costs

Batteries are the most expensive component of an EV, and fluctuations in the cost of raw materials like lithium and cobalt can directly impact OLA Electric’s profitability. Dependence on imports for these materials may also expose the company to global supply chain disruptions. - Infrastructure and Charging Network Challenges

While OLA Electric is investing in charging infrastructure, insufficient coverage or delays in setting up an efficient network could deter potential customers. This may slow down EV adoption and affect the company’s growth prospects. - Regulatory and Policy Uncertainty

OLA Electric operates in a sector heavily influenced by government policies and incentives. Any reduction in subsidies, changes in emission norms, or policy delays could affect the affordability and demand for EVs, impacting the company’s revenue and share price. -

Customer Trust and Product Quality Issues

Concerns about EV safety, such as battery fires, and reliability can impact customer trust. Any negative publicity related to product quality or service standards could damage the brand’s reputation and affect investor confidence in the company.

Read Also:- SJVN Share Price Target Tomorrow 2025, 2026 To 2030- Share Market Updates