Reliance Power Ltd is a part of the Reliance Group. Reliance Power Share Price on NSE as of 16 January 2025 is 41.20 INR. On this page, you will find Reliance Power Share Price Target 2025, 2026, 2027 to 2030 as well as Reliance Power share price target, Reliance Power share price target 2025, Reliance power share price chart nse, Reliance power share price chart 2025, Reliance Power share price target 2030, Reliance Power News, Reliance Power owner, and more Information.

Reliance Power Ltd

Reliance Power Ltd is a part of the Reliance Group, founded by Anil Ambani. It was established to develop, construct, and operate power projects across India and internationally. The company focuses on generating electricity through coal, gas, hydro, and renewable energy sources. Over the years, Reliance Power has built several large power plants but has faced challenges due to high debt and project delays. However, the company is working towards improving its financial health and expanding into clean energy.

Reliance Power Share Price Chart

Current Market Overview Of Reliance Power Share Price

- Open: ₹40.05

- High: ₹41.20

- Low: ₹40.05

- Mkt cap: ₹16.55KCr

- P/E ratio: 14.18

- Div yield: N/A

- 52-wk high: ₹53.64

- 52-wk low: ₹19.40

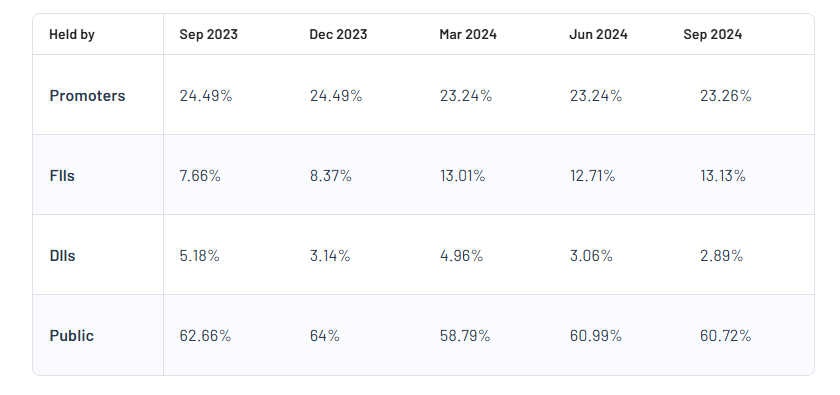

Reliance Power Shareholding Pattern

- Promoter: 23.26%

- FII: 13.13%

- DII: 2.89%

- Public: 60.72%

Reliance Power Share Price Target Tomorrow 2025 To 2030

| Reliance Power Share Price Target Years | Expected Share Price Target (₹) |

|---|---|

| Reliance Power Share Price Target 2025 | ₹55 |

| Reliance Power Share Price Target 2026 | ₹67 |

| Reliance Power Share Price Target 2027 | ₹80 |

| Reliance Power Share Price Target 2028 | ₹92 |

| Reliance Power Share Price Target 2029 | ₹105 |

| Reliance Power Share Price Target 2030 | ₹118 |

Reliance Power Share Price Target 2025

Reliance Power share price target 2025 Expected target could be between ₹50 to ₹55. By 2025, Reliance Power’s share price is expected to show moderate growth as the company works on improving its financial stability and expanding its energy projects.

Reliance Power Share Price Target 2030

Reliance Power share price target 2030 Expected target could be between ₹115 to ₹118. By 2030, Reliance Power’s share price is expected to grow as the company focuses on improving its financial health and expanding its energy projects. Key growth drivers may include debt reduction, investment in renewable energy, and overall demand for power in India.

Key Factors Affecting Reliance Power Share Price Growth

-

Debt Management

Reliance Power has faced high debt in the past. Effective debt reduction and financial restructuring can improve investor confidence and positively impact its share price. - Expansion in Renewable Energy

Increasing investments in renewable energy projects like solar and wind power can drive future growth, aligning with global clean energy trends and boosting the stock price. - Government Policies and Regulations

Supportive government policies for the energy sector, including subsidies and reforms, can benefit Reliance Power. However, strict environmental regulations could increase costs. - Operational Performance

Efficient management of power plants, cost control, and consistent profit growth are crucial. Strong operational performance can attract more investors and lift the share price. -

Market Demand for Power

Rising electricity demand in India due to population growth and industrial expansion can create more business opportunities for Reliance Power, supporting its stock price growth.

Risks and Challenges for Reliance Power Share Price

-

High Debt Levels

Reliance Power has struggled with heavy debt, which increases financial pressure. If the company fails to manage or reduce its debt, it could negatively impact its share price. - Regulatory and Environmental Policies

Strict government regulations and environmental policies can raise operating costs. Compliance with these rules may slow down projects and affect profitability. - Market Competition

The power sector is highly competitive, with many private and public players. Strong competition can limit Reliance Power’s market share and affect its future growth. - Project Delays and Cost Overruns

Delays in completing power projects or exceeding budget estimates can harm the company’s financial health, leading to reduced investor confidence. -

Fluctuating Energy Demand and Prices

Changes in electricity demand and fluctuations in coal and fuel prices can impact revenues. Lower demand or rising costs could put pressure on Reliance Power’s earnings and stock performance.

Read Also:- IRFC Share Price Target Tomorrow 2025, 2026, 2027 To 2030 and More Details