Hindustan Aeronautics Ltd (HAL) is one of India’s leading aerospace and defense companies. HAL Share Price on NSE as of 17 January 2025 is 4,120.00 INR. On this page, you will find HAL Share Price Target 2025, 2026, 2027 to 2030 as well as Hal share price target 2025, Hal share price target tomorrow, HAL Share price target 2030, HAL share News Today, HAL Share Price target tomorrow Moneycontrol, HAL Share Price Target 2040, and more Information.

Hindustan Aeronautics Ltd

Hindustan Aeronautics Ltd (HAL) is one of India’s leading aerospace and defense companies. Established in 1940, HAL designs, manufactures, and maintains aircraft, helicopters, and related systems for the Indian Armed Forces. The company plays a crucial role in India’s defense sector by producing fighter jets, transport aircraft, and advanced aerospace technologies. HAL is also involved in the development of indigenous defense equipment and systems.

HAL Share Price Chart

Current Market Overview Of HAL Share Price

- Open: ₹3,934.00

- High: ₹4,142.00

- Low: ₹3,882.20

- Mkt cap: ₹2.75LCr

- P/E ratio: 32.35

- Div yield: 0.85%

- 52-wk high: ₹5,674.75

- 52-wk low: ₹2,820.00

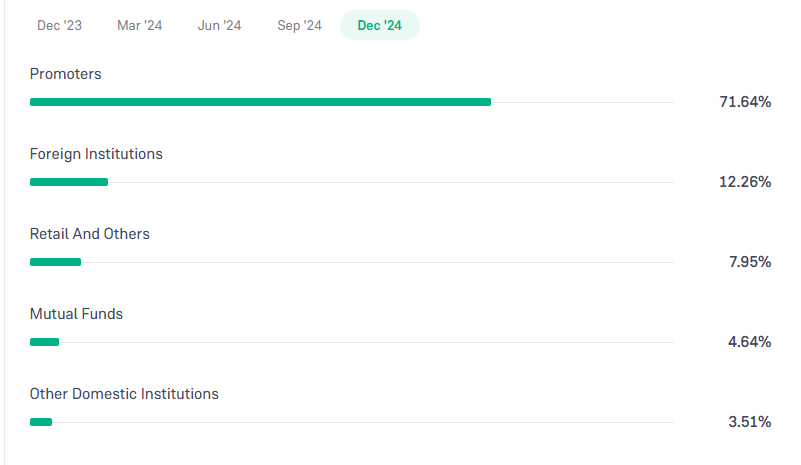

HAL Shareholding Pattern

- Promoters: 71.64%

- FII: 12.26%

- Retail and others: 7.95%

- Mutual Funds: 4.64%

- DII: 3.51%

HAL Share Price Target Tomorrow 2025, 2026, 2027 To 2030

| HAL Share Price Target Years | Share Price Target (₹) |

| HAL Share Price Target 2025 | ₹5,680 |

| HAL Share Price Target 2026 | ₹6,240 |

| HAL Share Price Target 2027 | ₹6,967 |

| HAL Share Price Target 2028 | ₹8,700 |

| HAL Share Price Target 2029 | ₹9,400 |

| HAL Share Price Target 2030 | ₹10,250 |

HAL Share Price Target 2025

HAL share price target 2025 Expected target could be between ₹5,480 to ₹5,680. Here are 4 Key Factors Affecting Growth for HAL Share Price Target 2025

-

Strong Government Contracts

Hindustan Aeronautics Limited (HAL) primarily manufactures defense aircraft and systems. Its growth depends on government contracts, especially from the Indian Ministry of Defence. New defense projects and increased government spending on defense can drive HAL’s revenue and share price. - Technological Advancements and Innovation

HAL’s ability to develop and integrate advanced technologies in aerospace and defense systems is key to its long-term success. Ongoing investment in R&D and technological innovations, like fighter jets and drones, can boost HAL’s growth prospects. - International Expansion and Partnerships

HAL is exploring international markets and strategic partnerships for exporting defense equipment. Expanding its presence globally and securing international orders will increase revenue streams and enhance market sentiment around its stock. -

Government Policies and Defense Budget

Supportive government policies, increased defense spending, and long-term defense modernization plans can create a favorable environment for HAL. Changes in the defense budget or political instability could impact HAL’s growth trajectory and share price.

HAL Share Price Target 2030

HAL share price target 2030 Expected target could be between ₹10,050 to ₹10,250. Here are 4 Key Factors Affecting Growth for HAL Share Price Target 2030

-

Defense Modernization and Large-Scale Projects

India’s long-term defense modernization plans, including the development of advanced fighter jets, helicopters, and unmanned systems, will provide HAL with significant opportunities. Winning large-scale contracts can drive substantial revenue growth and positively influence its share price. - Strategic Partnerships and Global Expansion

HAL’s ability to form strategic partnerships with global defense companies and expand its export capabilities will be crucial. International orders for defense equipment, such as aircraft and helicopters, can diversify revenue and enhance HAL’s global presence by 2030. - Technological Leadership and Innovation

The development of cutting-edge technologies, including stealth aircraft, drones, and aerospace systems, will position HAL as a leader in the aerospace industry. Continued innovation and successful project execution will help HAL stay competitive and support long-term stock growth. -

Government Support and Defense Budget Allocation

HAL’s future growth is closely tied to the Indian government’s defense budget allocation and commitment to indigenous manufacturing. Higher funding for defense projects and a focus on self-reliance in defense manufacturing will drive HAL’s growth and positively impact its share price by 2030.

Risks and Challenges for HAL Share Price

Here are 6 Risks and Challenges for HAL Share Price:

- Dependence on Government Contracts

HAL’s business is heavily reliant on contracts from the Indian government, especially for defense aircraft and systems. Any change in government policies, budget cuts, or delays in project approvals could affect HAL’s revenue and lower its share price. - Delays in Project Execution

HAL deals with large, complex defense projects that can face delays due to regulatory issues, technical challenges, or production setbacks. These delays may reduce earnings, disappoint investors, and negatively affect its stock price. - Competition from Private and Global Players

The aerospace and defense industry is competitive, with both global defense companies and private Indian firms entering the market. Increased competition can lead to pressure on pricing and market share, potentially affecting HAL’s profitability and share value. - Fluctuations in Government Defense Spending

Changes in the defense budget or government spending priorities can directly impact HAL. Any cuts or changes in funding for defense projects may reduce business opportunities, causing volatility in the company’s share price. - Technological Risks

HAL’s ability to stay ahead of technological advancements is critical. If HAL fails to develop cutting-edge defense technologies or falls behind in key projects, it could lose competitive advantages, harming its future growth and stock performance. -

Global Political and Economic Instability

HAL’s business could be impacted by global political tensions or economic instability. Issues such as trade restrictions, sanctions, or geopolitical conflicts may disrupt supply chains, delay exports, and reduce demand for HAL’s products, affecting its financial performance and share price.

Read Also:- Tata Moters Share Price Target Tomorrow 2025, 2026, 2027 To 2030- Stock Market Update